Personal Tax- Amount in SA103s profit/loss most equal the sum of SA103s Turnover-SA103s Other income etc. Also Expenses missing on self employment page

Article ID

personal-tax-amount-in-sa103s-profit-loss-most-equal-the-sum-of-sa103s-turnover-sa103s-other-income-etc-also-expenses-missing-on-self-employment-page

Article Name

Personal Tax- Amount in SA103s profit/loss most equal the sum of SA103s Turnover-SA103s Other income etc. Also Expenses missing on self employment page

Created Date

25th August 2022

Product

Problem

IRIS Personal Tax- Amount in SA103s profit/loss most equal the sum of SA103s Turnover-SA103s Other income etc. Also Expenses missing on self employment page

Resolution

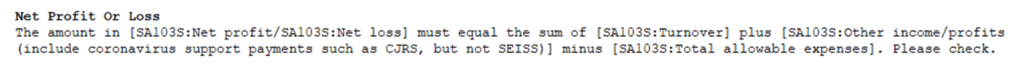

When you generate or submit the tax return you get this error: AND the expenses for the Sole trader are missing from the self employment pages eg box 20 (short page SES1 and the Full pages)

If you have TWO or more Sole Trade Businesses and one has claimed the trading allowance and one has claimed normal expenses. This is not permitted, HMRC rules state: if you are claiming the trading income allowance on 1st trade, this would preclude users from claiming any expenses on their second trade, or any trade. You cannot claim both the Trading Income allowance and expenses between the multiple trades. You need to decide which to keep either the trading allowance OR the expenses.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.