Digital tax return solutions

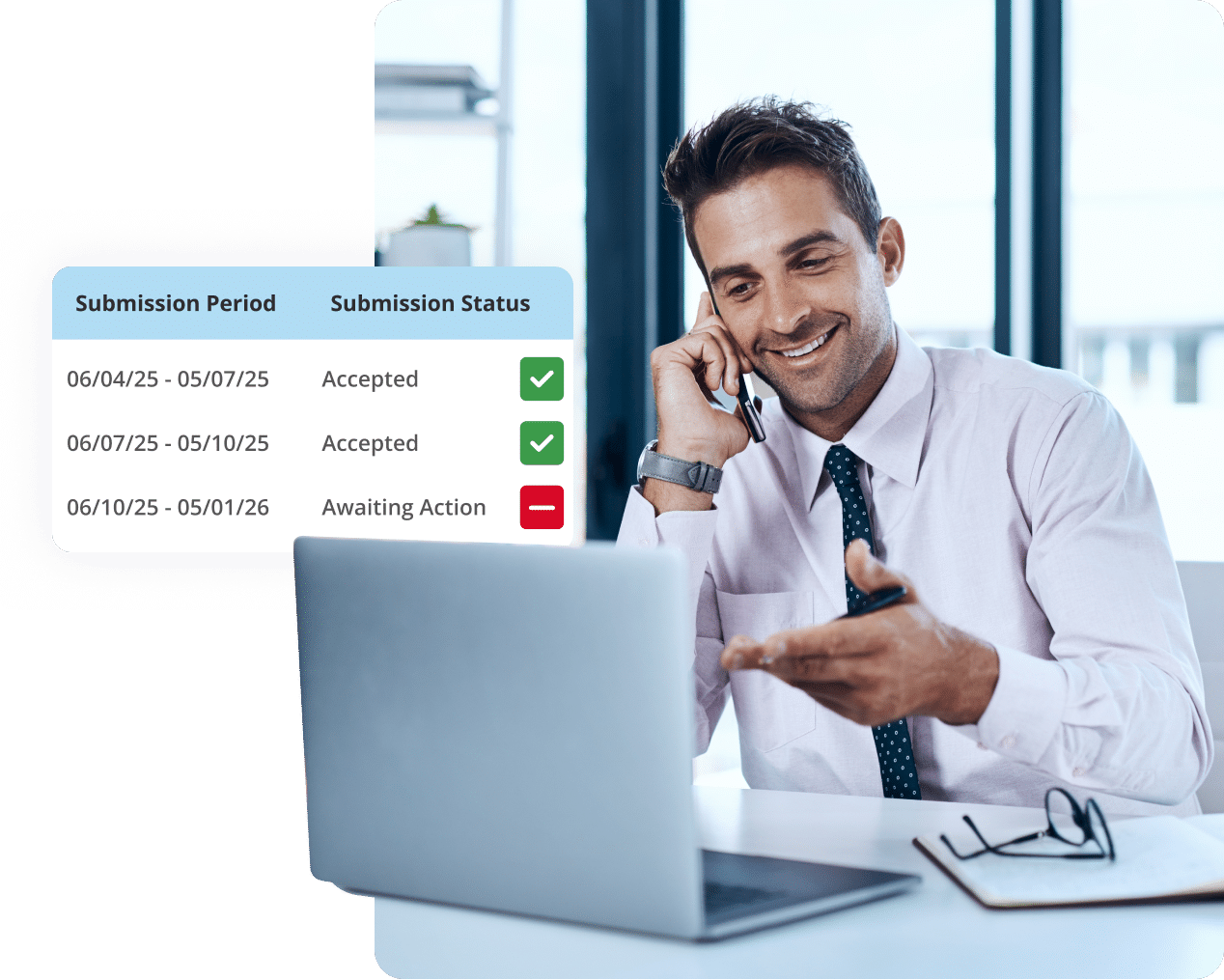

Get MTD-ready with a solution that works for you

Whether you’re crunching numbers with software, spreadsheets or both, your MTD solution needs to fit your workflow.

From desktop to cloud, our HMRC-recognised software and MTD outsourcing services can help you balance the books, improve efficiency, and ensure compliance.

Digitise MTD for ITSA

Income Tax Self Assessments (ITSA) for MTD

From April 2026, self-employed taxpayers* must submit their Income Tax Self Assessment (ITSA) digitally under MTD. Accountants and bookkeepers, it’s time to prepare!

Join the MTD for ITSA pilot from IRIS, and rely on MTD-compliant software, test our digital ITSA processes, and create an ideal workflow ahead of the deadline.

Available to both new and existing IRIS customers – sign up below to express your interest in the IRIS pilot today.

* The April 2026 MTD ITSA legislation applies to self-employed people and landlords with a total annual income of more than £50,000 over the tax year.

MTD software and services

-

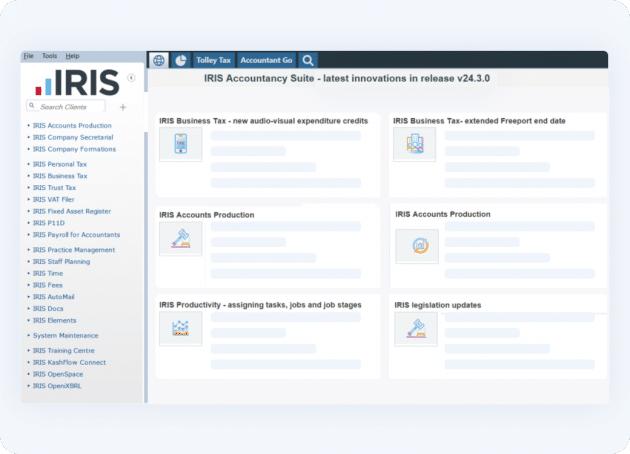

MTD-compliant desktop accountancy software

Rely on a trusted, accurate accountancy solution that ensures you and your clients comply with MTD, every time.

-

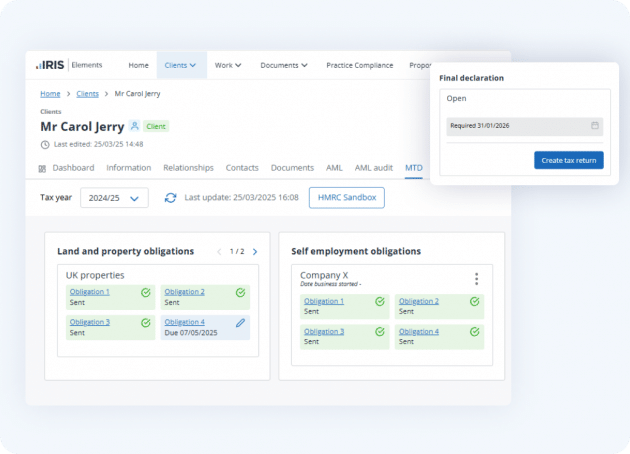

Flex to clients’ needs with cloud MTD software

Build your ideal MTD accountancy solution with flexible cloud-based software that’s HMRC-recognised.

-

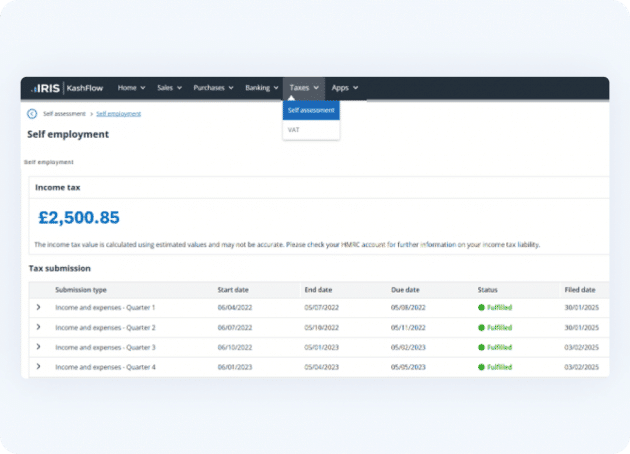

Ensure HMRC compliance with MTD bookkeeping software

Keep on top of digital tax reporting with a cloud bookkeeping solution for accountancy firms and their small business clients.

-

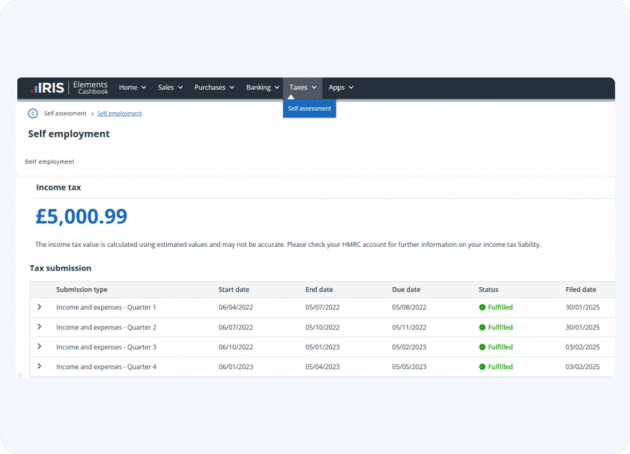

Support sole trader clients with IRIS Elements Cashbook

Provide your clients with accessible MTD-ready bookkeeping software and help them comply with MTD for ITSA.

-

Outsource your MTD admin to the accounting experts

Facing extra admin with MTD for ITSA? Outsource to the experts and improve workflows with IRIS Outsourcing.

Simplify bookkeeping and MTD for sole trader clients

* IRIS Elements Cashbook is available for free when you subscribe to any of the following compliance products: IRIS Personal Tax, IRIS Business Tax, IRIS Accounts Production, IRIS Starter Pack, Starter Pack Lite and IRIS Options, IRIS Elements Tax, IRIS Elements Tax and Accounts, or IRIS Elements Accounts Production.

Simplify MTD with IRIS Outsourcing – expert support to reduce admin and ease your workload

Trusted by over 24,000 accountancy firms like yours

Frequently asked questions about Making Tax Digital (MTD)

Digitising the tax submission process ensures compliance with HMRC’s requirements, streamlines the filing process, and reduces the risk of errors.

To comply with MTD legislation, accountancy and bookkeeping firms must use MTD-compliant software (like IRIS Accountancy Suite or IRIS Elements) to file with HMRC on behalf of their clients.

The following IRIS software is MTD compliant:

– IRIS Accountancy Suite

– IRIS Elements

– IRIS Elements Cashbook

– IRIS KashFlow Bookkeeping

Whether you’re recording financial data, preparing tax returns, or submitting them directly to HMRC, IRIS accountancy software can help you comply with MTD.

Under MTD for ITSA, self-employed individuals and landlords with an annual income above £50,000 are required to comply with the legislation, which involves keeping digital records and submitting quarterly income and expense updates to HMRC using compatible MTD software.

For accountants and bookkeepers, MTD for ITSA means firms may need to take action to help clients digitise their self-assessment submission and maintain adequate digital records.

From April 2026 onwards, applicable sole traders and self-employed taxpayers will be expected to use compatible MTD software to:

– Maintain adequate digital records

– Submit updates and tax returns to HMRC.

From April 2027, this threshold will include those earning between £30,000 and £50,000.

From April 2028, this threshold will lower again to include those earning above £20,000.

For accountants and bookkeepers, it’s crucial to ensure your clients comply with MTD for ITSA if they fall within these brackets.

Examples of MTD bridging software include IRIS Accountancy Suite and IRIS Elements. Both are MTD software that allow users to import spreadsheets (e.g. Excel documents) into the accountancy software, allowing accountants to calculate and submit their clients’ tax returns digitally.

MTD bridging software is a practical solution for accountants and bookkeepers who want to help their clients remain MTD compliant without them having to use new accounting software.

With IRIS, you can get IRIS Elements Cashbook – an easy-to-use MTD-ready bookkeeping tool – for free* if you already subscribe to a range of our compliance products, including:

– IRIS Personal Tax

– IRIS Business Tax

– IRIS Accounts Production

– IRIS Elements Tax

– IRIS Elements Accounts Production

– IRIS Elements Tax and Accounts

This HMRC recognised bookkeeping software is ideal for your sole trader clients, helping them digitise their records and prepare to submit their self-assessment tax returns digitally.