Personal Tax- Property Allowance Rules or Expenses missing from Schedules of Data/Comp

Article ID

personal-tax-property-expenses-missing-from-schedules-of-data

Article Name

Personal Tax- Property Allowance Rules or Expenses missing from Schedules of Data/Comp

Created Date

6th September 2021

Product

IRIS Personal Tax

Problem

Personal Tax: Property Allowance rules and the expenses are missing from Schedules of Data (Foreign section is triggered as well)

Resolution

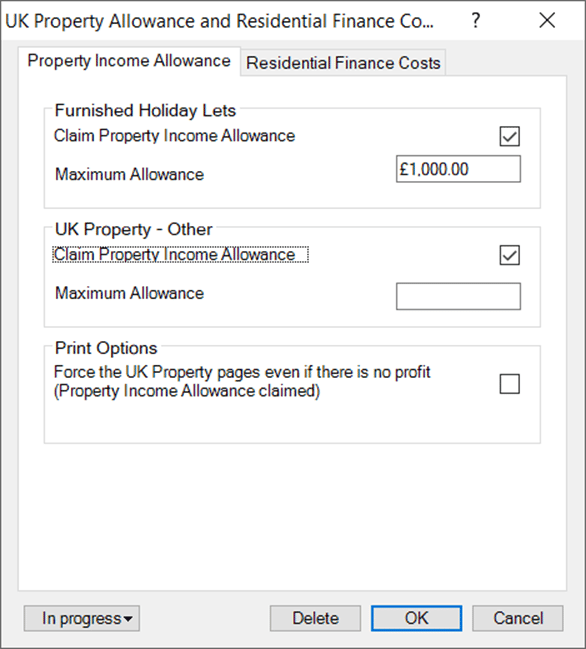

HMRC rule: If you claim either Furnished Holiday Let or Other property or Foreign ‘Property allowance’ (£1000) – this will override all other manual expenses from all the properties. This claim affects ALL property expenses (UK and Foreign). If you have lots of properties all with expenses, as soon as you make that £1000 claim, this will tick all the other property allowances and this will now be used rather then each expense claim. The expenses will no longer show on the Schedules of Data.

Schedules of Data report: If you claim UK allowances, the Foreign section will show even if no income is showing (this is a design feature and is currently under review in 2023). If you do not want this to show then save the report as WORD and manually edit it out.

£1000 Property Allowance is missing from Comp/Schedules: Open the UK property allowance screen, tick the relevant box and manually enter in the value. PT will not automatically populate this £1000 for you.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.