Personal Tax- Edit number of properties Box 1 UK1 page and Box 15 F4,5,6 page

Article ID

personal-tax-edit-number-of-properties-box-1-uk1-page

Article Name

Personal Tax- Edit number of properties Box 1 UK1 page and Box 15 F4,5,6 page

Created Date

12th October 2022

Product

Problem

IRIS Personal Tax- Edit number of properties Box 1 UK1 page and Box 15 F6 page

Resolution

NOTE: If you tick ‘Income from this property has ceased’ – this will not hide the property from the current year. It will prevent the property from being included in the bring forward routine for the following year.

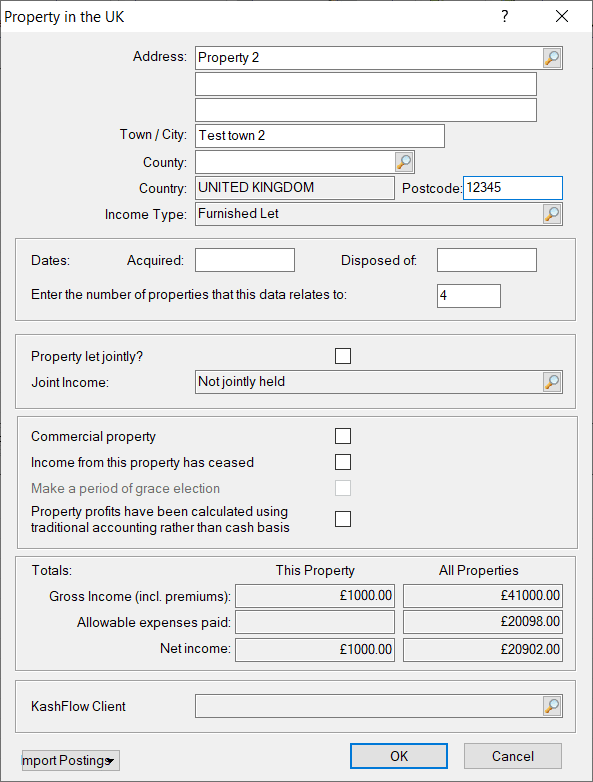

1) Open each property and enter a value under ‘Number of properties that this data relates to’ BUT if no value is entered then PT automatically reads each row entry as one property and this cannot be changed

2) Foreign entries (under the Foreign/ Property income – each will create multiple F4, 5, 6 pages with the number on Box 15. (read option 1 above)

3) If you cannot edit the number then use this workaround – Reliefs/Misc/ Additional information and add an additional note SA100 to declare its actually X properties and not the stated number

3) A workaround is to delete the property from the selected year (which it will no longer be counted) – it will NOT delete it from past years but you need to add back in future years.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.