Recoverability reporting in IRIS CRM

Updated 10th July 2024 | 5 min read Published 9th February 2018

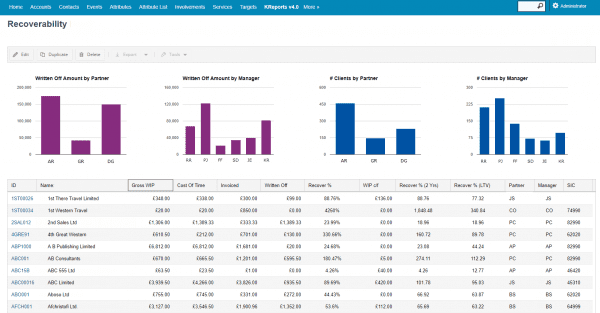

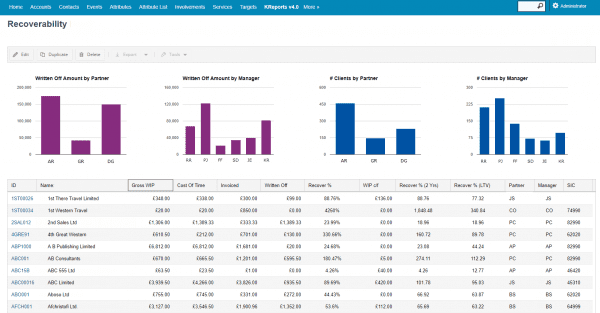

Recoverability reporting is now available in IRIS CRM with values being populated from IRIS on a daily basis.

What is recoverability?

All practices undertake work for clients and most of the time the work is invoiced. Sometimes the practice does more work than they can bill. Maybe they quoted a client a price but ended up logging significantly more time on the job. So 100% recovery is great but if this figure is less than 100% it highlights an issue. The greater the shortfall the greater the issue.

Bringing clarity to recoverability

Typically, recoverability reporting displays the rate only as a percentage which can obscure the true value of the recovery cost.

The recoverability report in IRIS CRM indicates a recovery percentage, the recovered amount and the option to group the report by different measures allowing a customisable report to match the demands of the practice. This combination provides more conclusive reporting and better business decisions.

Reports showing only a percentage figure can ‘mask’ the actual amount that has been under recovered. The IRIS CRM report can show this under-recovery. For example, maybe your new bookkeeping service has a recovery rate of 70% and generates £90,000 in annual revenue. Identifying under-recovery, caused perhaps by unforeseen un-billable work carried out by your staff, means that you can quote for work more accurately in the future. In this example, it could help recover over £38,000 additional revenue.

Graphical reporting

Having the report in IRIS CRM gives practices the freedom to manipulate the data. Graphs can be used in the report to provide a visual analysis of many things including grade, industry or age of the client.

As well as displaying the figures we also provide current year, previous years and the life time values per client. This comprehensive view may show that although the recovery rate from a client might seem poor for the current year, over the longer term they have been a good client.

The advantages of having a recoverability report within the CRM

• Informed Client Grading exercises. Workflow can be set up to grade the clients based on how beneficial they are to the practice. As the data is updated constantly, the report can run continuously. Better-graded clients can be nurtured and lower-graded clients can be monitored.

• Customised reporting to match your practice processes. If you determine recoverability of a client a certain way, it is possible to replicate that in the report.

• Determine effective pricing policies. Occasionally clients will not complete the work they agreed leaving the accountant to pick up the slack all within the agreed fee. Allocating a higher cost to such clients beforehand helps increase the recovery percentage.

• Help with performance review. It’s not about money that has been lost, it’s about money that hasn’t been made. By applying better policies and analysing the work practices can increase efficiency, motivation and profit.

Find out more about accountancy practice management software from IRIS.