Personal Tax- Share of Partnership Trading/profits, SA104S is greater then zero OR is negative etc OR 3001 8223

Article ID

personal-tax-share-of-partnership-trading-profits-sa104s-is-greater-then-zero-etc

Article Name

Personal Tax- Share of Partnership Trading/profits, SA104S is greater then zero OR is negative etc OR 3001 8223

Created Date

12th July 2024

Product

Problem

IRIS Personal Tax- Share of Partnership Trading/profits, SA104S is greater then zero OR is negative etc or 3001 8223

Resolution

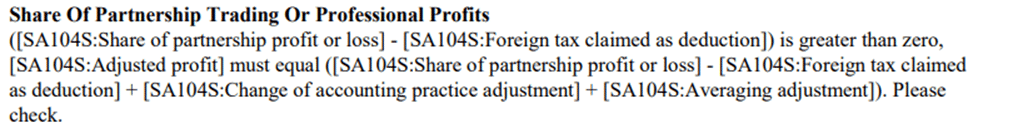

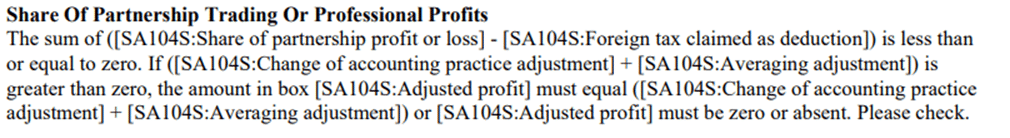

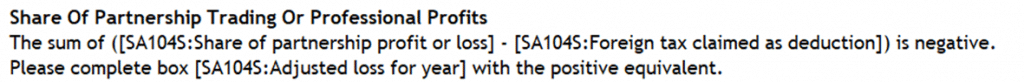

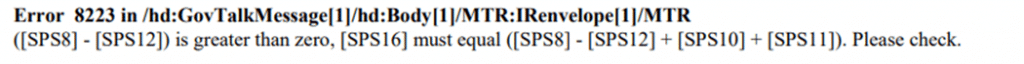

If you have a Partnership entry for the period and get the error:

- Load the client in PT and relevant year

- Open the period

- Business Details

- Tick ‘Force Full Partnership pages’

- Regenerate the return.

- If you still get the SA104s is greater then zero: You may have an overlap entry that has been entered twice – eg: once for Trading Income and again for Other Income – and therefore has been claimed twice. Trading income overlap must be utilised against any transitional part profits, which is automated by the software. By adding the second Other Income overlap value, and setting it against other income, it has also reduced the adjusted profit value in box 16 and this is what triggers the validation, so revisit the overlap and ensure that the correct amount is claimed.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.