Earnie Issue with Pension Qualifying Earnings Lower Limit 20/21

Article ID

12218

Article Name

Earnie Issue with Pension Qualifying Earnings Lower Limit 20/21

Created Date

20th March 2020

Product

Earnie

Problem

The first release of Earnie v1.34.132 unfortunately contained an issue which will affect AE pension contributions for the 2020/21 tax year, this KB discusses how to correct this issue.

This issue does not affect any payroll run for the 19/20 tax year.

Resolution

What happened?

It is regrettable that when first released, Earnie v1.34.132 contained an issue. This issue would cause AE pensions to be wrong in the 20/21 tax year.

Fortunately this issue was discovered quickly and we stopped the rollout of the update until it was corrected.

Unfortunately some users had already installed the affected update before we could stop the rollout and those users need this fix.

We have contacted the users we belive to be affected using Earnie software messages, please follow the steps below to correct this issue.

Correcting the Error

In order to correct the issue we need to replace one of the system files used by Earnie.

Step 1

Identify your Earnie installation folder.

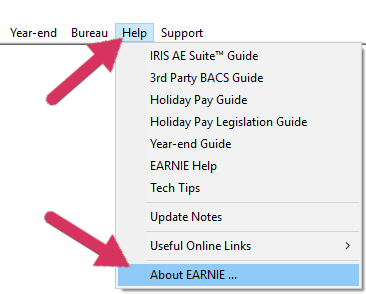

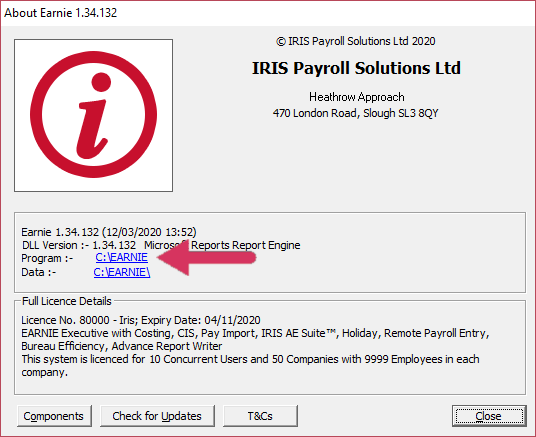

In Earnie go to “Help” | “About Earnie….“

This will open the “About Earnie” window

Please Note: If the version shown on the title bar of the About Earnie windows read any other version than v1.34.132, you are not affected by this issue and can stop here.

In the About Earnie window click on the blue text next to “Program“:

This will open your installation folder.

Step 2

Download the corrected version of the file “Intexsys.mdb”, click here.

Step 3

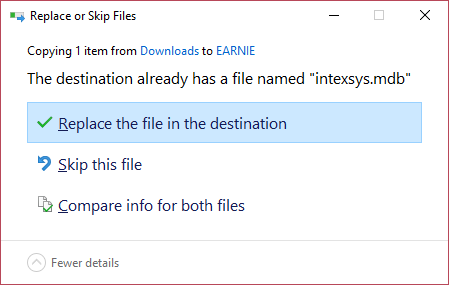

Replace the file

Leave the window showing your installation folder open. In another window find the file you downloaded in step 2, usually this will be found in your downloads folder.

Right click on this and select Copy

On the window showing you installation folder, right click and select Paste

You should see a message box similar to this:

Click the option to Replace the file

That’s it. The issue is resolved, but you should close and reopen Earnie before continuing to run payroll.

If you are having any trouble following these steps please email earniesupport@iris.co.uk for assistance

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.