Setting up Funds in Charity Accounts

Article ID

kas-0029

Article Name

Setting up Funds in Charity Accounts

Created Date

23rd January 2021

Product

IRIS Keytime Accounts Production

Problem

Setting up Funds in charity accounts

Resolution

You can create as many funds as required, these are defined as either unrestricted (general or designated), restricted or endowment (permanent or expendable), the software creates a General fund by default and this cannot be removed. The SoFA (Statement of Financial Activities) reports by fund type, the balance sheet reports current and previous year columns with a further breakdown of assets and liabilities by fund supplied in the notes to the accounts.

To create a fund:

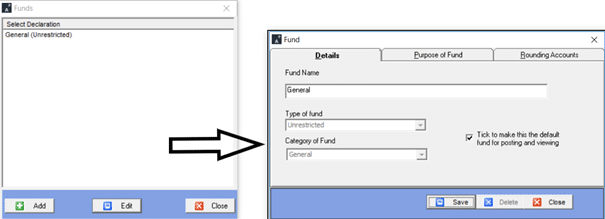

On setting up a new company you will be prompted to create funds, to create a fund once the initial setup has been completed click the Options menu / Funds click Add (or Edit to amend an existing fund).

Enter the fund name and select a fund type, if the type is either unrestricted or endowment select a fund category. The software will present the General fund by default when posting transactions or viewing reports, you can change the default by ticking the ‘make default’ box on the fund of your choice.

The SORP requires disclosure of the particulars of each type of fund: how it has arisen, the purpose and any restrictions imposed, this detail is stored with the individual fund and reported in the notes to the accounts. Click the Purpose of fund tab and enter the details of the fund.

The software automatically rounds figures to the nearest pound, reporting any rounding difference into pre-set rounding accounts in the SoFA and balance sheet. Each fund has its own set of rounding accounts to allow you to deal with odd balances appearing in individual funds and fund types on the SoFA. Default rounding accounts are pre-set but can be changed by clicking the Rounding Accounts tab and selecting the required accounts for the SoFA and balance sheet.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.