Personal Tax- Expect NIL/Refund of tax but Tax comp shows a unknown Capital Gains tax or Higher Tax Due

Article ID

personal-tax-expect-nil-tax-but-tax-comp-shows-a-unknown-capital-gains-tax-or-tax-due

Article Name

Personal Tax- Expect NIL/Refund of tax but Tax comp shows a unknown Capital Gains tax or Higher Tax Due

Created Date

18th October 2022

Product

IRIS Personal Tax

Problem

IRIS Personal Tax- The tax comp shows a Capital Gains tax or overall tax due amount when it should be a NIL or a refund of tax due? OR Foreign relief is being restricted - GIFT AID entries.

Resolution

This can be caused by a GIFT AID entry. Run Tax computation – it shows a £XXX Tax due and not NIL/Refund of tax as you were expecting OR the Tax due is higher then you expected. Why and which is correct? Also when you run the Capital Gains computation – it shows a NIL/£0/Refund Tax due but shows a CG tax due on the Tax comp (also if the CG Foreign relief is being restricted)

This can be coming from three entries you have made:

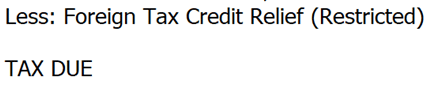

a) Foreign Tax Credit Relief claims under Capital assets or in Foreign income. You may get this on the CG comp:

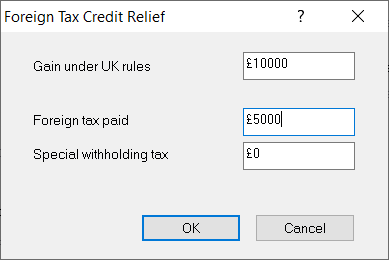

b) Gift aids under Reliefs/Charitable Giving and Annuities

c) Only have BRB ‘other income‘

1.If you have any Dividends, Capitals Assets, Open all disposals/gains in the year (under Assets/ Shares / OCG). Open it and check if there is a Foreign Tax Credit relief claim and tax entry made. If you also have any Foreign income – check the Foreign Tax Credit relief claim and tax entry made.

2. Now go to Reports and run the Foreign Tax Credit relief for Capital Gains report. Check if the Relief value (it compares the Tax charge to the Foreign relief and automatically has to use the LOWER value for the relief claim)

3. Now go to Reports and run the Foreign Tax Credit relief report. Check if the Relief value (it compares the Tax charge to the Foreign relief and automatically has to use the LOWER value for the relief claim)

4. Go to Reliefs – Charitable Giving and Annuities – check if you have ‘Gift Aid‘ entries and also check if you have only ‘BRB other income‘.

PT is following HMRC rules and running an automated restriction to the Foreign Tax Credit relief and creating this tax and may show this tax relief on the Tax comp). PT is correct with this tax due and you can submit.

As PT cannot yet produce a full breakdown of the Tax relief (apart from the Tax comp) please read this HMRC guide: https://www.gov.uk/government/publications/calculating-foreign-tax-credit-relief-on-income-hs263-self-assessment-helpsheet

For example: PT calculates the FTCR, however if the client has Gift Aid and only BRB other income, their FTCR needs to be restricted. In the Tax Comp it will not apply the Foreign Tax relief restriction in the last row thereby not affecting the Tax Due amount BUT it is correct. If you want to test, then remove the Gift aid and only BRB Other income and rerun the Tax comp to see it change back to NIL or a expected tax due.

I do not have a Gift Aid and only BRB other income – and only have Foreign credit relief but still getting a unknown CG tax. Our Development team has confirmed its a known issue so please update to IRIS version 23.3.0. You have three options before this update:

1.Submit the return as it is, with an additional info note to ask HMRC to remove this CG tax .

2. Remove the foreign tax credit relief and enter an other relief type to bring the gain down to NIL, with a additional info note.

3. Go to foreign | additional information | tick the box to override the foreign tax credit relief and manually adjust the amount

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.