P11D - Failed/Missing Authentication, check Username and Password

Article ID

p11d-failed-authentication-check-username-and-password

Article Name

P11D - Failed/Missing Authentication, check Username and Password

Created Date

18th February 2022

Product

Problem

IRIS P11D - when generate or submitting but you get Failed/Missing Authentication, check Client UTR, ID and check Password setup

Resolution

1.You must be on the latest IRIS version – check on Help and About.

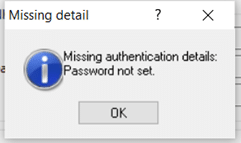

If you get ‘Missing Authenication details/password not set’: Client Magnifying Glass (top left) | View the company | Accountant | Set to ‘Agent’ and then check this, go to Setup – Practice Options – Tax Options – P11D tab – enter HMRC login information.

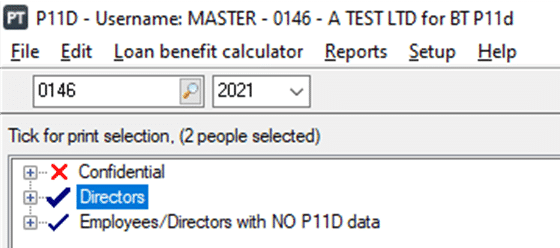

2. On the top left of the P11D where the company name ID is listed, select the magnifying glass and on the client select screen view that company:

3. Select: Accountant – this normally is set to Agent. (If its set to Alternative/branch then speak to your team to confirm if its correct, if yes then read the very bottom of this KB). It MUST NOT be set to No accountant.

4. Client | View | Tax tab and check the PAYE code is correct. You can delete it save and click OK and go back and enter the PAYE code again.

5. Setup | Practice options | Tax options You may need to log in as MASTER.

6. Open the P11D tab – are your agent credential ID and Password correct? – check the password length as well. Test this by logging into the HMRC gateway with the same ID and Password. If it logs in fine then go back to P11D and delete that ID and Password. Click OK and then go back in again re-enter it again carefully and save.

Do not submit right away as it remembers the old login details. Just regenerate it again and submit.

7. If it fails again then check your Agent Password. If it contains a special character (like £, $, %, ! etc.) then this can cause this issue. Log in to your HMRC gateway and change the password so it only contains numbers and letters, save it. Then go back to step 3) and enter the updated password.

8. If it still fails then you need to call HMRC support and speak to a senior as there are issues where HMRC can block the submission from their side.

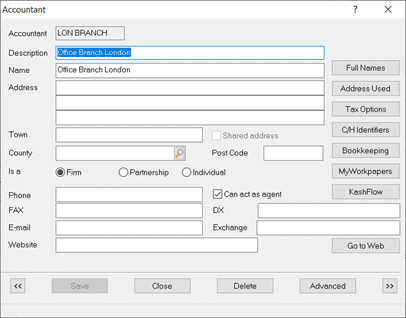

How to set up ‘Alternative’ or Branch accountant (see step 1)

Alternative or Branch accountants are usually set up if a practice has several branches/offices which have their own Agent Credentials login details (that is, you don’t use one login for all the branches).

Client | View | Accountant – Set to Alternative or Branch and click the magnifying glass. Either create a new one or select an existing one. You must tick ‘Can act as agent’ and click OK to save it and click view on it again. More options will show (you may need to log in as MASTER).

Click Tax options and open the Self Ass. or Corp tax tabs and complete the fields with the branches correct agent credential ID and Password.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.