Personal Tax FAQs

Find our FAQs below.

For Tax Year 2020 – you will only be able to submit Tax Returns if you are running Version 21.4.0 – However, we recommend you be on at least Version 21.4.0.

But for 2021: there will be a new update in April 2021 to allow you to submit those ones for 20/21.

it is being carried forward because the client does not meet three HMRC rules:

a) There needs to be enough profit for the property.

b) There needs to be enough taxable non-savings income.

c) The calculation will also be restricted if there is any other type of ‘income tax relief’

Reports and run the residential finance relief comp – this will explain the calculation and the relief can also be partially restricted, and the rest carried forward.

a) You are not allowed to claim entrepreneur’s relief on a residential property, both cannot be claimed at the same time. Check this by going to:

Dividends | Capital Assets | Assets | Double click on the asset in question | Land and property magnifying glass | Check to see if residential property is ticked.

Close this box and then go to ‘Disposals’ |Highlight the disposal in the second window | Check entrepreneurs’ relief box.

b) Trading income allowance claimed on a trade with no turnover. Check this by going to: Trade Profession Vocation – Sole Trade Partnership – Edit accounting period – Remove figure in ‘Other income’ and enter it in the ‘Turnover box’.

c) The difference on the 6492-error message is the Class 2 NIC figure. For this, go to: Trade Profession Vocation | Sole Trade Partnership | NIC adjustments | Untick voluntary payments.

d) If the user has overridden the tax deducted at source figure for interest income, delete the entry from the section and enter it in: Interest | Government Security.

e) Have you overridden any Interest entries? So, for instance have you entered an Interest entry in it has calculated the 20% tax figure and you have then overridden this? If this has been done this is a HMRC restriction which is what is causing the error.

f) Have you overridden any Trust entries? This one is much like the Interest entry one above.

Your net relevant earnings can be found under Employment | Earnings/Foreign Earnings.

Check the entry in: Under Reliefs | Pension Contributions | Personal Pension Contributions

The gross figure in the personal pension contributions cannot exceed the net relevant earnings in the ‘Employment’ section. The exception report is appearing because that figure exceeds the net relevant earnings. However, if you are happy with the tax computation you can still file your return.

This is because of a rule from HMRC where it will supersede your manual value with their own values.

Setup

Retrieve HMRC data options

Switch on the 5 tick boxes and Ok

Pension

Other pensions or State pension

Bottom right – tick: View pension summary

Set all to manual values – ok and close.

Ensure you are on the latest iris version (help and about)

Setup/ auth agents/ highlight the row with pre-population – reset credentials and say yes. Close and click retrieve HMRC data and log back in and answer security questions etc

Then load a client in PT which needs employment/pension data and click retrieve HMRC data button on top right.

If you still have a warning or no data, then it is very likely a HMRC issue – they have confirmed every year they normally finish compiling everyone data by the end of each year

You can keep trying every day, but it is never going to be 100%. If you need the data asap then either chase the client for this, use estimated figures or call HMRC.

Employment / Expenses / New/ Type 10 Student loan deductions.

You need to enter the income TPV/ Foreign income first AND then make the same entry under Sole trade or Partnership as well. This is because HMRC needs to know out of all your income, how much is from Foreign sources.

Employment / Expenses / New/ Type 10 Student loan deductions.

You need to enter the income TPV/ Foreign income first AND then make the same entry under Sole trade or Partnership as well. This is because HMRC needs to know out of all your income, how much is from Foreign sources.

If you want to voluntary pay NIC class 2 – Reliefs/ Miscellaneous/ NIC adjustment / Tick override and enter in the value and tick Voluntary payments.

Go to UK property income / create a FHL property first / then click FHL property options/ Import from File/ Import file and look for the excel/csv file.

Go to Trade, Profession or vocation/Sole trade partnership-click period/adjustments losses overlap tax/enter in tab that says offset against other income.

Go to Edit in the top left hand corner -capital assets- create a loss via assets/other capital gains/ then click edit in the top left hand corner of the capital assets window/losses and other information/enter figure in share loss relief used against this year’s income (double entry needed in the same heading).

Go to UK Land and Property and then UK Property Income. Double click on the first relevant property //Untick the “Property let jointly?” tick box// Click the Joint Income magnifying glass.

Delete all other sharers and change the owners share back to 100% as well // Click OK twice more until you are back on the Personal Tax screen with no popups.

Then run a tax computation to refresh the system.

Double click on the same property. Tick the “Property let jointly?” tick box//Add the sharers info back in.

Go to setup-retrieve HMRC data-ensure boxes are ticked//this will allow the user to select manual or HMRC value.

Go to setup in the top left hand corner – retrieve HMRC data//tick all boxes//go to pension and state benefits//other pensions/view pension and state benefit summary/select manual value/Run another comp.

Go to Administration in the top left hand corner – client account – highlight payment – click match/then click match again.

Ensure PAYE number has been entered/click between HMRC and manual values. Go to Set up-authorised agents-reset agent credentials. Set up data retrieval again. If it still does not pick up the data, may need to check with HMRC as Iris has no control over the data collected per client.

HMRC Restriction – they will not yet allow an amended P11d to be submitted online – you will need to print it out and post it to HMRC.

If this links to an employment, go to: Employment | Earnings/Foreign Earnings | Highlight Employment | Edit | Tick ‘Earnings include disguised remuneration’.

If this does not link to an employment, go to: Reliefs | Miscellaneous | Disguised Remuneration

The clients’ capital gains transactions would need to be entered into IRIS as follows:

there are 3 options to choose from:

Enter the disposal of the EIS shares and claim relief on the disposal to reduce the taxable gain to the required level.

If there is a loss (need to create the loss in cap assets – under other cap gains) which can be offset against the other income can be entered via the edit menu within capital assets- click edit- losses and other information and complete both of the share loss relief used against this year’s income boxes.

If there is a gain – the element of deferred gain which has become taxable within the tax year can be entered within the other capital gains section, (also you can enable the brokers schedule option within this section as this will eliminate the need to enter an acquisition date.

Sign in as the Master user in IRIS | Setup | Practice Options | Tax Options (right-hand side) | Click relevant tab depending on the software they are trying to submit on | Enter details.

It could be a refresh issue. Therefore, go to: Reports | Trade Computation, and close the report. Then, check to see if the overlap relief is being utilised

Trade, Profession or Vocation | Sole Trade or Partnership | New (bottom half) | Change | Please ensure the most recent account date entered is same as the cessation date

Trade, Profession or Vocation | Sole Trade or Partnership | Edit (top half) | Please ensure the correct cessation date is entered. Also, go into the ‘Related’ tab and ensure the individual has the correct end date entered.

Go to Trade profession or vocation/ Sole trade or partnership/ Highlight the sole trade on the top half/ Then on the bottom half click on New/ Add in a new period a year ahead of their last accounting period/ Click ok/ No need to enter any figures in this period. The system just needs to cover the full year.

Steps to do if carrying back loss from 2021:

1 – Trade profession or vocation |Sole trade or partnership | Go into the current accounting period | Adjustments Losses Overlap Tax tab | Enter loss amount to carry back

2 – Reliefs | Miscellaneous | Tax Calc | Tax code overpaid, underpaid and repaid tax |Tax Underpaid/Overpaid from earlier years. Manually enter in here the tax savings amount from the loss carry back.

3 – Reliefs | Miscellaneous | Additional info | sa101 | Make note of breakdown

To show the Losses brought back in 2020 tax year:

4 – Other income | Any other losses | “Future trading or certain capital losses” | Enter the same figure that was entered into loss carry back of the sole trade or partnership.

– Reliefs | Miscellaneous | Tax calc | Tax code overpaid, underpaid and repaid tax| Fill in tax reclaiming now field | Enter the tax savings amount that was manually figured out

– Reliefs | Miscellaneous | Additional info | sa101 | Make note of breakdown

- Go into person you entered the info into. Then go to UK Land and Property and then UK Property Income. Double click on the first relevant property

- Untick the “Property let jointly?” tick box

- Click the Joint Income magnifying glass. Delete all other sharers and change the owners share back to 100% as well.

- Click OK twice more until you are back on the Personal Tax screen with no popups. Then run a tax comp to refresh the system.

- Then go back and double click on the same property.

- Tick the “Property let jointly?” tick box

- Add the sharers info back in.

Edit | Capital Assets | Other Capital Gains or Shareholding | Open the EIS loss entry- Please select Unlisted Shares in Asset Type | OK. | Then regenerate the Electronic Tax Return and submit.

HMRC have recognised that the IRIS tax computations can now be used in replacement of an SA302. The clients name and UTR must be visible on the tax computation. To print a Tax Computation, select Reports | Tax Computation.

PLEASE BE AWARE THAT THIS WILL NOT HAVE SA302 PRINTED ON THE TAX COMPUTATION AS AN SA302 IS ONLY AVAILABLE FROM THE HMRC. HOWEVER, HMRC HAVE STOPPED PROVIDING THESE FORMS.

HMRC have not provided any link that we can point our clients to regarding this. Therefore if you have any banks/mortgage lenders that do not accept our computations then you will need to contact the HMRC which they have advised on their website.

Please see the KB https://www.iris.co.uk/support/knowledgebase/kb/ias-11886/

Firstly, ensure you are viewing the client you wish to deactivate.

Delete the tax year data for the client you wish to deactivate, to do this go to edit | delete tax year data. Then click Client and Status – say NO to the question ‘Is this person currently a client’

When you now go to view the client browser screen you will notice this client is no longer appearing within the list, as the view is set to ‘Currently registered in Personal Tax’ by default.

Next to ‘Show clients registered in’, change the drop-down option to ‘Whole Practice’.

You will be able to select the client you previously deactivated and re-register them back into Personal Tax so historical data can be accessed again if ever needed.

Edit | Capital assets | select the disposal | tick relief | select type 0

Fatal error means that HMRC gateway is busy. You will need to keep attempting to file the return possibly at another time until it goes through.

There are three reasons why an Authentication Failure message can occur.

The user ID or password details are incorrect

The clients UTR number is not correct

The service has not been activated using the PIN provided by HMRC

Checking the user ID and Password

Log into IRIS Personal Tax as a MASTER user and select the client

From the Setup menu select Practice Options

Click the Tax options button

Check that the User ID and Password boxes have been completed correctly

If the client has been assigned to an alternative accountant check the User ID and password have been entered correctly for the alternative accountant, this can be done by clicking the Client menu, select View, click the Accountant button, click the magnifying glass to the right of the alternative accountants details then view the accountant and click Tax Options

It is possible to highlight and copy this information from IRIS and paste into the relevant login boxes on the Government Gateway website. This is a good way to ensure the details have been entered correctly.

Checking the client’s UTR number

Log onto the Government Gateway Website and check the client list for the practice, ensure that the UTR number shown for the client is the same as the UTR number entered into IRIS Personal Tax.

Checking the service has been activated

To check this log onto the Government Gateway website using your User ID and Password and check for any options to activate the service.

Note, If the User ID and Password are correct and the UTR number is correct, refresh the clients file by reprinting the electronic Tax Return (to the screen) then transmit again.

If the client is still receiving the authentication message, then it is advised to contact HMRC as the message is coming directly from them.

You will need to right click on sections on the left hand side i.e. employment, pensions and click on view/change status/highlight entries individually and click on complete all.

HMRC Restriction. No this cannot be done.

Go to: Edit | Capital Assets | Click on shareholding | Events | Consolidation | Enter a date | Go to each event and reduce the amount to show what the shares have been changed to

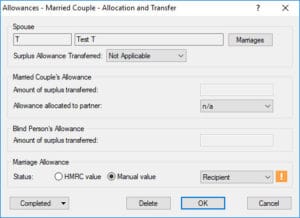

Married couple, allocation, and transfer

Check the following:

The recipient needs to be a basic rate taxpayer – total income should generally be between £12,501 – £50,000

The transferor income needs to be less than the personal allowance (£12,500)

Ensure the Married Couple – Allocation and Transfer screen look as follows (Reliefs | Allowances | Married couple – Allocation and Transfer)

Spouse field should be completed

Amount of surplus transferred should be blank and allowance allocated to partner should be set to n/a

Recipient should be selected in the marriage allowance section

If not retrieving from HMRC then manual should be selected.

If non-resident is ticked in reliefs | miscellaneous | residence question, in the same screen select Personal allowances and Double taxation relief tab | tick ‘Claiming personal allowances as a non-resident on some other basis’

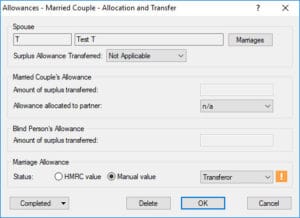

Check the following:

The transferor income needs to be less than the personal allowance (£12500)

The recipient needs to be a basic rate taxpayer – total income should generally be between £12,501 – £50,000

Ensure the Married Couple – Allocation and Transfer screen look as follows (Reliefs | Allowances | Married couple – Allocation and Transfer)

Spouse field should be completed

Amount of surplus transferred should be blank and allowance allocated to partner should be set to n/a

Recipient should be selected in the marriage allowance section

If not retrieving from HMRC then manual should be selected.

If non-resident is ticked in reliefs | miscellaneous | residence question, in the same screen select Personal allowances and Double taxation relief tab | tick ‘Claiming personal allowances as a non-resident on some other basis’

Go to setup | retrieve HMRC data practice options – tick marriage allowance

This is not meant to show on the return of the recipient. The box on the return is only for the transferor to fill out.

A claim must be made first online so HMRC are aware of the claim. https://www.gov.uk/marriage-allowance

Sole Trade and partnership | double click the relevant period at bottom of screen | Adjustments, losses overlap & tax | Enter figure in Deductions made by contractors on account of tax (CIS25s)

Personal Tax

Once you have submitted a SA100 to HMRC you want to ‘lock down’ a tax year to stop users from generating a further new/amended SA100, then follow these steps:

If you do lock down a tax year and you try and generate a new one you will get this warning: ‘This year’s tax matters have already been cleared up for this client’.

Load the client and select the relevant tax year

Administration

Edit Tax Return Dates

‘Submissions Status’ Section – scroll to the bottom

Add a date to the ‘Tax Clearance for year’ to lock it down OR remove this date to allow you to generate a tax return.

This is a HMRC rule set up for Foreign income. You cannot claim ‘Foreign Tax Credit Relief’ (FTCR) on Foreign dividends – and expect it to be shown on page TR3 boxes 6 etc. If you claim ‘FTCR’ on the dividends, then it needs to go on to the Foreign pages (and not TR3 box 6 etc). If you have a Foreign dividend entry, you can test this by following the steps below:

Foreign

Dividends and Interest

Open the dividend entry on the top half

Untick ‘Claim Tax credit relief’ box and then check page TR3.

If the client really has a ‘Claim Tax credit relief’ then re-tick it and it will only show on the Foreign pages.

This is an HMRC Restriction – You cannot claim a relief against a loss.

Adjust the disposal amount to obtain the correct loss figure. Then make a note to explain this further about the period covered by Principal Private Residence into box 37 on page CG 2 of the tax return. To make this note, go to the Capital Assets main window | Edit | Losses & Other Information | Tick the Additional Information box and make the note here.

Load the client and choose the relevant year

TPV, STP

Open the relevant accounting period,

Two options will show ‘Other income (not SEISS)’ at the top and ‘SEISS payments’ at the bottom.

Enter the values and OK. This will tick box 20.1 on page TR8.

There is an option for ‘Incorrect grant claims‘ under Reliefs | Misc (where data transferred from BT will show). Short Self-employment pages box 27.1 will be filled in from step 4. There is no function yet to claim SEISS and Covid grants against Property income so please add it under Reliefs | Misc | additional info | SA100 and state it here.

This will be fixed in Version 21.4. Please update your version when available on www.iris.co.uk

The tax return does correctly populate Box 70.1, HMRC have not updated their working sheet to cater for businesses where the basis period does not match the accounting period. In this instance we would suggest for you to contact HMRC for further guidance, as there is nothing to amend on the tax return as it is showing the correct amount as expected in the box.