P11D and PT- Car Engine size 'CC' and car benefit % calculation

Article ID

p11d-car-engine-size-cc-and-car-benefit-calculation

Article Name

P11D and PT- Car Engine size 'CC' and car benefit % calculation

Created Date

31st May 2022

Product

Problem

IRIS P11D and PT- Car Engine size 'CC' and car benefit % calculation query - why is the % calc different to what you expected

Resolution

The Car benefit % value is calculated using these three factors:

a.Car Registration Date (as it uses either the NEDC or WLTP tables from HMRC)

b. Fuel Type

c. CO2 emissions /Approved zero emissions OR Engine Size.

The IRIS P11D/PT car benefit screen follows the % table for engine size from this HMRC link (So please double check your entries in the P11D – this is a common issue):

and this is the HMRC table used for each year

The P11D uses the HMRC table to calculate the % – https://www.gov.uk/guidance/company-car-benefit-the-appropriate-percentage-480-appendix-2

Read this KB link as well – https://www.iris.co.uk/support/knowledgebase/kb/p11d-car-make-model-missing-and-co2-engine-size-issue/

The Help ? option on the top right of the car benefit screen for engine size uses an old table and this will be updated. Please use the link above to find the correct % calculation.

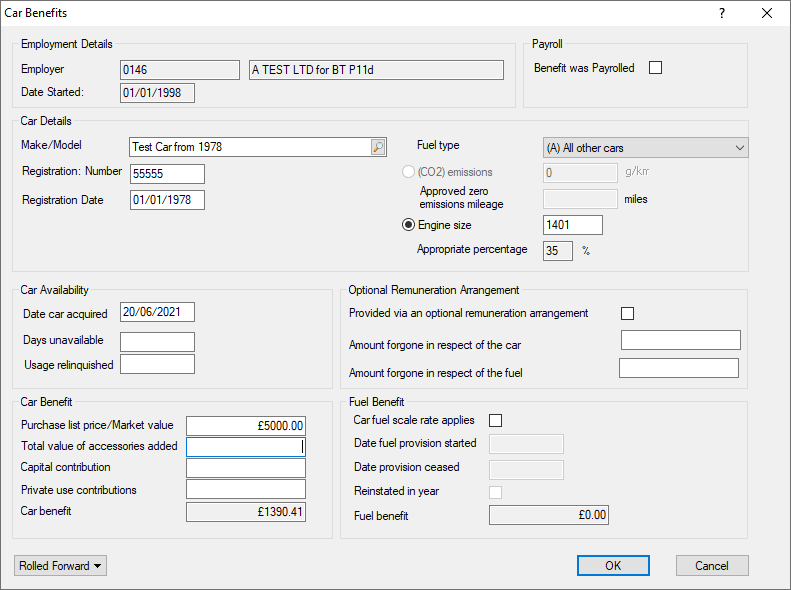

Below example uses the ENGINE SIZE to calc the % of 35% – if you edit the size (and also the approved zero/CO2 emissions- the % will change based on the HMRC rules)

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.