Personal Tax- UK property SA108 tax on gains Box 9 already charged. 3001 8392 CGT10 present CGT9 present

Article ID

personal-tax-uk-property-sa108-tax-on-gains-box-9-already-charged-3001-8392-cgt10-present-cgt9-present

Article Name

Personal Tax- UK property SA108 tax on gains Box 9 already charged. 3001 8392 CGT10 present CGT9 present

Created Date

4th November 2022

Product

Problem

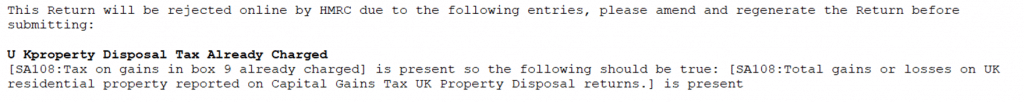

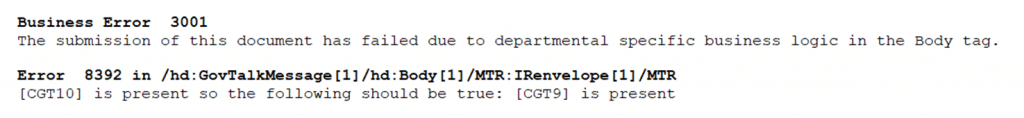

IRIS Personal Tax- Validation SA108 tax on gains Box 9 already charged. 3001 8392 CGT10 present CT9 present

Resolution

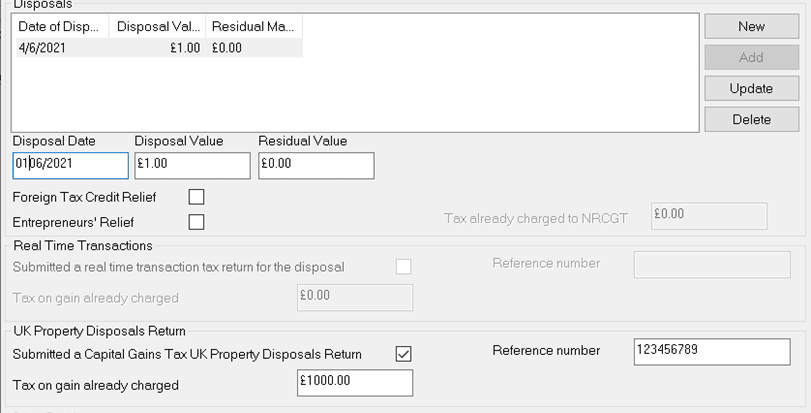

1.Dividends and Capitals assets- check Assets and OCG for any asset disposals in the affected year- open the disposal and check if there is a entry for Tax on gain already charged:

2. Run the Capital gains comp – is the asset showing any GAIN or LOSS. If there is no gain or loss and shows a 0 then run the Draft tax return. Go page CG1 and look at Box 10, the tax charge value will show. There must be a LOSS or GAIN value in Box 9 (You cannot have tax on gains if there are no gains/loss). This submission will rejected by HMRC if nothing shows in box 9 and you have a entry in Box 10.

3. Dividends and Capitals assets- check Assets and OCG for any asset disposals in the affected year- open the disposal and reduce OR remove the Tax already charged entry.

4. If you remove the tax charged entry – add it under Dividends and Capitals assets, Edit, Losses and other Info and Additional information.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.