IFRS 16: Frozen GAAP and how to bridge that accounting gap

Updated 26th May 2021 | 6 min read Published 22nd August 2019

Bringing more debt on to your balance sheet through adopting IFRS 16 needn’t result in the breaking of covenants with your lenders and whilst loan agreements often contain such financial covenants which the borrow must adhere to so not to be in default of the agreement those covenants are usually calculated according to accounting principles – that is with the possibility that during the loan period new or revised accounting standards may be introduced.

It shouldn’t be necessary now that we are in 2019 but, nevertheless it does bear repeating that published back in January 2016, 'IFRS 16 Lease' – the new lease accounting standard or put simply a new accounting principle – has now become mandatory for those businesses and entities affected for all accounting periods beginning on or after 01/01/2019.

IFRS 16 replaces the guidelines set out in IAS 17, where assets relating to operating leases were “off balance sheet” and lease rentals were charged to the P&L as an operating expense - though most usually the degree of outstanding and committed operating lease liabilities was laid out in the notes to the accounts. All rentals relating to finance leases were treated as debt, with the “purchase price” for the lease being regarded as a liability on the balance sheet of the “purchasing company” and the leased asset sat on the balance sheet and was depreciated over the term. The prime aim of IFRS 16 remains to improve completeness, transparency and accuracy of financial statements. Fundamental to achieving this, the new standard has set out to remove the distinction between operating and finance leases and have all leases treated the same (namely as finance leases) for the purposes of lessee accounting.

Though the concept of operating leasing continues with residual investment-based agreements only short-term leases (less than 12 months) and leases covering “low value” assets can now be taken off balance sheet and thus be considered “debt-free”.

Inevitably any lessee that has used operating lease facilities to date and still has operating leases on its portfolio will find that their reported indebtedness will increase as a result of the convergence of accounting treatment for the two types of lease and consistent treatment for all leases. Factors such as discount rates, the period of the lease and lease payments, and residual-value guarantees or penalties, will all play a part in determining the liabilities and the way any lease on the lessee’s portfolio is treated but generally:

- the right to use the asset subject to the lease will be reported on the lessee’s balance sheet as an asset, and the value of the asset will be depreciated over the term of the lease contract;

- appearing on the balance sheet as a liability but also reducing over the term of the lease as payments are made will be the present value of all outstanding future rentals

- the interest element of each lease, which will reduce over the lease term as rentals are made will be reported as a finance expense on the lessee’s P&L and

- finally, the annual depreciation in the asset value, set out in (a) will need to be charged to the P&L through the life of the asset.

Indebtedness and Covenants

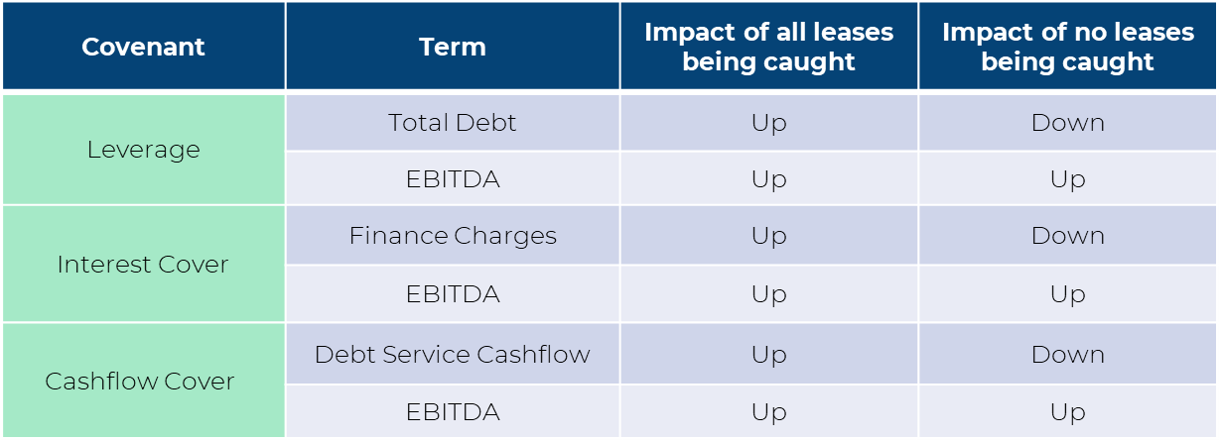

Where a lessee has under compliance with IFRS 16 now increased its indebtedness through bringing operating leases onto the balance sheet there will be a consequential impact on any covenant that previously excluded operating lease liabilities as debt.

The effect can be seen below in the table and the explanation follows.

Loan agreements often contain financial covenants which the borrow must adhere to in order to avoid being in default of the agreement. Financial covenants are generally calculated according to accounting principles and many of these covenants will have been set up when the parties concerned were adhering to IAS 17. Typical covenants might be

- A certain level of debt to equity must be maintained. What is debt and what is equity on the balance sheet is determined by accounting principles and if those principles change there could be a breach of the covenant.

- The lessee must publish its accounts in a timely manner in a certain format and to set standards including frozen GAAP or floating GAAP.

- No CCJ or winding up orders etc.

Suddenly in the new world, the lessee is reporting under IFRS 16 and in the context of loan documentation, a borrower whether subject to frozen or floating GAAP will need to look at reporting adherence to the covenants under IAS 17 whilst publishing its financial statements under IFRS 16. Extra work but necessary work? With the right software solution in reaching and retaining compliance then the “double” reporting is automatic and therefore requires no extra work – look at “LLA” from innervision.co.uk

- “Frozen GAAP”, i.e., using the same accounting principles, practices, and policies from the preparation of its original financial statements or any original base case model; or

- “Floating GAAP”, i.e., taking into account the changes in GAAP from time to time.

Loan documentation will most usually set out how changes in the bases of measurement are handled. Any arrangement usually requires the borrower’s auditors to provide a reconciliation statement suitable for the purpose of the lender determining that the financial covenants continue to be met on the basis on which they were set.

Summary

Even when under frozen GAAP the terms of a facility agreement specify the process to address such changes (or are based on floating GAAP), the interested parties may disagree on how the changes to the accounting practices should be reflected or how they impact the various defined terms used in the facility agreement. Parties may even disagree on how the different elements of operating leases (including rental, interest, and other payments) should now be treated.

Generally, lenders do not want to put their borrowers into default but be aware that if a lessee took out an operating lease in full knowledge of the advent of IFRS 16 then an actual court of law may view that differently from it simply being subject to frozen GAAP.

Taking a “frozen” GAAP position, lessee’s should push for extant operating leases to be treated as per IAS 17 and to this end prepare accounting entries under these old guidelines such that auditors and lenders can agree that no breach has occurred as a result of compliance or as a result of continued compliance. New lease facilities will, of course, result in increased debt and possible breach of covenant just as an increase in borrowings does. To ensure you have the necessary valuations under both IAS 17 and IFRS 16 then look no further than LLA from Innervision as the work will be done as part of your IFRS 16 transition and compliance project.

Disclaimer: this article contains general information about the new lease accounting standards only and should NOT be viewed in any way as professional advice or service. The Publisher will not be responsible for any losses or damages of any kind incurred by the reader whether directly or indirectly arising from the use of the information found within this article.