Personal Tax- How to carry back trading loss for Sole trader/Partnership. Error SA103 or SA104F(S) exceeds

Article ID

ias-12098

Article Name

Personal Tax- How to carry back trading loss for Sole trader/Partnership. Error SA103 or SA104F(S) exceeds

Created Date

13th October 2015

Product

IRIS Personal Tax

Problem

IRIS Personal Tax- The clients business has made a loss within the tax year, how to can this be carried back? and if you get error SA104F or (S) exceeds etc and Terminal Loss. Underpaid OR Overpaid tax from earlier years have been entered

Resolution

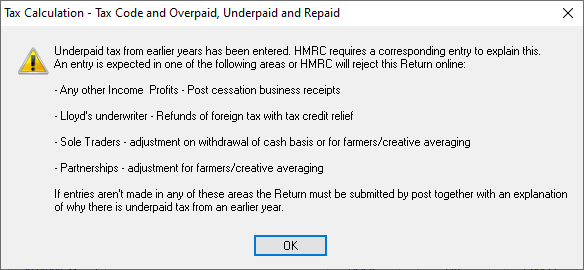

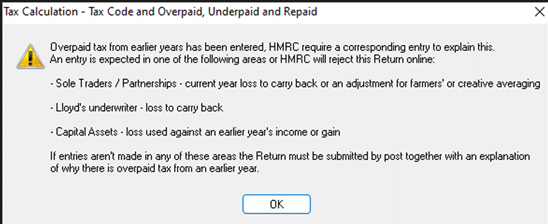

If you get a warning: Underpaid OR Overpaid tax from earlier years have been entered then read the very bottom of this KB

How to carry back or Terminal loss relief for Sole Trader or Partnership

1. Load the client and select the relevant tax year where the loss is.

2. Click Trade, Profession or Vocation | Sole Trade or Partnership

3. Select the current accounting period and click Edit

4. For Partnerships, enter the loss into Loss to carry back field within the Trading Income tab.

For Sole Trades, go to the Adjustments, losses, overlap and tax tab and enter the loss here into the Carry Back field. Then click OK.

5. Go to the Reliefs | Miscellaneous | Tax Calculation | Tax Code, underpaid/Overpaid/Repaid tax. In the box: Tax underpaid/overpaid from earlier years. You have to manually calculate the Tax savings value and enter here, then click OK.

6. Under Reliefs, click Additional Information then select Tax Calculation (SA100) enter a note stating that the client has a loss of X amount which is being carried back to the prior tax year, and then click OK.

If you want to show the loss carry back into the previous year.

7. Select the previous year

8. Other income/any other losses/put in the loss amount being brought back in the ‘Future trading or certain capital losses‘,

9. Reliefs /Miscellaneous/Tax calc/Tax overpaid etc and enter in the ‘Tax reclaiming now’ the tax savings value (the manual calculation from step 5 above) and click ok

10. Reliefs /Additional information/SA100 and enter the same note

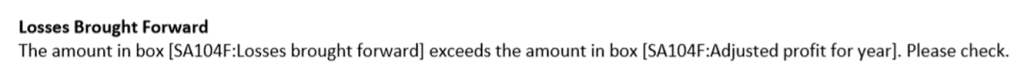

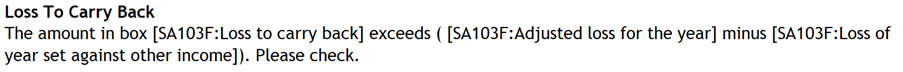

If you get the error Amount in SA103F OR SA104F exceeds SA103/4 F (OR a S which is Short pages): You have a made incorrect/invalid entry on the FULL or SHORT pages, go through all the steps again and ensure they have been entered it correctly- in the year of loss and also the year of carry back.

Check: ‘Adjustment’ tab and the ‘Adjustment to arrive at profit/loss’ box – an entry here may trigger the SA103/4F warning and needs to be removed/or edited. This adjustment box is to allow for edits to the final profit or loss. If you need to inform HMRC of this value then add it under Reliefs/MISC and additional information.

If you cannot find the cause:

Run the ‘Trade comp’ – notice it makes auto adjustment to the stated loss to give a new loss figure

As per HMRC rules your only allowed to carry back up to this new loss amount (not more).

In the sole trade/partnership loss carry back box – change the figure to this adjusted loss amount.

If you get a warning: Underpaid OR Overpaid tax from earlier years have been entered – you have entered a incorrect value and must recheck the loss carry back steps and recheck the value you made in step 5 for the loss making year and the carry back loss to year- you may have entered a negative value when it should be positive

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.