Benefits of IRIS payroll software

Discover HMRC payroll software that saves you time, ensures compliance, and helps you pay your people on time.

Trusted by employers and payroll providers like you

Find your ideal payroll software

“Of all the software we’ve used, Staffology Payroll by IRIS has exceeded all our expectations. The team at IRIS is investing in the product, and enhancements have been added in the time we’ve been using it. I think it’s fantastic value for money and a payroll system I would highly recommend.”

Peter Cannan, Upp

29 out of the top 30 accountancy firms rely on IRIS payroll solutions

IRIS payroll software UK

Payroll software for every kind of pay run

-

Payroll software for employers and businesses

Simplify the payroll process with cloud-based HMRC payroll software that scales to your needs, whether you’re a small start-up or an established enterprise.

-

Payroll software for accountants and bureaus

Wow your clients with exceptional payroll services and handle every kind of payroll with a specialist cloud payroll solution for accountants and bureaus.

-

Payroll software for schools and trusts

Want to run in-house payroll for your trust or school? Rely on cloud payroll and pensions software designed for single and multi-academy trusts and schools.

-

Payroll software for healthcare practices

Trusted by more than 5,000 UK Practice Managers, this GP payroll software ensures compliance with legislation, so you can pay staff accurately with ease.

Explore the full range of IRIS payroll software

Whether you need to pay 10 people or 10,000, find the right payroll management software for your organisation with IRIS payroll solutions.

Award-winning payroll software that works for you

Rely on award-winning payroll software to deliver reliable performance, top-notch support, and competitive features.

Count on us for a simplified payroll solution, so you can focus on what really matters.

Frequently asked questions about IRIS payroll software

-

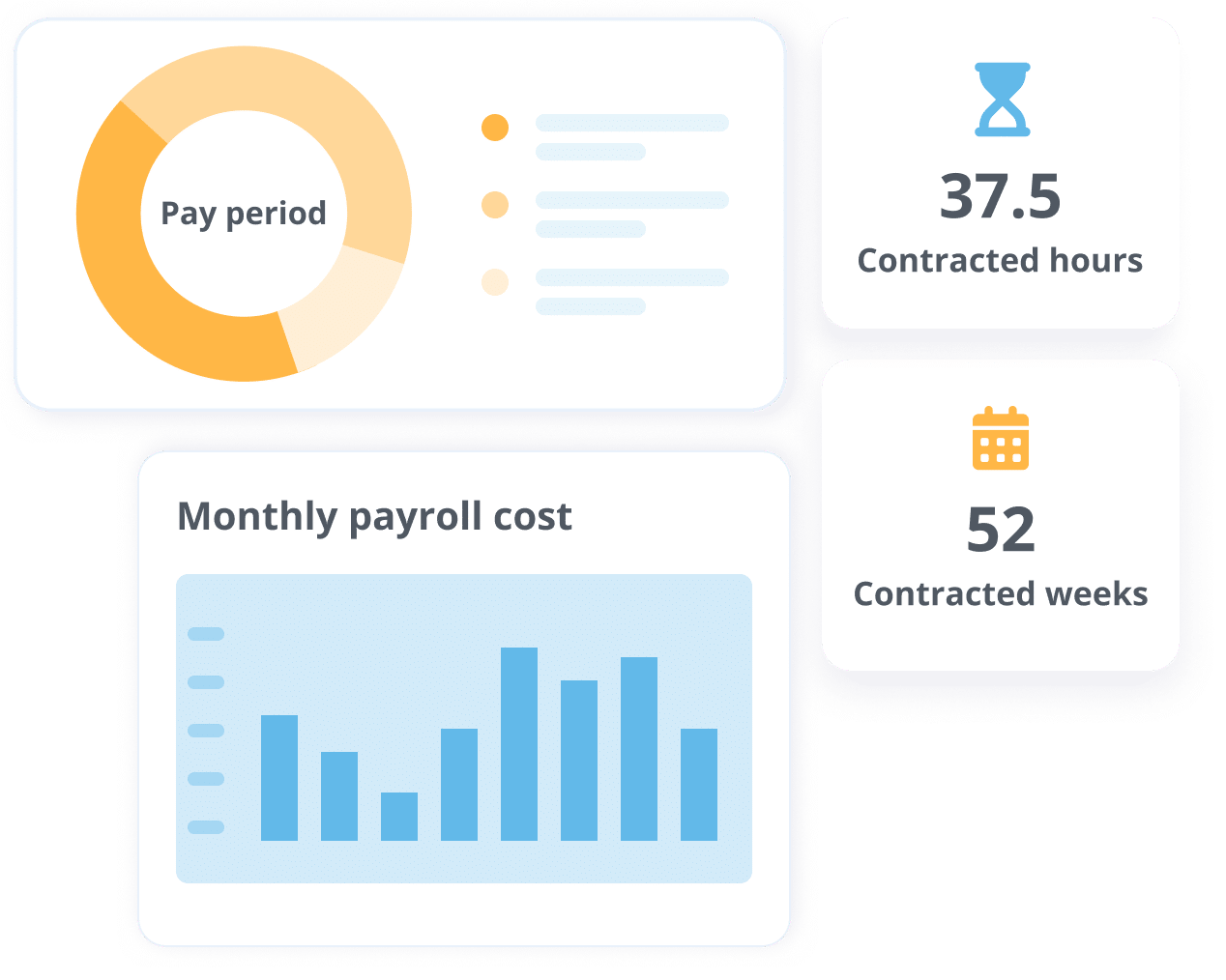

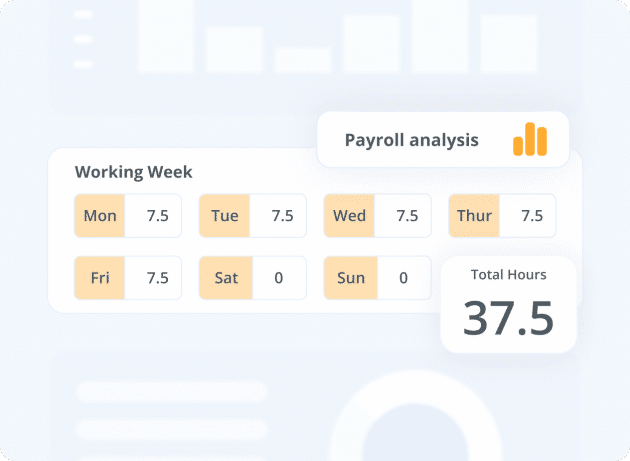

As an employer or payroll service provider, you can use payroll software to automatically manage the process of employee compensation.

The best payroll management software calculates wages, tax deductions, National Insurance contributions, and pensions – all while ensuring compliance with UK regulations. HMRC-recognised payroll software can also streamline payroll tasks like payslip generation, making statutory payments, reporting on payroll data, and Real Time Information (RTI) submissions to HMRC.

Most modern payroll platforms are user-friendly, allowing you to cut back on needless payroll admin, save time, and reduce the risk of payroll errors. -

Reliable payroll software is essential for any organisation responsible for paying employees. If you decide to run payroll yourself, you need payroll software that reports to HMRC.

Whether you employ one person or manage payroll for a large workforce, cloud payroll software helps you meet compliance requirements, calculate employee earnings, make statutory payments, improve efficiency, and simplify payroll management.

If you’re an accountancy firm providing payroll services or a payroll bureau, you can also benefit from using payroll bureau software to help you support your clients. -

Yes, IRIS payroll software is recognised by HMRC, including:

- Staffology Payroll by IRIS

- Staffology Bureau by IRIS

- Every Payroll

- IRIS GP Payroll

- IRIS Payroll Basics

Our payroll solutions are fully compliant with UK payroll legislation, including RTI and Automatic Enrolment for pensions.

Using HMRC payroll software ensures compliance, meaning your payroll operations adhere to regulatory standards. This also helps you avoid negative consequences like regulatory fines, reputational damage, or serious legal action. -

Yes, you will still need to rely on HMRC payroll software even if you only have one employee. Payroll software helps you make accurate payroll calculations, so you always have the right payment and tax information for your employees.

Payroll software also helps you ensure compliance with payroll legislation (including Automatic Enrolment for pensions) and maintain accurate record-keeping of payroll data.

Another option for small businesses with only a few employees is to outsource their payroll, using managed payroll providers like IRIS Payroll Services to ease the admin workload and ensure compliance. -

The cost of payroll software in the UK depends on various factors such as the size of your workforce, the specific features you need, and the provider you choose.

Many providers, including IRIS, offer scalable pricing models that can scale to meet your exact business needs. For example, Staffology Payroll’s pricing begins at just £39 (+VAT) a month.