Online Filing Issues - 1046 / Authentication Error

Error 1046 / Authentication Errors are the most common issues that arise when trying to submit your files online to HMRC.

This error occurs when a user’s credentials cannot be recognised by the Government Gateway.

Web Browser Advanced Settings

Please Note: IRIS Support cannot advise you on the effects of these setting on your local PC / Network. If you are at all unsure about these settings you should refer to your IT support.

These instructions releate to Microsoft Internet Explorer, for other web browsers please contact your IT support.

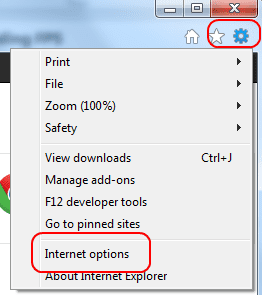

Open Internet Explorer, click on the cogwheel icon in the top right hand corner

Click on “Internet Options”

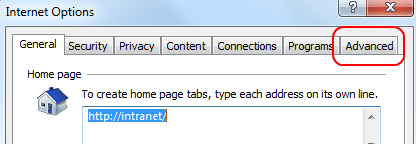

On the Options window you need to go into “Advanced”

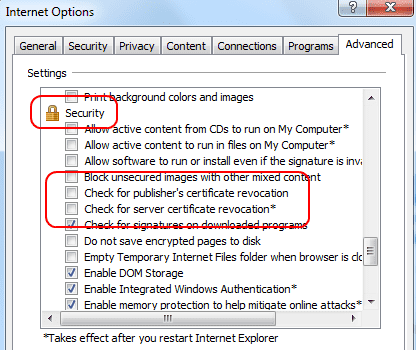

Scroll down the “Settings” list until you get to the security options.

Make sure the options:

“Check for publisher’s certificate revocation”

and “Check for server certificate revocation”

are both unticked.

Please Note: If you are unable to change these options you will need to log into Windows as the administrator. Please refer to your IT support.

Restart your PC and try the submission again

Check the following to resolve error 1046:

Sending Submissions to the Wrong Service

On the 14th February 2018 HMRC changed the web address (URL) you use to send your RTI submissions. If you are getting the 1046 Authentication Failure error OR a 501 Not Found error on or after the 14th February 2018, first check the version of your software.

The URL address changes were implemented in our software in the following versions:

PAYE-Master: v5.22.0.25

GP Payroll: v2017.1.28

Business/Bureau: v2.18.119

IPP/Earnie: v1.26.58

EarnieIQ: v1.28.0 – Patch C

If you are using a version earlier than those listed above, please update your software and try the submission again.

Click here for our software downloads page.

Otherwise, if you are already using a version higher than listed above, continue to the steps below to resolve the error.

Incorrect credentials

Incorrect credentials

When filing online using your IRIS Payroll product your Gateway User ID, Password and PAYE-Reference (tax district and reference number) are checked against the records held on the HMRC systems. If one or more of these do not match you will receive an Error 1046.

Incorrect User ID & Password

This is the most common reason for receiving an Error 1046. A good way to check the user ID and password is to go to the HMRC login website and try to log in by copying and pasting the User ID and password.

When entering the password into the HMRC website, only the first 12 digits are accepted. When entering them into the software it recognises all digits so would deem anything after the first 12 as being incorrect causing the Error 1046. If your password is longer than 12 digits, only use the first 12 within the payroll software.

If you are unable to log in to the online services website please call the HMRC Online Services Helpdesk on 0300 200 3600.

Please note : A security feature employed by HMRC means if you enter the wrong User ID or password three times or more when trying to log on to the HMRC website, your account will be locked and you won’t be able to use HMRC Online Services for the next two hours. You will be able to try again after the 2 hour period has expired.

Incorrect PAYE-Reference (If you are filing for your own company)

Log on to the HMRC website using your User ID and Password.

Click on “Your Services“

Check the companies “Tax District” and “Reference” are registered and activated for you to file RTI submissions online.

The Tax District field should contain 3 numbers (example : 123). The Tax Reference field should contain the other details (example : AB45678). You should not enter a forward slash in to the fields. This will cause the submission to fail.

Incorrect District Name

We have had instances of the submission failing due to an incorrect tax district name.

Check the district name with HMRC to make sure the correct details are used in your payroll software.

Not registered / activated for the service

Not registered for the service

If PAYE for Employers is not listed under “Your Services” you will need to register for this before you are able to file online.

Not activated for the service

After registering for a service you should receive an activation code. The activation code will be issued within seven days – use it once then throw it away. It will expire if you don’t use it within 28 days of the date on the letter, you will have to request a new one.

You will not be able to file online unless you have registered for PAYE for Employers and activated this service.

Agent not registered the PAYE Reference of the company

For an agent to submit RTI returns and receive PAYE message from HMRC on behalf of a client the agent needs to be authorised by either:

• Completing paper form FBI 2– this will only give you authority to act for your clients online

• Online authorisation process – which will allow HMRC to deal with you online, by phone or in writing about each of your clients’ PAYE or CISmatters

To submit an online authorisation request for your client you’ll need:

• To have registered for HMRC Online Services and enrolled for the PAYE/CIS for Agents service

• Your client’s employer PAYE reference and Accounts Office reference

• The authorisation code HMRC will send to your client by post – the code with ‘PE’ for PAYE and ‘CS’ for CIS

Please note: the authorisation code can take up to 7 days to arrive. You will need to enter the code before the client appears on your client list, so ideally you need to do this well in advance of a filing deadline. You must enter the code within 30 days from the date on the letter, otherwise it will expire.

Auto complete active on web browser

Auto Complete

NOTE: This advice has been supplied to us from the HMRC Online Service Helpdesk. If you are unsure on how to change the settings please contact your IT support.

If you have completed the previous steps but are still receiving the 1046 Error then you can try and disable “auto complete” on your internet web browser. Information entered when trying to log into the Government gateway or HMRC Online Services website may be stopping your Payroll software from authenticating successfully.

To adjust Auto Complete settings in Internet Explorer

You can configure Auto Complete to save and suggest only the information you want. You can choose whether to use Autocomplete for web addresses, forms, passwords or not use it all. You can also clear the history for any of these.

– In Internet Explorer select “Tools” | “Internet options” OR Click on the cog wheel icon in the top right hand corner of internet explorer, and then select “Internet options”

– Click the “Content” tab

– Under Autocomplete click “Settings”

– Select the check boxes for the AutoComplete options you want to use, HMRC online services have advised un ticking “Forms” and “User names and passwords on forms“

To adjust Auto Complete settings in Mozilla Firefox

If you don’t want Mozilla Firefox to remember what you have entered in to the form fields then you can turn off the Auto Form Fill feature.

– At the top of the Firefox window on the menu bar click Tools | Options | Preferences

– Select the privacy panel

– Remove the check mark from the box that says “Remember what I enter in forms and the search bar“

– Click “OK” to close the Options window

– Click Close to the Preferences window.

Disabling form history also prevents Firefox from storing search history for the Search Bar in the Navigation Toolbar.

To adjust Auto Complete settings in Google Chrome

Click on the menu button, ,and then go to “Settings“

Click “Show advanced settings”

Under “Privacy” click on “Clear browsing data…“

Untick all options except “Autofill form data” and click “Clear browsing data“