Approaching the three-year anniversary of auto enrolment

Updated 11th July 2022 | 3 min read Published 10th April 2015

The legislation that was brought in was not intended to be a "set and forget" type process where you could simply set up your pension scheme, enrol those that are eligible and have done with it.

The workplace pension reform requires that after three years, you need to re-assess and re-enrol eligible employees because of the changing nature of businesses and employees. There are two types of re-enrolment, explained below:

Cyclical re-enrolment

Cyclical re-enrolment is the process of re-enrolling those employees who are eligible jobholders (Find out about the different types of workers) and are no longer in a pension saving scheme. This could probably be because they chose to opt-out of auto enrolment.

New permissive legislation that is active as of 1st April 2015 states however that if an employee has decided to opt-out of a pension scheme up to 12 months before re-enrolment, the employer may choose whether to re-enrol these employees or not. This employee would then have to be re-enrolled a further three years later, providing that they do not opt-out again 12 months before the re-enrolment date.

For example; for businesses approaching their re-enrolment date in October 2015, if an employee was to op-out today, that employee would not have to be re-enrolled in October. They would however have to be re-enrolled in October 2018 (providing that they do not opt-out after October 2017). This legislation is permissive however and the employer may choose to re-enrol that employee regardless if it is easier or more cost effective to do so.

In addition to this, it must be noted that while re-enrolment carries the same process as when the employer first reached their staging date, only eligible jobholders that have already had an auto enrolment date with the employer. Employers are also not able to postpone their re-enrolment (more information can be found in The Pension Regulator's (TPR) guide to re-enrolment).

Immediate re-enrolment

This is when an employer must put a jobholder (whose active membership of a qualifying scheme has ceased even though it was not their choice) into an auto enrolment scheme immediately when certain conditions are met.

Choosing your re-enrolment date

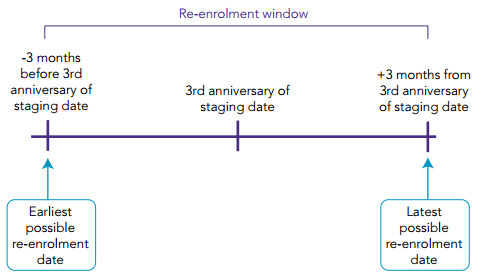

There is a good deal of flexibility over choosing when you have to re-enrol your employees. The window is between three months before the third anniversary of your staging date up to three months following the third anniversary of your staging date. The following diagram from TPR will help to illustrate this:

The first day of the six month window is the earliest possible re-enrolment date that the employer can choose and the last day of the six month window is the latest.

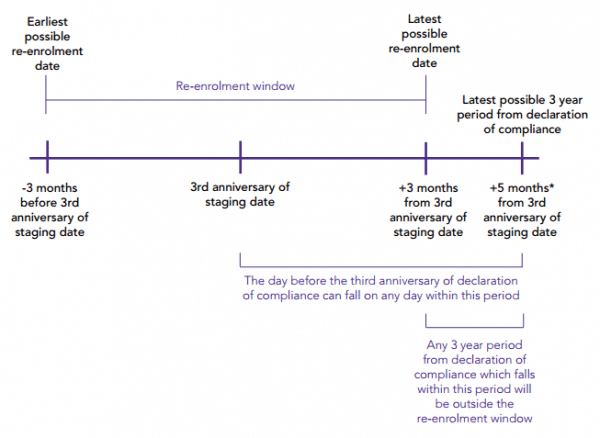

Your declaration of compliance is also something that you have to re-submit to TPR upon re-enrolment. The following diagram explains the deadline for re-enrolment. There are different criteria based on the different dates that you submitted your original declaration of compliance.

More in-depth information can be found in TPRs guide to re-enrolment.

Make sure that your auto enrolment process is a streamlined as possible. IRIS AE Suite™ automatically assesses your employees with every payroll run which makes the whole process much easier and simpler. Find out how you can take advantage of the IRIS AE Suite™ and prepare early for re-enrolment by booking your completely free demo.