Business Tax- How to add Account Analysis details to a Tax comp?

Article ID

business-tax-how-to-add-account-analysis-details-to-a-tax-comp

Article Name

Business Tax- How to add Account Analysis details to a Tax comp?

Created Date

20th February 2024

Product

Problem

IRIS Business Tax- How to add Account Analysis to a Tax comp?

Resolution

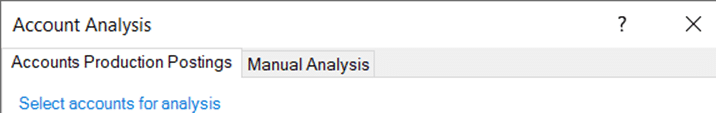

The Account Analysis option can be used to produce an additional report on the Corporation Tax Computation that displays detailed postings made in IRIS Accounts Production. The report also details any automatic or manual posting adjustments that have been made for the Corporation Tax computation by the Postings option in IRIS Business Tax or by the Business Tax Accounts option. A manual adjustment option allows details to be entered manually (that have not come from IRIS Accounts Production automatically).

- Load the client in BT and relevant period

- Go to Edit

- Accounts Analysis

- Accounts Production postings

- Tick the required posting. It can only add the analysis if its already listed in the AP postings (if a certain posting isn’t listed it cannot create it).

- OR use the ‘Manual Analysis’ tab and add in a NEW OR type in the empty white space to add in a description

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.