Personal Tax- Period Reform: Transitional Profits to carry/bring forward to 2025/2026/2027/2028 etc?

Article ID

personal-tax-period-reform-transitional-profits-to-carry-forward-to-2025-2026-2027-2028-etc

Article Name

Personal Tax- Period Reform: Transitional Profits to carry/bring forward to 2025/2026/2027/2028 etc?

Created Date

2nd January 2025

Product

Problem

IRIS Personal Tax- Period Reform: Transitional Profits to carry/bring forward to 2025/2026/2027/2028 etc?

Resolution

With the 2023/2024 release of Period reform of Transitional Profits and to spread them out over the next 5 years.

- Period 2023/2024 – If your client falls within the rules: you can see the calculation of the Transitional Profits in 2024, 1/5th of it being taxed in the 2024 Tax comp etc (or if you overrode step 5 on the Transit period screen and entered a higher profit value). The rest is being carried forward to 2024/25, 2025/26, 2026/27, 2027/28 etc. But when you change to 2025 year, the tax comp dosnt show the relevant profit being taxed on the 2025 Tax comp, see point 3.

- Period 2024/2025 – Help and About – update to the 25.1.0 IRIS version, it will show the brought forward and relevant taxed Transitional Profits on the 2025 Tax comp etc.

- Carried/Brought forward values are missing from 2024 to 2025? Please read this KB This is an intermittent issue however you can still manually enter this b/f amount in 2025

- The 2025 Transitional profits screens are now updated (compared to 2024) as it only needs to being forward values from 2025 onwards. Please read below with screenshots

- Claim more of the profits in 2025 onwards? To claim the remaining amount of the transitional profit to be taxed in the 2025/2026 etc year- you can now enter the amount in a new box called ‘Accelerated Transitional Profits‘ and run the trade computation to see a new line for this.

- Period 2025/2026 onwards – please await the April 2026 (26.1.0) IRIS version update which will show the brought forward Transitional Profits. So each new year you will have to await the relevant update in April.

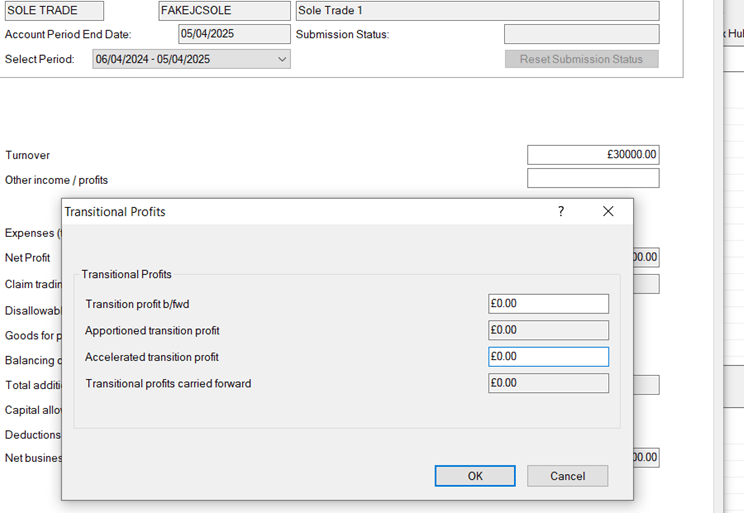

2025 year has a updated layout compared to 2024 – it will now show this box with 4 boxes when clicking Transitional Profits. This is because 2024 is the year where the transitional profits are first calculated (if relevant) and carried forward values/profits will now be show in 2025/2026/2027 etc

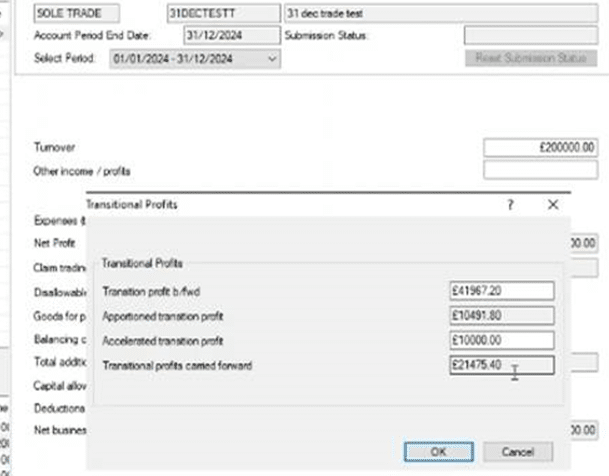

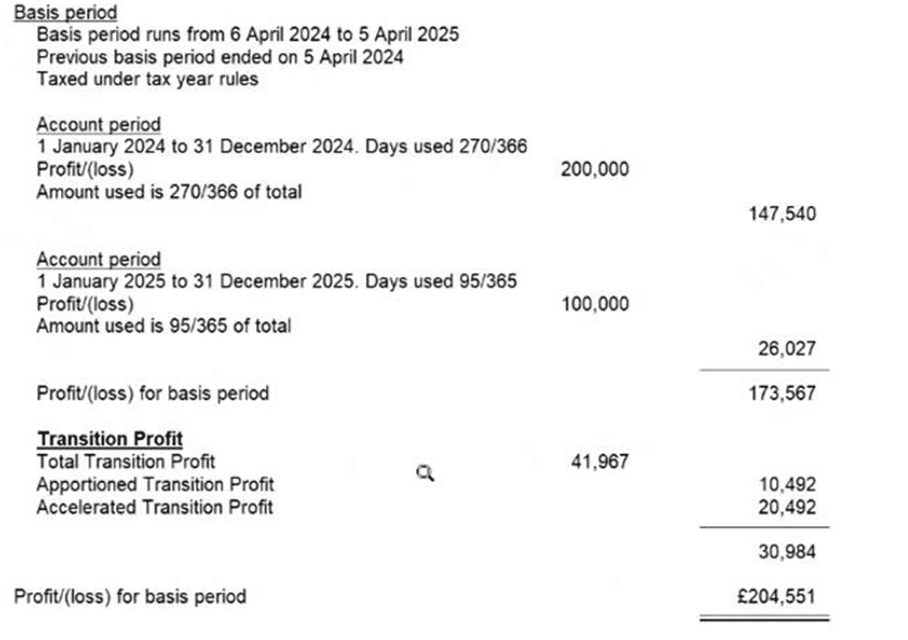

As a example for 2025– Shows £10491 apportioned profit is to be taxed in 2025. User wants to claim more profit to be taxed in 2025 by a £10,000 extra and manually adds this in.

Run the TRADE Comp and it will add a extra row called ‘Accelerated Transition Profits‘ which automatically adds the £10,000 to the £10492= and show as £20492. The £10000 will NOT show on its own on the Trade comp.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.