Do I have to contribute to my workers’ pension?

Article ID

11743

Article Name

Do I have to contribute to my workers’ pension?

Created Date

15th June 2017

Product

IRIS PAYE-Master, IRIS Payroll Business, IRIS Bureau Payroll, IRIS GP Payroll, IRIS Payroll Professional, Earnie, IRIS Earnie IQ

Problem

Do I have to contribute to my workers’ pension?

Resolution

As an employer you must contribute to the pension of your Eligible Jobholders and any Non-eligible Jobholders who opt in.

What are the minimum contributions?

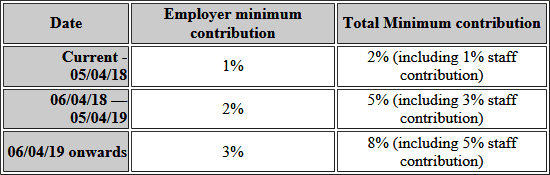

To comply with the legislation you must meet the minimum contribution rates for automatic enrolment. Initially, the minimum contribution is 2% of the employees’ pensionable earnings. This must include at least 1% contribution from the employer.

The Pensions Regulator plan to increase the minimum contribution over the next few years.

For more information see the Pension Guides

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.