Personal Tax- How to use EIS/SEIS Share loss (Negligible value) against current income tax?

Article ID

personal-tax-how-to-use-eis-share-loss-against-current-income-tax

Article Name

Personal Tax- How to use EIS/SEIS Share loss (Negligible value) against current income tax?

Created Date

21st September 2021

Product

Problem

IRIS Personal Tax- How to use EIS/SEIS Share loss against income tax? and EIS Negligible value claim

Resolution

NOTE: If you want to carry back a share loss to past year then read this KB

To use EIS/SEIS share loss against current years income tax OR a EIS Negligible value claim (this relief will NOT be just against capital gains)

1.Load the client and the relevant year of loss

2. Edit, Capital assets, you must have an existing loss OR create the loss – So either a ‘Shareholding’ loss or an ‘Other Capital gain (OCG)’ and make a loss entry. Ensure the date of loss falls into the right tax year or no relief will show.

NOTE: You MUST enter it as a share loss or a OCG loss. If you only enter this loss under ‘Assets’ then this will trigger a error.

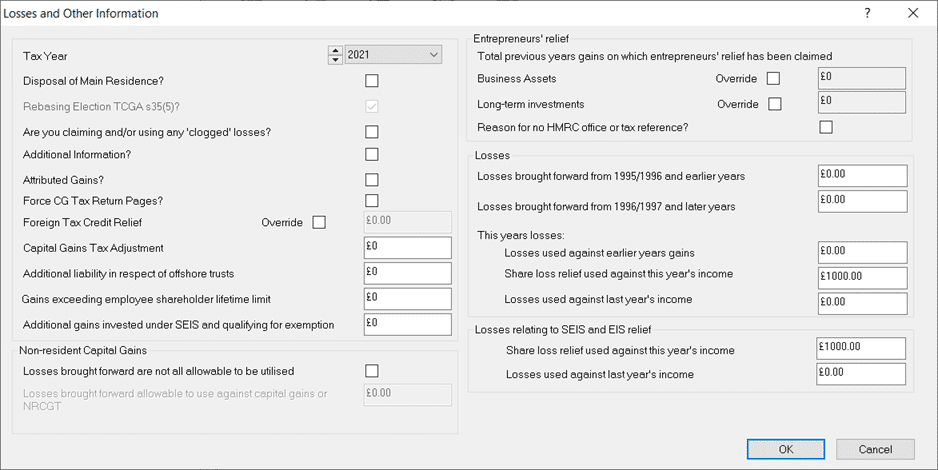

3. Edit, Capital assets, Edit(next to file), Losses and other information, make a double entry: Enter the loss value in a) ‘Share loss relief against this years income’ and again in b) ‘Share loss relief against this years income’ (you can see two identical fields which both need to be completed)

4. Run the tax comp – it will show as a ‘Income Tax relief’ and not show as a change in values under the CG tax comp or only affect the CG tax due. It will only be used against income.

If its a EIS relief clawback(not a loss) then read this KB: https://www.iris.co.uk/support/knowledgebase/kb/personal-tax-eis-seiss-relief-carry-back-to-prior-year-not-a-loss/

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.