Personal Tax- Exception: Cannot establish figures for basis period because period missing. Class 4 may not be shown

Article ID

personal-tax-exception-cannot-establish-figures-for-basis-period-because-period-missing-class-4-may-not-be-shown

Article Name

Personal Tax- Exception: Cannot establish figures for basis period because period missing. Class 4 may not be shown

Created Date

29th May 2024

Product

Problem

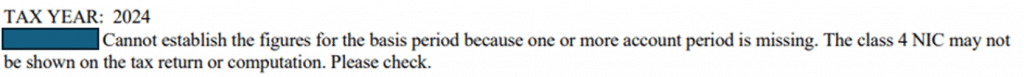

IRIS Personal Tax- Exception: Cannot establish figures for basis period because period missing. Class 4 may not be shown

Resolution

When you run a Tax comp/report and this exception appears. This may appear in the 2024 year due to new HMRC Period reform rules.

1. Load Client and the 2024 year in PT

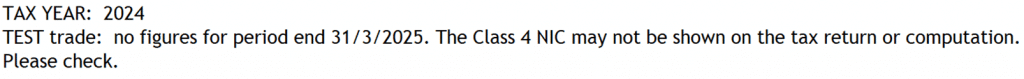

2. Check all partnerships and self employment entries and ensure they have the next period entered for 2023 or 2024 and with any income etc entered (the 2023 or 2024 period could be missing). Once entered the exception will not show anymore.

For example: you have self employment periods of 05/04/2022, 05/04/2023 but nothing for 05/04/2024. Just enter in the missing 2024 period.

If you get a new exception: then the system has detected you have entered the relevant following years 2024/2025 etc but possibly no income was entered and its checking whether this is correct. If it is then ignore and submit as it wont block submissions.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.