Personal Tax- Capital Tax on gain already charged value is Rounded up and triggers a refund

Article ID

personal-tax-capital-tax-on-gain-already-charged-value-is-rounded-up-and-triggers-a-refund

Article Name

Personal Tax- Capital Tax on gain already charged value is Rounded up and triggers a refund

Created Date

16th August 2022

Product

Problem

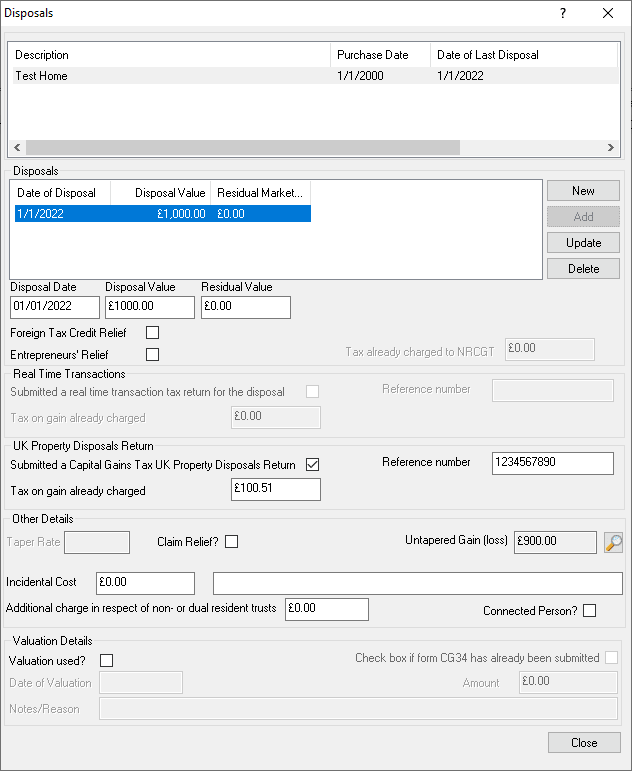

IRIS Personal Tax- Capital Tax on gain already charged value is Rounded up and triggers a incorrect refund

Resolution

IRIS PT is following HMRC rounding rules where the Tax charged is always rounded up to the £. For example the Capital Tax on gain already charged value is £100.51. When you run the Capital Gain computation it shows instead as £101. This may create a incorrect capital refund if the capital tax calc is a similar value.

If you don’t want to trigger a capital refund:

Open the Disposal and edit the value of Tax on gain already charged so it doesn’t do the rounding (by manually rounding it up or down) – then go to Edit, Losses and Other information and tick Additional information and state the correct tax charged value here.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.