COVID 19: Accounting for Rent Concessions Under IFRS 16 and ASC 842

Updated 12th May 2021 | 2 min read Published 20th July 2020

In response to the coronavirus pandemic, many lessees have been requesting and negotiating rent concessions from lessors such as rent holidays, payment deferrals and partial rent forgiveness. Such concessions can have a variety of accounting implications under the current lease accounting guidelines.

In an effort to provide relief and make it easier for lessees to account for these COVID-19 related concessions, the International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB) have issued amendments to the IFRS 16 and ASC 842 lease accounting standards.

The new amendments intend to lighten the burden on the lessee in assessing large volumes of rent concessions and assessing whether modifications should be applied or not.

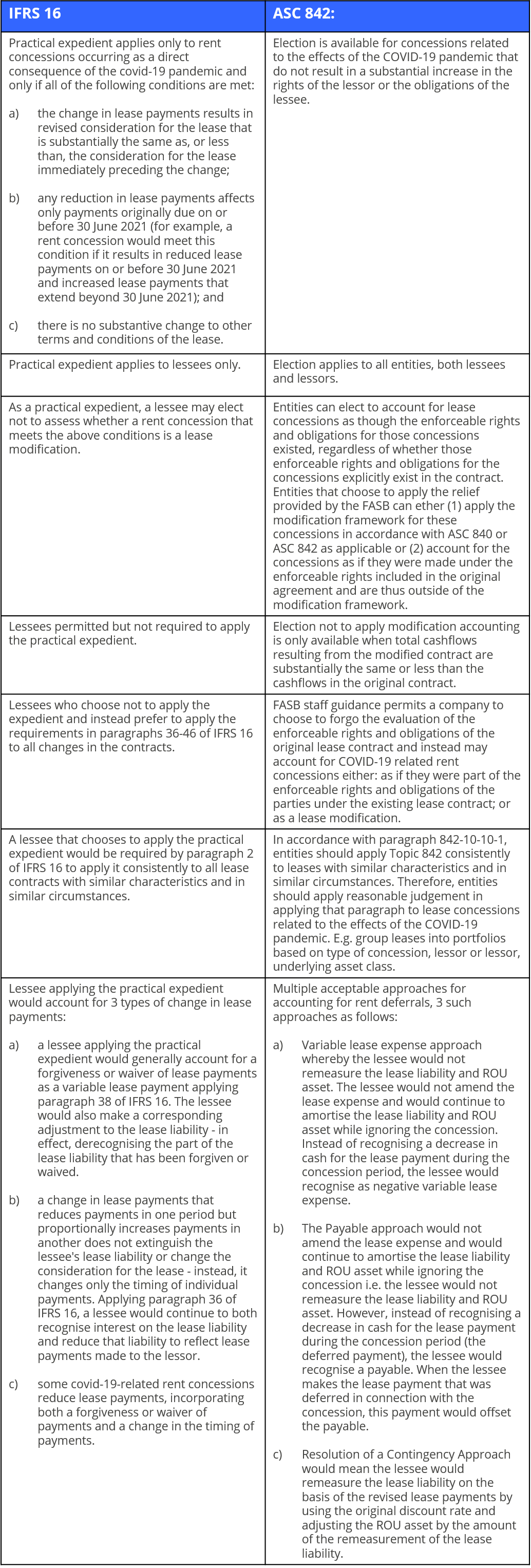

Although the two boards sought to achieve close alignment, some differences between the two amendments exist. The biggest being, that the IASB did not amend the accounting requirements for lessors whereas the FASB did.

How do the amendments differ?

The table below highlights how the COVID-19 related rent concessions should be applied under each standard and illustrates the similarities and main differences between both amendments.

To help organisations effectively apply the recently announced concessions, Innervision has developed new functionality within our lease accounting solution that accommodates both the IASB and FASB COVID-19 rent related concessions.

As neither the IASB nor the FASB are explicit as to how to account for COVID-19 Rent Concessions, our system offers 3 accounting approaches common to both IASB and FASB for users to select from with in built validations customised by the customer with associated disclosures.

When deciding on which approach your organisation should apply, Innervision strongly recommends and encourage preparers to engage with their auditors as to the preferred accounting approach of the audit firm, as not all audit firms have taken the same approach.

If you are interested in finding out more about the new COVID-19 related functionality, request a call back from out of our lease accounting system specialist today.