Personal Tax- 3001 6215 Entry in CAL16, Box AIL3 must also be completed

Article ID

personal-tax-3001-6215-entry-in-cal16-box-ail3-must-also-be-completed

Article Name

Personal Tax- 3001 6215 Entry in CAL16, Box AIL3 must also be completed

Created Date

11th October 2022

Product

Problem

IRIS Personal Tax- 3001 6215 Entry in CAL16, Box AIL3 must also be completed

Resolution

1.Load the Client and the relevant period

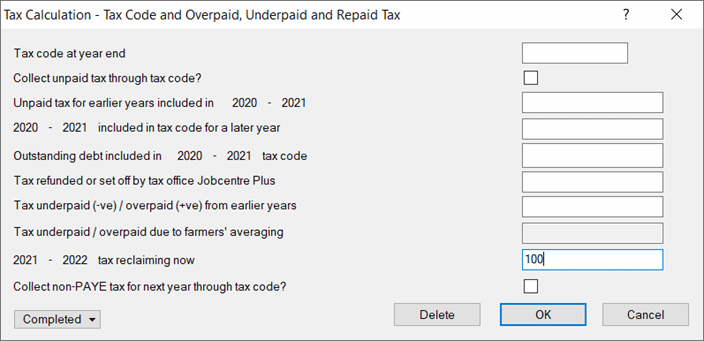

2. Reliefs, Misc, Tax Calc, Tax Code and Overpaid – check if you have entry under Tax reclaiming now. For example here is 2021 period

This ‘Tax reclaiming box’ can only be used under these conditions – a reclaim will be necessary where:

- A trading loss from the following fiscal year is carried back into the current year. (Enter details of the claim in the additional information box)

Link on loss carry back and when to use the reclaim box: https://www.iris.co.uk/support/knowledgebase/kb/ias-12098/

- A personal pension contribution is brought back into the current fiscal year. Note that where the contribution is made net then the tax reclaimed will be difference between basic and higher rate bands.

- IRIS does not compute this amount automatically. Work out the difference to the tax liability the amount brought back would have had if it had been given as a deduction in the computation. This can be achieved by simply entering a deduction in the Reliefs section just to see the effect. The difference between the tax in the computation with the deduction and the one without is the amount for this field.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.