Trust Tax- Fill in box 21 R185, Dividend taxed at non payable 10%

Article ID

trust-tax-fill-in-box-21-r185-dividend-taxed-at-non-payable-10

Article Name

Trust Tax- Fill in box 21 R185, Dividend taxed at non payable 10%

Created Date

17th January 2023

Product

Problem

IRIS Trust Tax- Fill in box 21 R185, Dividend taxed at non payable 10%

Resolution

This affects certain Trust types like Estates in administration. Users must first enter the income etc into Capital assets, shareholdings and Dividends which could lead to the auto filling in Dividends (box 18) & Dividend non-repayable (box 21)

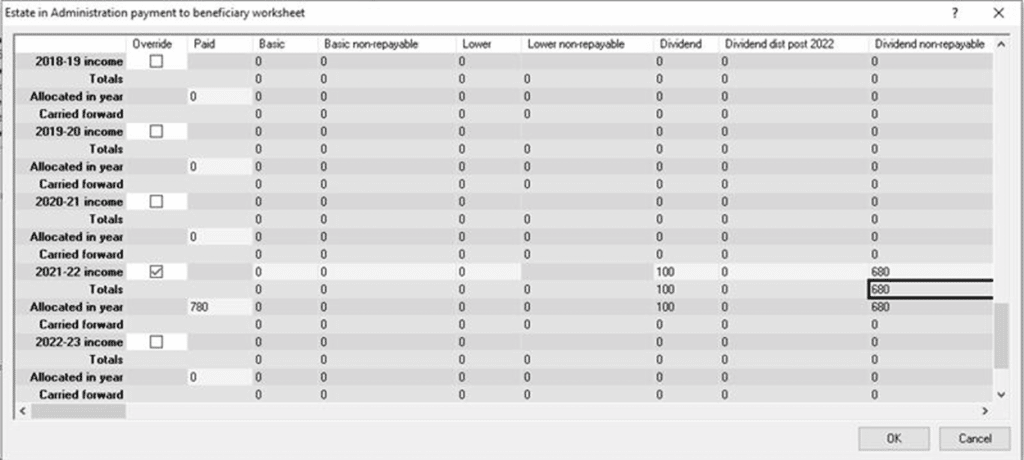

In the section: Payments to beneficiaries- Payments of income – select beneficiary and edit and select Worksheet. Scroll down till you get to the relevant tax year eg 2021/2022

After ticking Override – Columns for dividend(box 18) & Dividend non-repayable (box 21) the total of these amounts cannot be more than the income before tax and expenses, then the user must tick allocate the total in amount in the ‘allocated in year’ row, this will then automatically fill in the columns from left to right (last column is called ‘Dividend non repayable’). You cannot fill in the majority of the columns manually as it depends on your PAID entry and HMRC rules.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.