Business Tax- How to attach PDF of a IXBRL/Tax comp when generating CT600?

Article ID

business-tax-how-to-attach-pdf-of-a-ixbrl-when-generating-ct600

Article Name

Business Tax- How to attach PDF of a IXBRL/Tax comp when generating CT600?

Created Date

13th October 2021

Product

IRIS Business Tax

Problem

IRIS Business Tax: How to attach a PDF version of accounts IXBRL and Tax comp when generating CT600?

Resolution

You have a reason to attach a PDF copy of the Accounts IXBRL copy or a PDF of the Tax comp. (For example the accounts was created by another company, or you have issues attaching the IXBRL)

When generating a CT600 – Business Tax is defaulted to look for the Accounts Production IXBRL copy and it will auto generate a Tax computation. You have to switch this off.

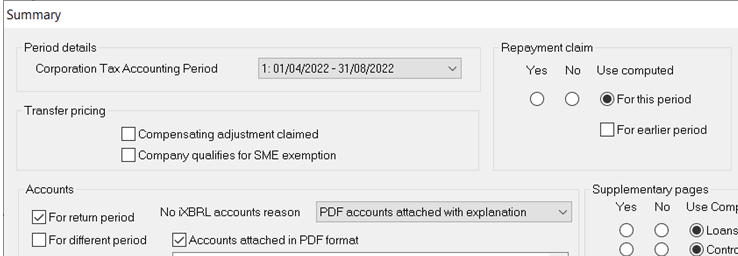

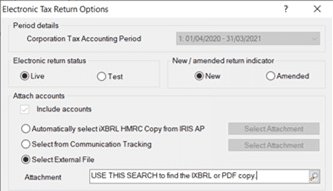

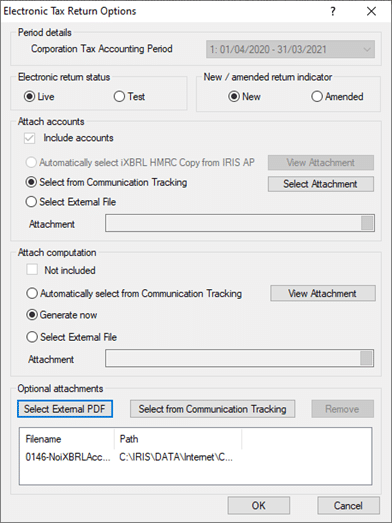

For the Accounts IXBRL: Load the client and relevant period: Data Entry, Summary – Accounts- tick PDF and select PDF option from the pull down list. Save the IXBRL from AP as a PDF. Generate the CT600 and use the ‘Select External File’ and click the Magnifying glass to find the PDF file and attach it.

For the Tax Comp: Load the client and relevant period: Data Entry, Summary – Computations- Untick ‘for return period’ and select PDF option from the pull down list. Save the Tax comp from BT as a PDF. Generate the CT600 and use the very bottom ‘Select External File’ and click the Magnifying glass to find the PDF file and attach it.

PDF size limit from HMRC: There is a limit to ANY PDF attachment added to a submission, the PDF has to be below 2MB in size. If you exceed this and submit you may get a error/warning. You will need to edit the PDF to reduce its size and attach the newly updated PDF.

If you get a ‘Page 1 of the CT600’ warning when trying to generate a CT600- go to this link: https://www.iris.co.uk/support/knowledgebase/kb/business-tax-page-1-of-ct600-indicates-accounts-comp-are-attached-so-you-must-attach/

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.