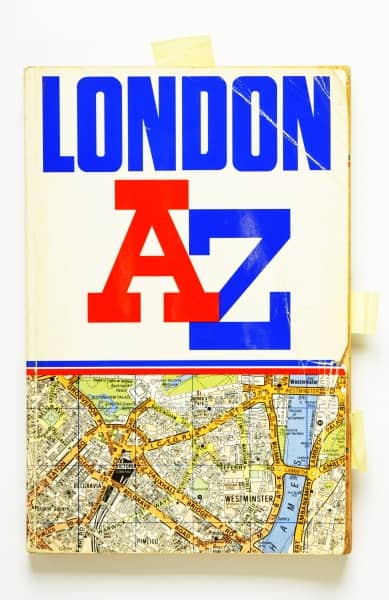

Still using an A – Z?

Updated 10th April 2018 | 3 min read Published 10th April 2018

Navigating around an unfamiliar city was always a challenge. Most motorists would take a copy of an A-Z. In fact before leaving home most people went through the same routine - keys, wallet and street map.

The A-Z was a great way to plan your journey, but they were not perfect. Inevitably as soon as the map was printed they were out of date. New roads from recent housing developments, pedestrianised town centres and congestion zones all challenge the motorist.

However times have changed first sat-navs and then smartphones became the preferred navigation method. Not only can you determine your route but now with dynamic updates it’s possible to change routes as prevailing conditions demand. Congestion can be avoided, as can toll roads; drivers can even select a quick routes or take a more scenic journey.

Many drivers suggest using sat-navs gives them a feeling of control and reduce the stress of driving.

When setting your business goals and monitoring performance most businesses still use their final accounts from the prior year.

Final accounts are typically prepared 6-9 months after the end of the fiscal year – basing your company’s future on 9 month old data is questionable – waiting until the next set of final accounts to determine if your plans have been successful is quite another. Most businesses would benefit from reviewing their progress on a monthly basis.

IRIS Insight takes the guess work out of business performance.

Identify problem early

Create profit & loss, balance sheet and cashflow forecasts quickly. Clearly presented data highlights performance and upcoming cash flow issues before they become critical.

IRIS Insight enables leaders to track actual financial performance against their plan. Review progress, make updates and collaborate with advisors to help achieve business goals.

Problems in cashflow could have various sources – higher costs, poor sales performance or increased debtor days. If your business is missing their cashflow targets, leaders can quickly evaluate the potential causes and take appropriate action.

The powerful 'what if' function can identify cashflow risks and model possible business changes. The impact of potential decisions is available in seconds, make informed choices and ensure you always stay on top of your cashflow.

Still a role to play

The A-Z still has its place and defenders of paper maps note that they are immune to the 3G black holes that afflict some cities. However the success of the new business planning tools leaves little room for older planning methods.

IRIS Insight allows businesses to identifying issues early, evaluate options, and take appropriate action to ensure goals are achieved.