Business/Personal Tax: HMRC Unsuccessful submission for Reference XXXXXX

Article ID

business-personal-tax-hmrc-unsuccessful-submission-for-ref-xxxxxx

Article Name

Business/Personal Tax: HMRC Unsuccessful submission for Reference XXXXXX

Created Date

3rd May 2022

Product

IRIS Personal Tax, IRIS Business Tax

Problem

IRIS Business/Personal Tax: HMRC Unsuccessful submission for Reference XXXXXX

Resolution

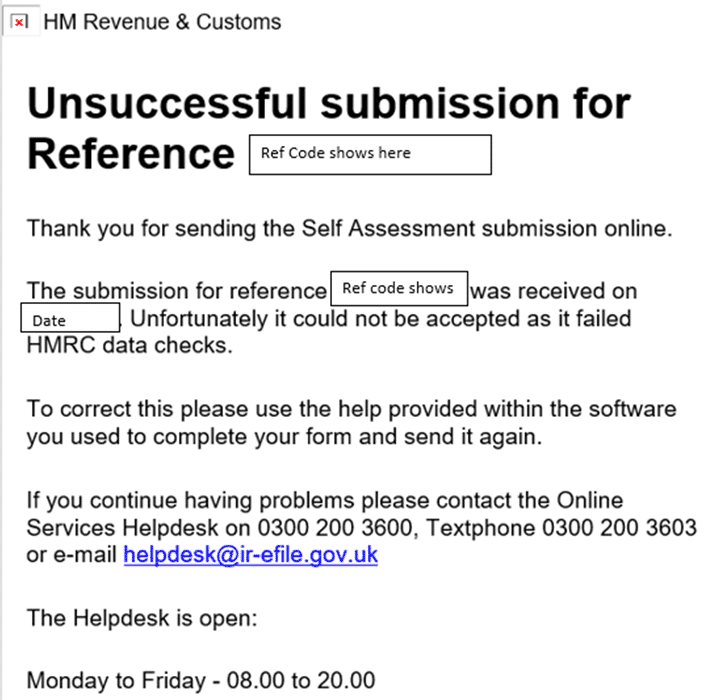

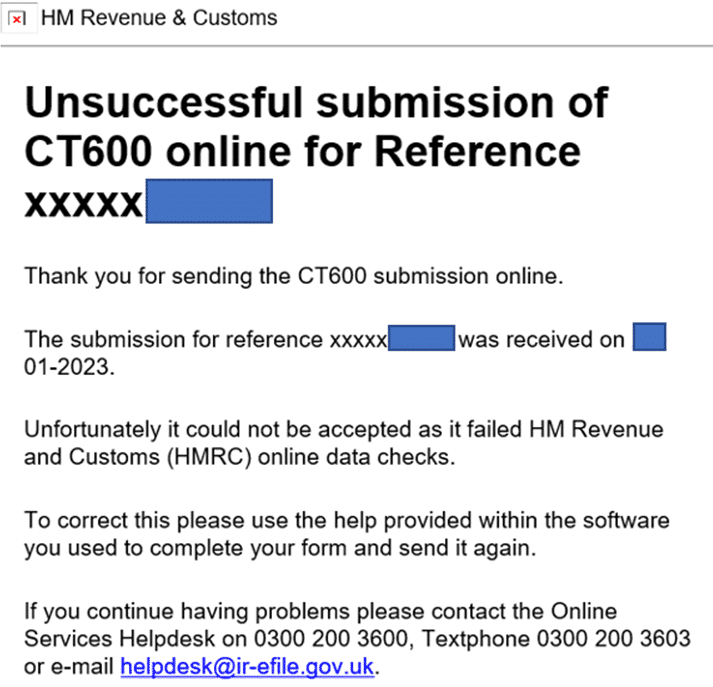

This warning is coming from HMRC. If you submit a BT or PT tax return to HMRC and you get a warning ‘HMRC Unsuccessful submission for Reference XXXXXX’.

- When you generated the tax return; did you get a ‘Validation warning or an error’?, if yes then note that warning down (if your unsure, then regenerate a new tax return etc) and to look for an answer under the Knowledgebase search tool – for example if you get a 3001 6492 error etc then you need to check for any incorrect entries for the affected client. If you ignore the validation and try and submit you may the ‘HMRC Unsuccessful submission warning’.

- If you did not get any errors when generating then you may need to contact HMRC support directly to find out why the submission was unsuccessful.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.