Personal Tax - Basis Period Reforms and Transitional profits 2023/2024 onwards

Article ID

personal-tax-basis-period-reforms-2023-2024

Article Name

Personal Tax - Basis Period Reforms and Transitional profits 2023/2024 onwards

Created Date

3rd March 2023

Product

IRIS Personal Tax

Problem

IRIS Personal Tax - Basis Period Transitional Reforms 2023/2024? Released with the 24.1.0.578 IRIS update

Resolution

UPDATE JULY/AUGUST 2024: We have released the IRIS version 24.1.9.2 and also 24.2.0 to cater for this, please update to this version here.

Reports updated: The Trade Comp, Schedules of data, Tax Comp and SA100 have been updated with the new rules, read this KB on examples where the profit will show.

The ‘Trade computation’ will show the separate profits that will be taxed for the standard profit/loss and the transition profit, however the report then totals those values up to give the Profit/loss for basis period. This profit/loss for basis period figure is not designed to show on the tax return and tax computation as a total. The figures will show separately as standard profit/loss and spread of transition profit treated as arising. For example in this Partnership scenario: The standard profit/loss will show as XXXX in box 16 and the transition profit treated as arising will show as XXXX in box 16.3. Similarly the standard profit will show in the income section of the tax computation as partnership income and the transition profit treated as arising will show under the tax borne section separately (This same logic applies to sole traders, you will see the values showing on the Self employment pages and are not meant to show on a Tax comp) .

The government announced the basis period reform which is a change in the way trading income is allocated to tax years rather than basis periods for self-employed traders, partnerships, and trusts. This change is to come into effect as of April 2024 (see below for 24.1.0.578 update), for accounting periods that do not align with the tax year, a transitional profit will be calculated to align to the tax year, with all overlap relief being given. Businesses who draw up accounts that align to the tax year will not be impacted by this realignment. The reform has introduced a spreading provision to ease the impact of any additional tax charges on the additional profits attributed to the 2024 transitional year. Transitional profits will spread over five years starting from the 2024 tax year.

1.For accounting periods that do not align with the tax year, a transitional profit will be calculated to align to the tax year, with all overlap relief being given.

2. Businesses who draw up accounts that align to the tax year will not be impacted by this realignment.

3. The reform has introduced a spreading provision to ease the impact of any additional tax charges on the additional profits attributed to the 2024 transitional year. Transitional profits will spread over five years starting from the 2024 tax year.

4. From 2025 onwards updates have been made to IRIS Personal tax to tax business profits and losses on a ‘Tax Year Basis’ rather than ‘Current Year Basis’ for individual and Trust tax returns. There will be a transitional year in tax year 2024 which will include the standard profits and the transition profits up to 5th April 2024.

- Transitional profits apply to Businesses that do not have 31/3/to 5/4-year end.

- Basis period will run from the beginning standard accounting period that falls within the year and ends to the 5th of April 2024

- The basis period profits are split into standard part and transition part.

- Once transition profits are realised (using calculation) the transition profits are apportioned to 20% and each 20% is spread over the next 5 years. You can choose to pay more in the current year (using Apportion profit override option) and the rest will be carried forward and re-calculated in the next year.

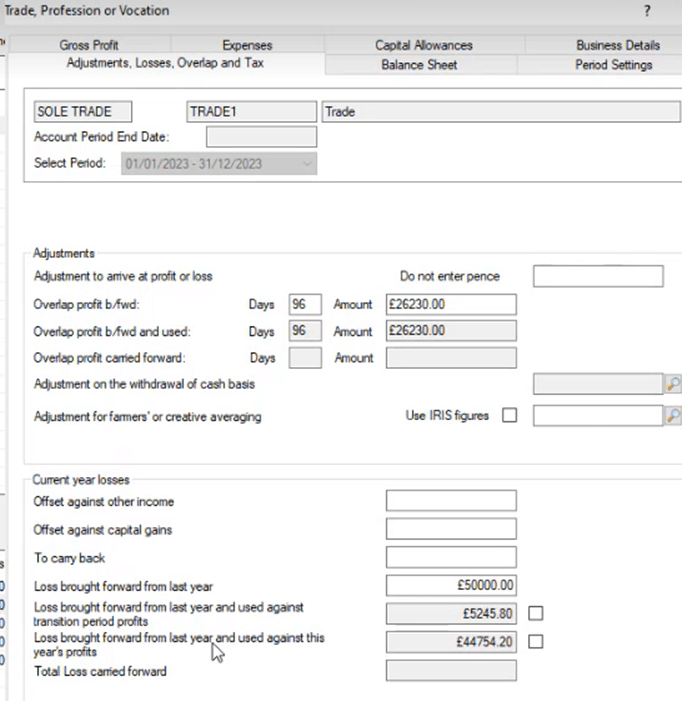

- Based on HMRC legislation IRIS will automatically utilise all overlap relief with nothing to carry forward to 2025.

- The Overlap is first used against the transition part.

- If Overlap creates a loss, then these can be treated as a terminal loss and be carried back. You can use the ‘carried back’ field for this.

- A new screen can be found in the Trading section of all supplementary forms affected to cater for these changes.

- If income is below the personal allowance then no transitional profits will be calculated.

- If you are working on a 2024 tax year, you MUST also create a 2025 accounting period or the Transitional data may not show and/or the relevant trade pages will not appear.

- The Trade Comp and Schedules of Data ‘total values’ are not designed to show on the Tax comp/SA100. Please read this KB on examples where the profit will show.

Follow the steps below:

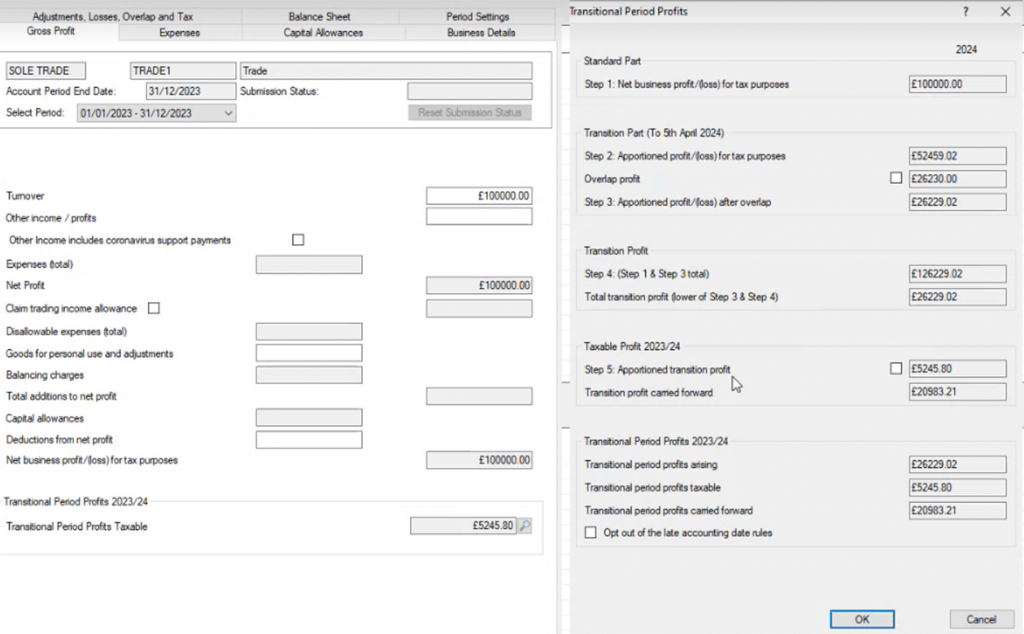

a. Load the client and select the 2024 year and open that 2024 period (if no 2024 period exists then create one, at the bottom a new box will appear ‘Transitional Period Profits 2023/2024’ and ‘Profits Taxable’. Click the mag glass to see the calculation. This new field will only show up if you selected the 2024 year (it will not show in earlier like 2023 etc).

Period Rule: The Transitional profits calculation will only appear if the accounting period straddles over 31/3/xxxx to 5/4/xxxx.

b. You can override the calculations if needed, once you agree to the value in Step 5. Apportioned Transition Profit. Click Ok to save

c. Run the Trade comp to see the final applied calculation to the 2024 income which be shown on the Tax comp/Tax return.

Not getting any Transitional Profits in 2024 for my 05/04/2024 period, why?

When there is a 5th April year end 2024, the period is not liable for any Transition Profits. However, we are aware that there are some instances where the current year end has been extended to a long period that ends 31st March-5th April 2024, then the transition profits are not being calculated. In the mean time if the period end is not changed, this will calculate and show the Transition profits as expected: We have released the IRIS version 24.2.0 to cater for this, please update to this version here.

Example here is a 01/01/2023 to 31/12/2023 period

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.