Personal Tax- How to Transfer Marriage Allowance

Article ID

personal-tax-how-to-transfer-marriage-allowance

Article Name

Personal Tax- How to Transfer Marriage Allowance

Created Date

6th August 2021

Product

IRIS Personal Tax

Problem

IRIS Personal Tax- How to Transfer Marriage Allowance between partners if born after April 1935. You can only claim this if the Transferor and the Receiver are within the income threshold set by HMRC:

Resolution

Marriage Allowance and Married Couples Allowance are two separate allowances. Married Couples Allowance is only viable for clients born before April 1935, read this KB

Marriage allowance has income threshold limits set by HMRC – for example if you have filled in the all the steps below but the clients income is too high then you cannot claim the allowance, it will not be given/shown (read the HMRC rules on this).

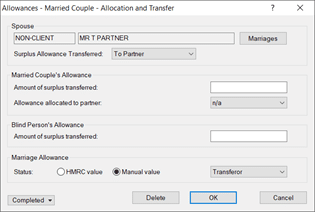

1.If claiming Marriage Allowance, then do not touch the ‘Married Couple’s Allowance’ three boxes (Amount/Spouse/allocated), leave the boxes untouched and empty. Load the client who is transferring the allowance from (i.e partner giving away their allowance). If it’s a non client then go to step 6.

2. Go to Reliefs, Allowances, Married Couple, complete the ‘Marriages’ field.

3. Surplus Allowance Transferred field: Select ‘To Partner’

4. Status: Select ‘Transferor’ (if you cannot select -switch to Manual Value)

5. OK to save. On this clients Tax return page TR5, the bottom field will be completed (It will not show on the one receiving the allowance, see step 10).

Do not touch the ‘Married Couple’s Allowance’. This only applies to people born before April 1935. If you complete this accidently then it gives a wrong calculation on the receiver of the allowance.

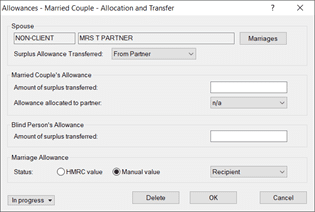

6. Load the client who is receiving the allowance

7. Go to Reliefs, Allowances, Married Couple, complete the ‘Marriages’ field. IF it’s a non client partner then create a non client.

8. Surplus Allowance Transferred field: Select ‘From Partner’

9. Status: Select ‘Recipient’ (if you cannot select -switch to Manual Value). BUT if this option is ‘greyed’ out- see below.

10. OK to save. Note: Tax return page TR5, for the receiver of the allowance, the bottom field will not be completed as its only designed to show for the partner giving the allowance away.eg step 5. If you are instead claiming the Married Couples then it is not designed to show on the TR5 page.

Do not touch the ‘Married Couple’s Allowance’. This only applies to people born before April 1935. If you complete this accidently then it gives a wrong calculation on the receiver of the allowance.

Can we edit the allowance? It cannot be restricted in anyway, HMRC rules state you can claim all 100% or none at all.

If the Status option is greyed out: then follow these steps: Setup, HMRC data retrieval options, switch on all 5 boxes and OK, now back to marriage screen and you now can edit the status. If the HMRC was already switched on, then untick all 5 boxes and OK and now edit the Status.

Invalid Data entry- Spouse Date of Birth: The ‘date of birth’ is required for both clients (client and view) because there are two different HMRC rules to this allowance based on their DOB.

I have all the correct settings but the allowance will not show on tax comp – Basic rate tax payer: Check the basic rate band before personal allowances and note it down. If the ‘total income before Personal Allowance is more than this amount’ then the client is a higher rate taxpayer and will not be eligible for marriage allowance.

Paper / E-Checklists – On Section C and Allowance it still shows the partner name even when separated from them- why? This is because of ‘Marriage allowance’ as it is still available even if separated from spouse/civil partner- so it needs to show the name etc on both checklists.

Client born before 6th April 1935: KB Article. Also use the help symbol ? on top right. PT will apply the HMRC maximum allowances based on the tax year (eg for 20121/2022= £9125): https://www.gov.uk/government/publications/rates-and-allowances-income-tax/income-tax-rates-and-allowances-current-and-past. Also under the allowances screen you can adjust the calc using the ‘Amount of Surplus Transfer and allowance allocated to partner boxes’

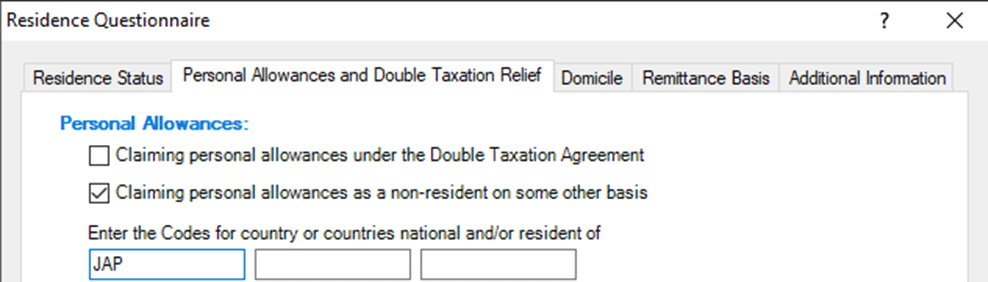

Client is Non Resident but the allowance will not show on tax comp or TR: Open the Resident Questionnaire and the Personal Allowance tab- if ticked like this, it will show the allowance (but only tick if its relevant for the client). The ‘Double taxation’ option may remove the allowance claim and not appear on TR5 page and cannot be overridden.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.