Personal Tax- How to bring forward data for clients

Article ID

ias-12103

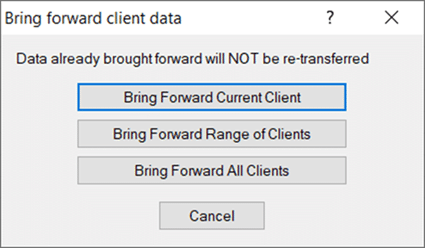

Article Name

Personal Tax- How to bring forward data for clients

Created Date

13th October 2015

Product

IRIS Personal Tax

Problem

IRIS Personal Tax- How to bring forward data for clients OR data is missing

Resolution

1. Log on to IRIS Personal Tax and select a client

2. Select the Tax year

3. Go to Edit, Bring Forward – and choose which one – current client, range and all. These will only work if there is existing data in PT for the prior year.

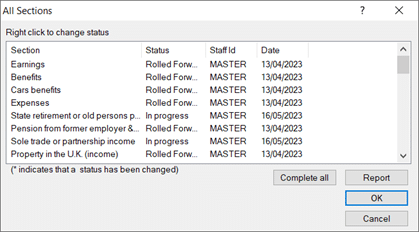

4. Some or all data is missing? Go back to the prior year and go to EDIT and ‘Mark data entry complete’ – then tick ‘Complete all’ and ensure all sections are done, then run a Final tax comp next. Change to next year and then use the bring forward.

When I bring forward for all my clients it freezes at a certain point (stops at certain client name/letter)

You may get an error like this. There is a data issue on 1 or more of your clients. For example, when you run the bring forward for all and it reaches that affected client, it will freeze and stop the entire bring forward. Use the Range of clients option when you first run the bring forward. Ignore/bypass the specific name (if a name/id appears in any way) where it freezes and run it from the names afterwards

If that works, then manually look at the client you believe is the cause – check all sections are completed, check if the spouse data is brought forward as well etc.

If you cannot find a issue then you would need to run the bring forward manually per client OR use the ‘Range of clients’ to bypass the suspected client which is blocking the bring forward all clients.

When it doesn’t bring forward any data for a client: Even when you have marked all data as complete, for the affected client do they have a spouse? if they do then Bring Forward for their spouse first and then re-ran the Bring Forward everyone. There is a known random issue caused by a spouse client causing a block (or client linked) so the fix – run the spouse first as bring forward and then run it all all clients again.

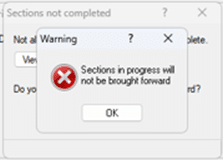

Warning: Sections in progress will not be brought forward. Load the previous year, and follow step 4 from above to mark all sections as complete, run a final tax comp. then load the next year and bring forward again.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.