Paying Statutory Paternity Pay (SPP)

Article ID

12062

Article Name

Paying Statutory Paternity Pay (SPP)

Created Date

27th February 2019

Product

IRIS Payroll Professional, Earnie

Problem

How do I process SPP?

NOTE: Before processing SPP you must make sure you have configured your payroll calendar. Click here for more details.

Resolution

How to set up Statutory Paternity Pay

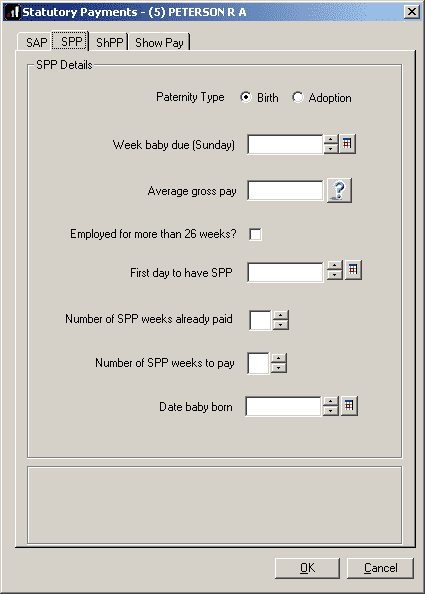

Go to “Employee” | “Statutory Payments“. Select the appropriate employee from the list. Make sure you select the “SPP” tab:

Week baby due (Sunday)

Enter the date of the Sunday of the start of the expected week of childbirth.

Average Gross Pay

The employee’s average gross pay during the qualifying period is shown here. If you are starting the program mid-year, you can enter a figure to force eligibility, rather than entering a gross pay history, week by week.

You can click on the Show Pay tab card for details of the relevant eight weeks earnings used in the calculation of the average gross pay.

Employed for more than 26 weeks?

If this is not ticked the employee will not qualify for SPP. The program checks the employee’s start date and puts a tick here automatically if the employee qualifies.

Sometimes, if taking over payroll during the tax year, for example, the software will not have enough history to tick this box. If you are sure the employee does qualify you can tick this option yourself.

First day to have SPP

If the employee gives you a date he plans to start his paternity leave enter it here. Otherwise, enter the same date as for the Expected week of Childbirth (Sunday).

You will not be reminded. Payments start when the Payroll Date is on or after the first day on which SPP is due.

Number of weeks already paid

The main reason for this field is for companies starting to use the system part way through an employee’s leave. You need to enter how many weeks have already been paid in order that the system can calculate the remaining Number of Weeks SPP to pay.

Number of weeks to pay

If the employee wishes to receive their full entitlement of SPP leave this figure as it is. If they wish to come back to work before receiving the full entitlement you may reduce the number of weeks accordingly.

You cannot increase them.

Date baby born

The child’s birth date must be entered before SPP can be paid.

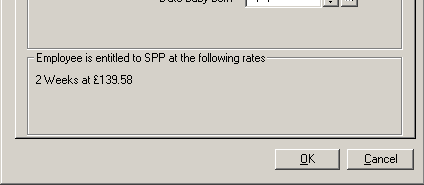

Summary of entitlement

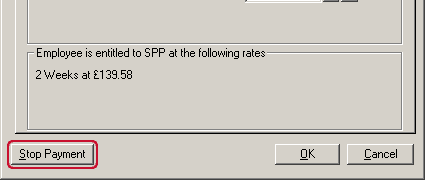

Once the details have been completed the lower part of this window will display a summary of the statutory entitlement for the employee:

Please Note: The weekly rate for SPP in the 2021/21 tax year is £151.20

Employee does not qualify

If at this stage, the employee still does not qualify for SPP when you think they ought, it may be worth looking at the history of gross pay.

If you have not altered the Average gross pay and it reads 0.00 it means there is no record of gross pay in the qualifying weeks.

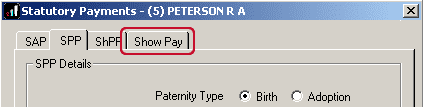

If you click the Show Pay tab you will see what gross pay there is on the employee’s records for the qualifying weeks:

If the qualifying weeks show zero pay when you know the employee really did earn money during that period it is probably because you have started to use the program comparatively recently.

In this case, click the SPP tab card and enter in the Average Gross Pay field the employee’s true average gross pay.

When you have finished entering details to establish qualification click OK and, if SPP is due, the program will pay it at the proper time and in the proper amounts, automatically.

Payment of SPP

At payroll run time you will not be reminded. Payments start when the Payroll Date is on or after the first day on which SPP is due.

Each time SPP is paid an entry is made in the employee’s diary recording the date, the amount of the payment and how many weeks it was for.

End of SPP payments

When the full entitlement of SPP to an employee has been made, further payments are stopped automatically.

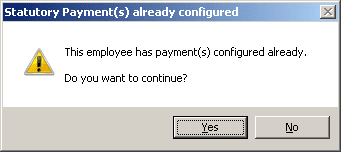

If you want to stop SPP payments at any other time you can do so by returning to “Employee” | “Statutory Payments” and selecting the employee. You will see the following warning:

Click “Yes“. Click “Stop Payment” button:

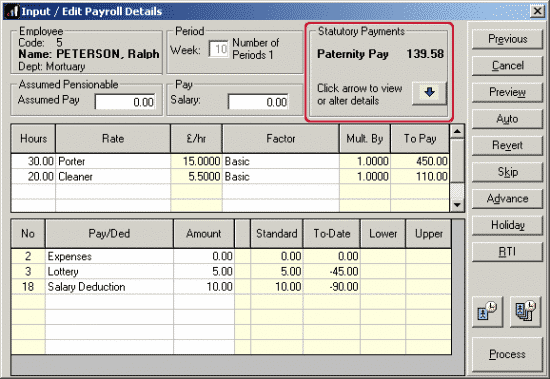

SPP on the Input/Edit Payroll Details Screen

With all the details saved in the statutory payments form the payment will automatically start when processing payroll with a pay date that is at least 7 days after the “First day to have SPP” date recorded.

You will see the “Statutory Payments” section displays payment values:

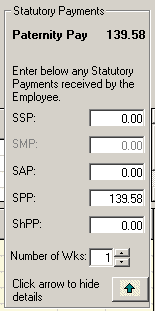

You can click on the arrow button to expand this section for further details on the number of weeks the software is paying. If you wish you can alter the number of weeks being processed in this pay period:

Please Note: The weekly rate for SPP in the 2018/19 tax year is £148.68

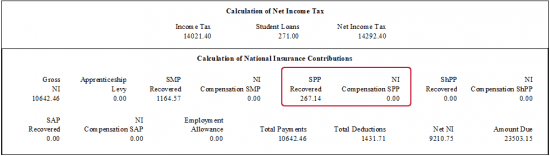

Recovery of SPP

The software will automatically calculate any SPP recovery when you perform month end processing.

On the final page of your month end summary, you will see the break down of any recovery or compensation the software has calculated:

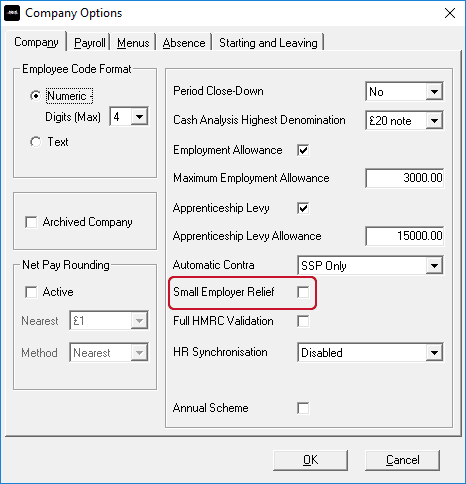

The amounts the software will calculate will depend on whether or not you have activated small employers relief. If small employers relief is activated the system will calculate 100% SPP recovered and 3% SPP compensation. If small employes relief is not activated the system will calculate 92% SPP recovery ONLY.

For more details on Small Employer Relief please see HMRC details here.

The option to change whether small employers relief is activated can be found in “Company” > “Alter Company Options“:

If you are reducing your payment to HMRC due to recovery or compensation on any statutory payments (SMP, SPP, SAP, ShPP) you will need to send an Employer Payment Summary (EPS) to HMRC otherwise they will recognise you as having underpaid your remittance. Please Note: Your FPS submission WILL NOT reflect any recovery or compensation amounts on statutory payments, this is correct as per HMRC specifications.

Please Note: Statutory Sick Pay (SSP) is excluded from this process as no element of sick pay (as of April 2014) is now recoverable in payroll.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.