Latest Anti-Money Laundering (AML) Information

The new Anti-Money Laundering (AML) requirements came into force in June 2017. The European Union Fourth Anti-Money Laundering Directive is the most sweeping AML legislation in Europe in several years, requiring accountancy practices to review their AML procedures in order to remain compliant.

The UK Organised Crime and Corruption Reporting Project reported in March 2017 that British banks processed more than £20 billion worth of dirty money. This clearly highlights more needed to be done to address the issue.

The subsequent legislation conscripts the accountancy sector, Legal profession and others to step up to the front line in the fight against money laundering.

The requirements have the potential to add to the significant compliance burden efforts already undertaken by accountants.

To comply with the regulations accountants must:

- Appoint a member of the board or management team to be responsible for compliance and screen employees that work on the firm’s AML procedures.

- Outline procedures to analyse their clients potential exposure to money laundering or terrorist financing.

- Carry out a risk assessment and provide details to their regulatory body if/when requested.

- Demonstrate that risk assessments are conducted, kept up to date and acknowledge risk factors relating to their customers.

- Retain records of Customer Due Diligence documents and supporting evidence for at least five years after the end of the business relationship. At the end of the five-year period, the personal data can, in most cases, be deleted.

How can IRIS help?

AML software enables accountants, solicitors, and other regulated businesses to perform all aspects of compliance recording and monitoring. With our AML software, IRIS Elements AML, you can manage and document all AML related policies and procedures, and implement a risk-based assessment scheme for all your clients.

Key features:

- Ensure your practice is compliant with UK Money Laundering regulations.

- Interactive tools and onscreen functions designed to make complying as easy as possible.

- Keep your whole team up to date with the latest in changes to legislation.

- Save time by automating business processes.

- Manages and documents all AML related policies and procedures and implements a risk-based assessment scheme for all clients.

- Includes an AML compliance technical reference manual by SWAT UK Limited.

Compliance

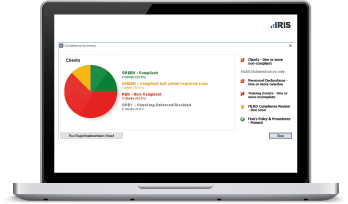

IRIS Elements AML flags up non-compliance through a quick and easy to read traffic light system, it assesses client risk and records Know Your Client information as well as allowing staff to raise a suspicious activity report, supporting your Money Laundering Reporting Officer. On top of this, it connects to Companies House and provides a free search confirming the name and address of the company you’re working with.

Up to date

Ensures your whole team is up to date with the very latest in changes to legislation and the requirements of compliance. It enables your practice to maintain up to date policies and procedures, with the ability to communicate these to your team and to put personnel declarations in place and have them agreed by staff. You can also download the latest Treasury sanctions list, all at the click of a button.

Training and Education

You’ll receive comprehensive staff training through the Newswire & Training Modules, ensuring the whole team is equipped with the required knowledge of the rules. The system carries the ability to track when staff have completed training and comes with AML compliance technical reference manual by SWAT UK Limited.

With IRIS Elements AML you can immediately see which activities have been completed and what work is still required. The easy to read ‘traffic light’ system clearly identifies compliance or non-compliance, and the comprehensive training package ensures you can easily and confidently achieve your compliance obligations.