Change an employee's NI table letter part way through a Tax year.

Article ID

10274

Article Name

Change an employee's NI table letter part way through a Tax year.

Created Date

1st January 2019

Product

IRIS Bureau Payroll, IRIS Payroll Business

Problem

Change an employee's NI table letter part way through a Tax year.

Resolution

You may find you need to change an employee NI rate part way through the tax year. Most commonly this is because an employee has reached state pensionable age (spa) and provided an age exemption certificate. This allows them to move to NI rate C and stop making employee NI contributions.

In the 15/16 tax year HMRC introduced NI rates for employees under 21. Your payroll software will automatically change the NI rate for employees once they reach 21, you shouldn’t have to make any manual adjustment.

The instructions below are based on changing an employee for NI rate A to NI rate C but the same procedure applies to any rate change.

PLEASE NOTE: Before you change an employees NI rate to C, your employee needs to show you one of the following to prove they’ve reached State Pension age:

- birth certificate

- passport

- a certificate of age exception (CA4140), if they’ve already got one(New CA4140 certificates are no longer being issued by HMRC.)

Employee has reached SPA in the current pay period

If the employee reaches SPA in the current pay period all you need to do is alter the NI rate in their personal details before processing payroll.

PLEASE NOTE: An NI rate change should be done BEFORE you save any variations or calculate payroll in the current pay period. If you have already saved or calculated you will need to UNDO the employee before proceeding.

Double click on the employee name in the list down the left hand side of the main screen.

Go to “Tax / NI” tab. Change the NI rate to “C-No Ee’s”. Click “Save”.

Process your pay as normal, the employee will no longer pay NI but the employers NI will continue as normal.

Employee reached SPA in a previous pay period

If you are processing a change in NI rate retrospectively, ie. you have been provided with the certificate of age exemption late, you will need to perform an NI adjustment. Before doing this we recommend you create a back up of your current data.

PLEASE NOTE: An NI adjustment should be run BEFORE you save any variations or calculate payroll in the pay period. If you have already saved or calculated you will need to UNDO the employee before proceeding.

First, as above, go into the employee details, “Tax / NI” tab and set the NI rate to “C-No Ee’s“. Click “Save” then “Close“

Check the correct employee is still highlighted in your list, then go to “Employee” | “Ni Adjustment”.

Click “Yes” to the warning prompt.

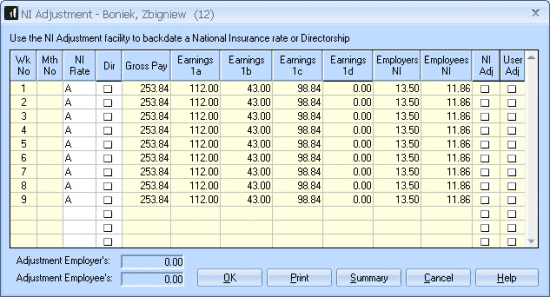

You will then see the NI adjustment window, this details the NI calculation, per pay period, for the employee:

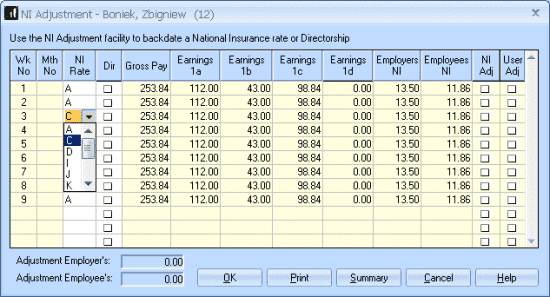

In this example the employee has just given us the certificate of age exemption, this should have been applied since week 3.

Click into the “NI Rate”column for the appropriate week/month and select the rate you want to be applied:

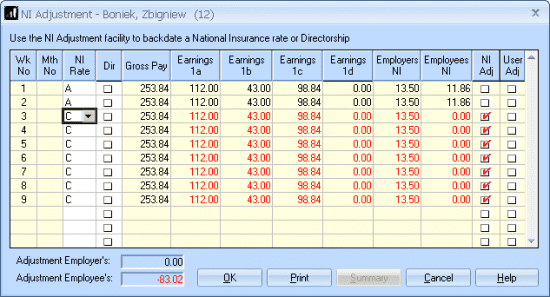

You will then see the system recalculate the NI on all the following periods, at the foot of the window you will see the adjustment that will be included in the employee next pay:

Click “OK” and continue with payroll as normal.

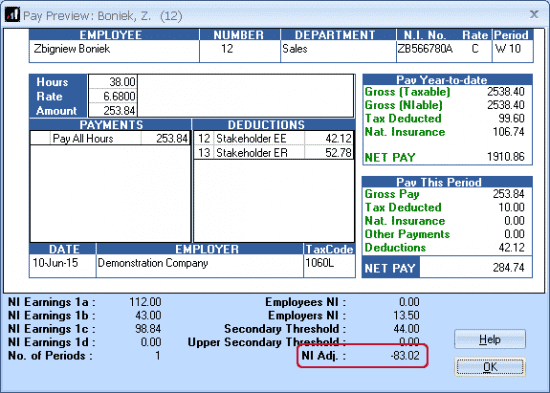

If you check the pay preview from the pay variations screen the adjustment will show in the bottom right corner:

PLEASE NOTE: An employee changing NI rate will have the new rate applied for the WHOLE of the period the change applied. You do not need to split the NI calc over 2 rates for the same pay period ie. 1st half of the month on rate A, 2nd half of the month on rate C. The correct calculation would be the whole month on rate C.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.