Personal Tax- Period Reform 2024: Profit or Loss Transition Part, if FPS16.1, SA104F Overlap relief, Taxable Profits after Losses is less then zero. Error 3001 8620/8630

Article ID

personal-tax-profit-or-loss-transition-part-if-fps16-1-sa104f-overlap-relief-taxable-profits-after-losses-is-less-then-zero-error-3001-8620-8630

Article Name

Personal Tax- Period Reform 2024: Profit or Loss Transition Part, if FPS16.1, SA104F Overlap relief, Taxable Profits after Losses is less then zero. Error 3001 8620/8630

Created Date

12th September 2024

Product

Problem

IRIS Personal Tax- Period Reform 2024: Profit or Loss Transition Part, if FPS16.1, SA104F Overlap relief, Taxable Profits after Losses is less then zero. Error 3001 8620/8630, Partnership with Overlap relief

Resolution

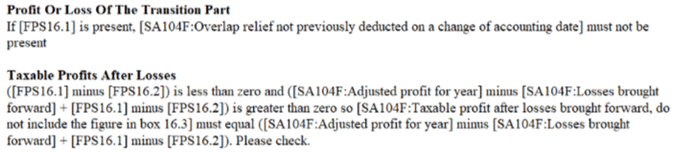

If you have Partnership income with overlap relief and generate a tax return you get this validation error and if you bypass it and submit you get a rejection 3001 8620 and 8630

This is confirmed as a DEFECT on 24.2.0 and our Development team is investigating and we shall update this KB once we have news of a fix.

Please use this workaround: If you expect to see the overlap relief in box 13 or box 16.2 on the tax return.

If you need to see it in box 13 – If they go into transitional profit screen and tick ‘opt out of late accounting dates’. Then check the Tax comp and regenerate the Tax return

or

If you need to see it in box 16.2 – Go into transitional profit screen and override the overlap profit to 0. Then check the Tax comp and regenerate the Tax return

If the Trade comp is showing a different trade profit compared to the Tax comp. If you have ‘Savings income’ then the Trade comp is not picking it up correctly and the Tax comp is correct. You can still submit the tax return. if you need to correct the Trade comp then save it as a Word file and edit it. This is also with our Development team is investigating and we shall update this KB once we have news of a fix.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.