Personal/Trust Tax- Edit HMRC Interest Rates

Article ID

personal-trust-tax-edit-interest-rates

Article Name

Personal/Trust Tax- Edit HMRC Interest Rates

Created Date

27th March 2024

Product

IRIS Personal Tax, IRIS Trust Tax

Problem

IRIS Personal/Trust Tax- Edit Interest Rates

Resolution

You have an incorrect HMRC Interest rate being applied in Personal Tax or Trust Tax.

1.Load Personal Tax or Trust tax

2. Administration and ‘HM Revenue & Custom Interest Rate’ (This one table is shared between PT and TT, if you update in PT only then it will auto auto show in TT as well)

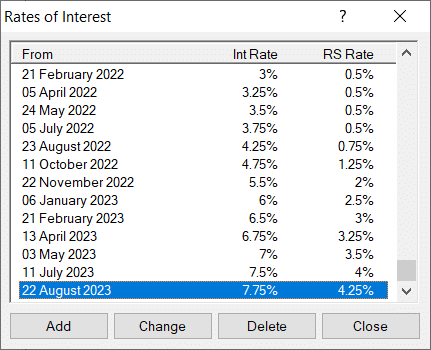

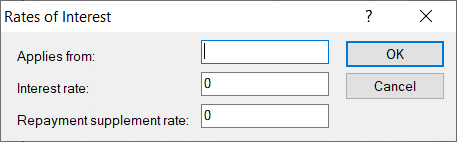

3. Scroll down the list to find the latest rates. You can either click Add– to add in a new Interest rate and when it should apply OR Click on relevant row and Change and edit the % rate

4. Why Interest rate are not automatically updated with the latest HMRC rates for the year? We will update the HMRC Interest Rates at certain times of the year which are linked to the next IRIS version (which are regularly released several times over the year). Because of these planned IRIS updates, it means we cannot update IRIS instantly whenever HMRC releases new Interest rates, so please use the ‘ADD’ option to fill in the missing interest rate and not wait for the next IRIS update.

NOTE: If you have added in a new interest rate and then update to a new IRIS version (which dosnt publish new HMRC interest rates), it may delete your manually added in Interest Rates. This has been raised to our Development team so currently please just add them back in again.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.