Personal Tax- How to add a new Sole Trade/Partnership/Employment/Director business?

Article ID

personal-tax-how-to-add-a-new-sole-trade-business

Article Name

Personal Tax- How to add a new Sole Trade/Partnership/Employment/Director business?

Created Date

6th December 2022

Product

Problem

IRIS Personal Tax- How to add a new Sole Trade OR Partnership business OR Employment/Directorship business ? Also applies in Business Tax on adding a new person to a sole trader etc

Resolution

If a Employment/Directorship for a business company:

- If you already created the company in AP/BT. It should already appear when you load the client in PT, if not then click at the bottom – New Employment/New Directorship, Client Mag Glass(or non Client mag glass) find the company, highlight it and click Select. It should now appear.

- If a New business (not created in AP/BT) – then read this KB

- If a Non client company (which you are not the accountant for): New Employment/New Directorship, Non Client mag glass, find and select the company OR click NEW, Fill in name etc, click OK, it will appear on list, highlight it and click ‘Select’, it will now appear. If it dosnt appear, go back and create a new non client company and ensure you give it a unique name (don’t use the exact name you entered before, this is because you may have a existing company name created in the BT/AP/PT system).

If a Sole Trade/Partnership: Dates and Periods are vital to the PT system on how it calculates the trade income for a year/period. For example: Trade Income may not show correctly/missing on the Tax comp/Tax return.

- Ensure at least 2 periods entered for a trade- for example it started in 2023, so just add in period 2022 or 2024 even if it has no income. We recommend you do not use just one period entry for a new starter in PT.

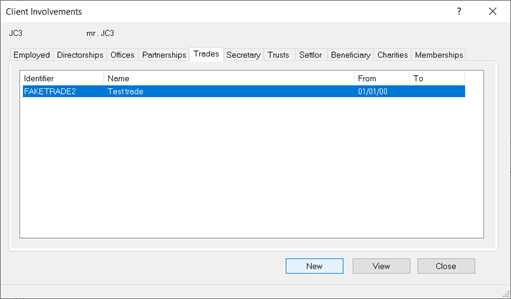

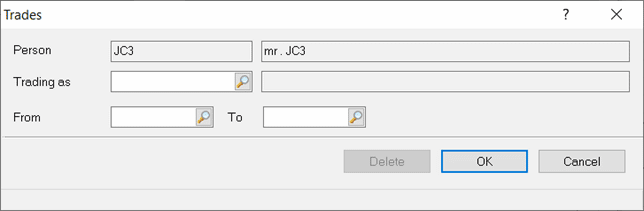

- Trade Commence date and Ceased date – Double click the trade name at top and look at the two date fields. PT will always use this commence date as the start of the business as trading and ignore any prior periods entered. Run the Trade Comp and you can see the calculation on what days are being used based on the commence/ceased date. This cannot be overridden unless you edit/remove the date. Also check the FROM and TO dates, on the top half, click NEW, click on the Relevant tabs and find the business name and check the two dates

- Client Involvement dates – Double click the trade name at top, click the Related tab, Involvements, find the persons name and View- check the FROM and TO date. These dates can also affect the calculation. This cannot be overridden unless you edit/remove the date.

- Trade business missing from the top? On the top half, click NEW, Click on the Relevant tabs and find the business name and check the FROM and TO dates. If the TO date is in the past then it will automatically hide this trade from view, just edit that TO date.

To add a Sole Trade or Partnership please do the following:

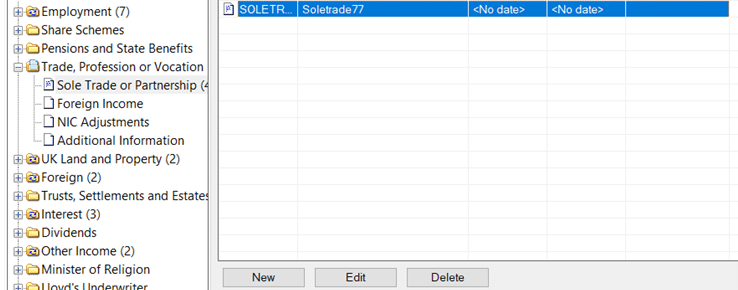

1.Select Trade, Profession or Vocation – Sole Trade or Partnership

2. Click ‘New’ (In the middle of the screen)

3. Select the ‘Trades’ OR if ‘Partnerships’ tab

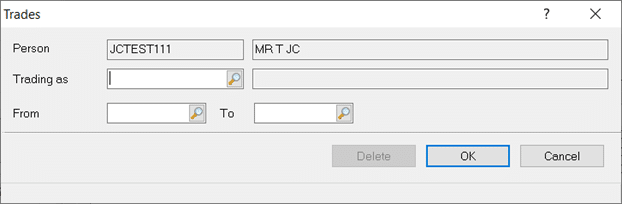

4. Click the New button- on the next screen, click the Spyglass next to “Trading as”

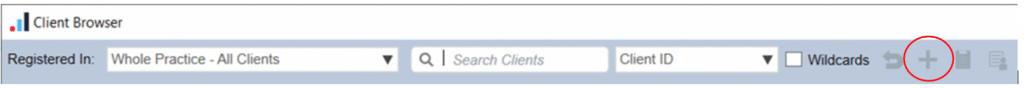

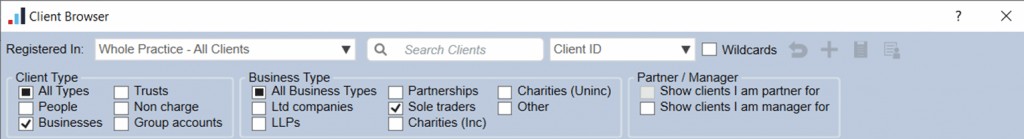

5. The Client browser screen will load, go to the TOP RIGHT there is a greyed out ‘+’ sign, now click this + symbol (example below is circled in red). (If there is no + sign then look at bottom or right side for add/new option, this only appears on older version of IRIS)

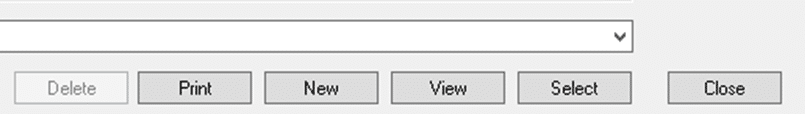

If you cant see a + symbol then it may look like this: Click NEW

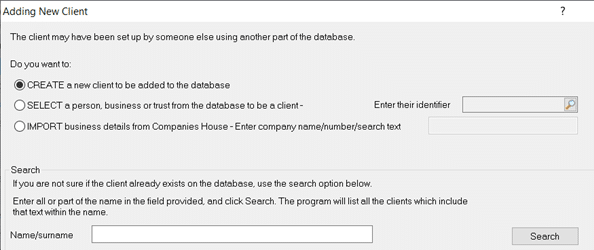

Select ‘Create a new client’

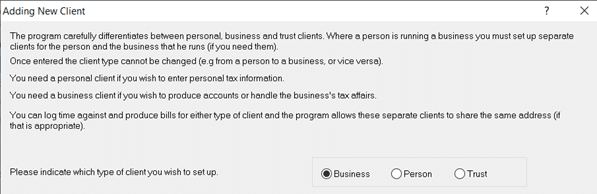

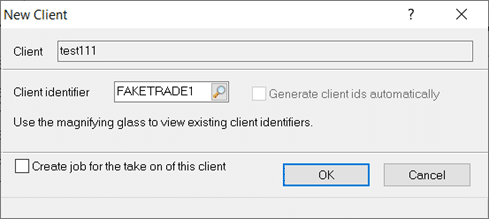

6. On the Adding new client screen, choose ‘Business’ and enter the details of the Sole Trade Or Partnership etc and give it a unique ID code. Once saved the code, the client browser screen will load up, now find the Trade you just created and click on it and click ‘select’, it will load this trade in etc.

7. If a new Partnership then there must be 2+ related partners link to this business or it appears as a Sole Trade (newly created ones are linked to the one client you are working on, thus initially showing as a Sole Trader). Highlight the new business and double click it, Related and Involvements , in the Partners tab click New , in the Partner field click the mag glass, now find the other partner to add to this business.

If you do not have the details of the other partner (eg your not their accountant etc) then create a fake partner name and add it to the list. Once created now select this fake client so it can be used as the 2nd partner. Once set up , the sole trade will now change to partnership.

8. If you are not the accountant for the ‘Partnership business’ itself then you can still create a new fake partnership and give it a relevant name so you know this can be used for other similar situations. There is no function to create a NON CLIENT Partner or Partnership business in PT.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.