BLOGS

5 big changes to Making Tax Digital (MTD) everyone should know

HMRC recently announced some updates to Making Tax Digital (MTD) for small businesses—a number of which have slipped the radar of wider discussion.

But will any of these changes make life easier for taxpayers and accountants?

After much discussion with the industry, we think the answer is yes. At least five changes that have been announced for MTD for Income Tax Self-Assessment (ITSA) will help small businesses and any accountants or bookkeepers who work with them.

Even if you or your clients are unaffected by these updates, they serve as a sign that HMRC is listening and potentially paving the way for further positive developments.

A quick reminder on where we are with MTD

MTD aims to improve accuracy in tax reporting, where the government has estimated losses to the exchequer to be as high as £8.5 billion (2018/19 figures). It asks that businesses meeting certain criteria report quarterly online using recognised software instead of once a year.

And what are the current criteria? All VAT-registered businesses, regardless of their turnover, are required to follow MTD rules for their first VAT return period starting on or after April 2023.

If you're not VAT registered, then from 6 April 2026, businesses or individuals with an annual business or property income exceeding £50,000 will be required to follow MTD rules for ITSA. This threshold will be lowered further in April 2027 to include those with an annual income of more than £30,000.

How did the recent changes to MTD come about?

The rules around MTD are not set in stone; there's been a specific focus on ironing out issues before more people are required to sign up for the digital system.

A recent consultation sought feedback on the draft legislation for small businesses that report via ITSA. HMRC spoke to accountants, professional bodies, software vendors, and even some taxpayers directly and opened the consultation to anyone who wanted to comment. The results were published in November.

That's given the accountants here at IRIS time to dig through the details and talk to the industry—not least at our recent roadshows, which have been taking place up and down the country.

And whereas we've noted some concerns about MTD, we do have to say that the following changes look the most promising.

1. End of Period Statements (EOPS) will be axed

One significant change in the MTD for ITSA landscape is the discontinuation of End of Period Statement (EOPS) declarations.

So, how did EOPS work, and why was it a problem?

Once all four quarters had been submitted via MTD, plus any adjustments or allowances, the business or its agent was required to make a fifth submission that said, “Everything for this business has now been submitted.” Any other income that the client would have, like bank interest, dividends, and similar items, would also be submitted.

Following that, a final declaration had to be made.

This meant the number of submissions required for each individual was mounting up considerably. Accordingly, the government and HMRC received significant feedback questioning the purpose of the End of Period Statement.

The government agreed it was an unnecessary step. We think this is proof it's listening and that if they can make things easier, they will.

2. Less accounting pain for joint landlords

There's also been a change that affects multiple individuals who rent out one or more properties jointly.

The way MTD originally worked in this scenario was that each individual would be responsible for submitting their own share of income or expenses from that property every quarter.

There was a lot of feedback that said if you've got joint holders, multiple people will record different information as the year progresses, but they might decide at the end of the year how to split the income or expenses between them.

So, quarterly reporting for individuals who share their source of income becomes very difficult.

Again, the government agreed. They’re going to make it easier for these individuals; they won't have to submit expenses every quarter, which means a lot less detail to keep track of.

3. Automatic exemptions

HMRC is creating automatic exemptions within MTD for individuals facing unique (and sometimes, because of this, difficult) circumstances. This more nuanced approach applies to groups such as foster carers and also individuals without a National Insurance Number.

Prior to this, such individuals would have to apply to be exempted. An automatic exemption, by contrast, is a more thoughtful and practical approach.

4. Multiple agents will now be allowed

In the real world, an individual might have more than one agent. For instance, you might have a bookkeeper for the day-to-day and an accountant for more complex, end-of-year tasks.

However, the process for MTD for ITSA only originally allowed for one of these agents to talk to HMRC.

Soon, they will both be able to liaise on your behalf. A solution hasn't been developed yet, but the government has made a commitment to ensure that one's on the way.

5. Cumulative quarterly submissions

I've saved potentially the best for last. It's a change that will make a world of difference for accountants and taxpayers.

What are we talking about? Cumulative quarterly submissions.

Prior to this change, the workflow for MTD for ITSA was as follows: you reported on the quarter's figures individually. So, figures submitted at the end of the first quarter only refer to Q1. Then the second quarter's figures only refer to Q2, and so on.

This brought problems. Say, for example, you were submitting Q3 figures, and noticed in the process there was a mistake in Q1. What would you have to do? You would have to go back and resubmit Q1 before you could do Q3.

But the new system is cumulative. So Q3's figures are Q1's and Q2's plus the third quarter earnings added on top. Under this new regime, if there's a mistake in Q1, you simply add it into Q2, Q3 or Q4, depending on when you spot it.

Will there be other changes before MTD for ITSA becomes mandatory?

Based on the work done and the feedback, the government and HMRC have tackled the biggest concerns that were flagged by stakeholders.

But is there anything that's still on our wishlist? Probably a change to the way thresholds work.

If you're currently having to report within MTD, you don't exit the system immediately if your income drops below a threshold; instead, the situation must remain the same for three years.

It may well be that staying in MTD is the best way for many taxpayers and their agents if they're used to this system, but a discussion and some clear guidance for all parties would be very helpful.

- Want to hear firsthand from the industry about what's affecting tax? Check out our podcast, Accounted For.

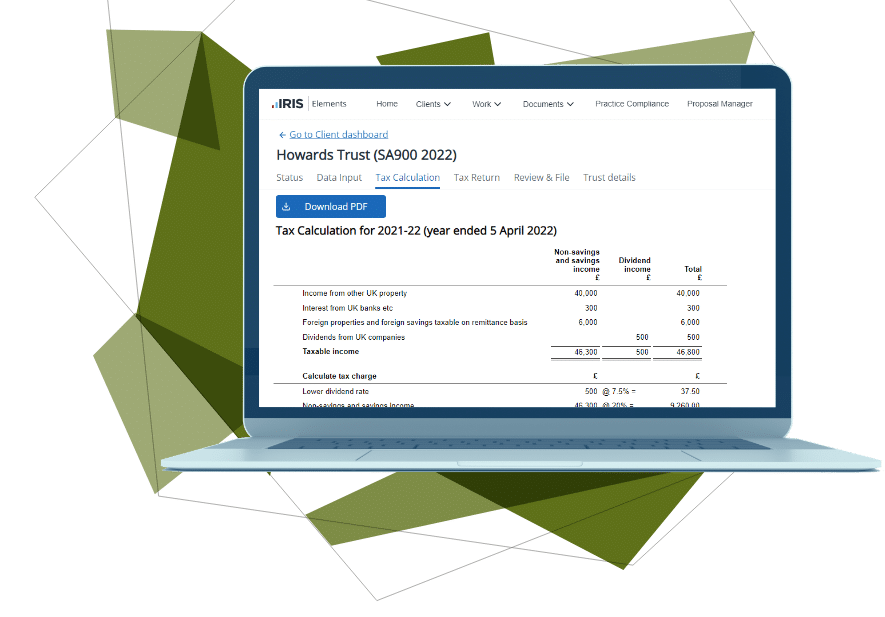

- Meanwhile, if you want to prepare for MTD for ITSA, check out our products IRIS Elements (for accountants and bookkeepers) and IRIS KashFlow (for business bookkeeping).