Personal Tax- Claim Trading income allowance/ Expenses missing on SEF2 page. NET PROFIT LOSS SA103F validation

Article ID

ias-12843

Article Name

Personal Tax- Claim Trading income allowance/ Expenses missing on SEF2 page. NET PROFIT LOSS SA103F validation

Created Date

27th June 2018

Product

IRIS Personal Tax

Problem

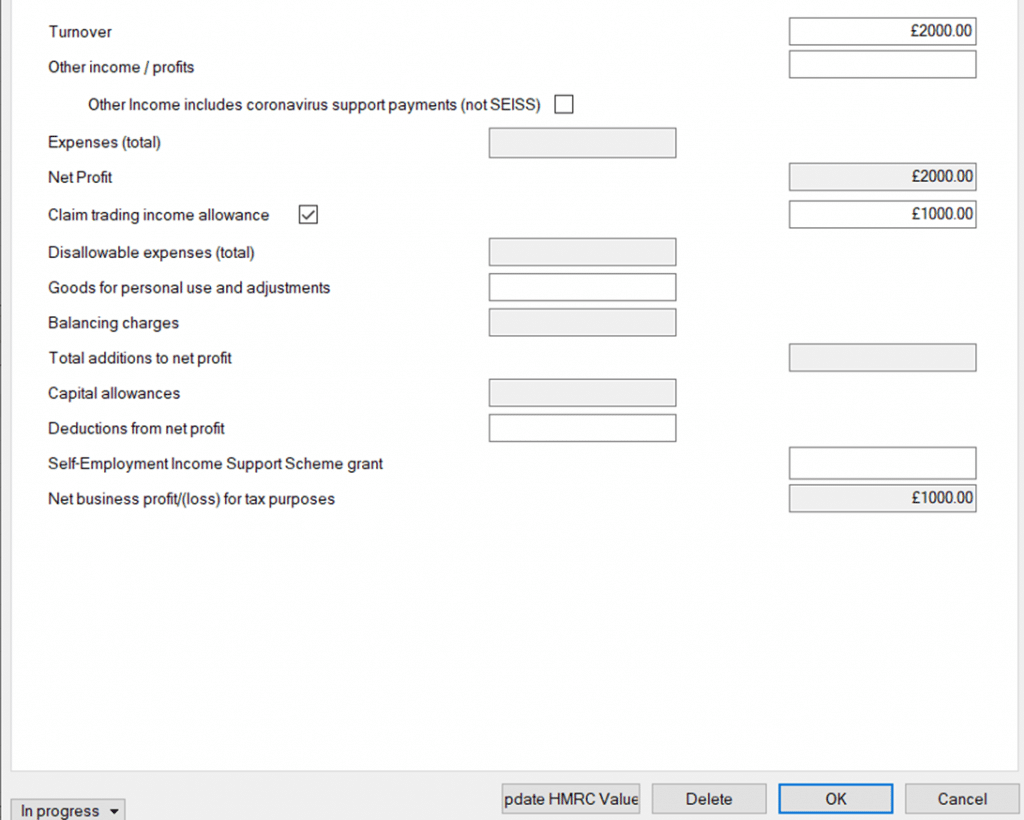

IRIS Personal Tax- Claim trading income allowance £1000 OR your manually entered Expenses missing on SEF2 page. NET PROFIT LOSS SA103F validation

Resolution

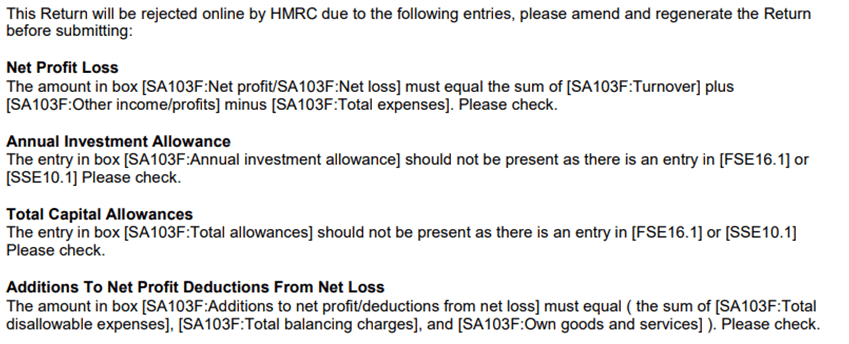

If you get a NET PROFIT LOSS SA103F validation: read the very bottom of this KB.

If you do not claim the trading allowance: Open the relevant period, Business details tab, tick the box for expenses below 85K. The expenses will now show on SEF2 page.

Claim trading income allowance but the SES/SEF pages are now missing: Open the relevant period, Business details tab, tick the box ‘Force self employment pages even if no profit with trading allowance claimed’.

Not giving £1000 claim: Known random issue on versions 24.2.0 and 24.3.0, when you tick the “Claim trading income allowance” it dosnt fill in the box on right side with £1000 (could be greyed out) and the Tax Comp etc isn’t reducing the turnover. Our Development Software Team is planning to fix this with a IRIS Service pack to be released week commencing 2nd December 2024 (subject to change). In the meantime try these two workarounds: 1) Untick the trading allowance and close the screen, later on go back in and tick it again and it may fill in the £1000 and the tax comp is correct (you may need to try this several times if it dosnt work initially). 2) Untick trading allowance and go to the Expenses tab and fill in the ‘Other’ box with £1000 (remove all other expense entries) and add a note under Reliefs/Misc/sa100 to state this is the trading allowance claim.

Note if you have multiple trades: If you claim this allowance and you have multiple sole trade businesses then it will apply to ALL the sole trades businesses. Its either this allowance claim OR your manual expense entries – you cannot claim both. HMRC rule: If you have TWO or more Sole Trade Businesses and one has claimed the trading allowance and one has claimed normal expenses. This is not permitted, HMRC rules state: if you are claiming the trading income allowance on 1st trade, this would preclude users from claiming any expenses on their second trade, or any trade. You cannot claim both the Trading Income allowance and expenses between the multiple trades. You need to decide which to keep either the trading allowance OR the expenses.

NET PROFIT LOSS SA103F validation – If you try and generate with Trading allowance claim on 1 trade and Normal expenses on 2nd trade you may this validation error: So remove the Trading allowance claim (as the HMRC rule above)

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.