Business/Personal/Trust: Tax User has reached License Package Limit or how to Unregister/Archive clients

Article ID

ias-12659

Article Name

Business/Personal/Trust: Tax User has reached License Package Limit or how to Unregister/Archive clients

Created Date

11th December 2017

Product

IRIS Personal Tax, IRIS Business Tax, IRIS Trust Tax

Problem

IRIS Business/Personal/Trust and P11D: Tax User has reached License Package Limit or how to Unregister/Archive clients

Resolution

Why unregister/archive client in IRIS Accountancy? You are no longer the accountant for your client (they have moved on etc).

Is clients data saved when unregistered/archived? Yes, when you unregister/archive a client then their data is saved. Just re-register and the clients data will be restored.

Trust Tax: If ‘Package/License Limit Reached’ only appears for a certain tax year (and other years are fine) – Please read this KB

Accounts Production & Business tax Clients– Unregistering/Archiving a client in AP/CS will NOT automatically unregister the same client in BT (and vice versa this is because they are different programs)- if clients need to unregistered for both BT and AP then it has to be done twice. If you run an active client report you may note a difference of client numbers then it is because of this, so just archive the relevant clients in the other program. If you try and load a client in BT and get a Unsuitable client warning

How to Unregister (Archive) a client in PT, BT and TT:

1.Load the client in Personal/Business tax etc and importantly first note down their ‘Client ID’ (this ID is important in case you need to re-register/unarchive).

2. Select the Client tab. Status message: Is this person currently a client?

3. Click No. This will Unregister (Archive) your client. They will still be in the system and will free up a license. Do this for each client individually until the message above disappears. Keep unregistering ex clients until you are within your license limit.

4. In Personal Tax affects only a specific year: If you have unregistered enough clients where you are below the license limit but you get the warning ‘License limit reached’ when you are in a certain year(eg back dating to 2023), yet other years are fine. Check your clients (including the unregistered/archived clients) for any tax data entry for the affected year, for example income entries etc. This is because a manual entry in that specific year can also use up a PT license. First keep a backup of the clients data eg save extract, save a Tax comp/Tax schedule etc, Edit, Delete tax year data, which deletes just that one years data entries. Load an unaffected year, then reload the affected year, if warning appears then continue to do this on another client until you are within your license limit.

5. If you need to Re-register (Unarchive) a client: Go to Client, Select , Registered in (on top left) and select ‘Whole Practice-all clients’ and find the clients ID etc, and load and if it asks to register say yes.

How many registered/active clients do I actually have (Registered/active client report) ?

1.At the very top- Go to Client and then ‘Select’

2.Click Generate client list (Its the top right icon but if its not there look to the very bottom of the screen and see a PRINT option there). Tick PT, BT or TT tax option boxes. If you need a Trust report- untick all the Business Type options on the bottom left as well and ensure the trust option under SELECTION tab is also ticked.

Note: If you select ‘No restriction’ option- it lists clients which have already been unregistered/archived.

Note: If you untick ‘Exclude unregistered clients’ option- this will allow you to view all archived/unregistered clients as well

3.On the Selection tab, you need to tick PT, BT or TT tick boxes, then Run the report. The last page of the report will show a count of how many active clients you have running.

Trust Tax: Still getting the warning when below the Package limit and only for a certain year? Please read this KB

If in P11D – You need to archive the company: Edit and Business Status, tick NO to unregister from the P11D- note the client data is normally part of BT and PT which feeds into the P11D.

P11D If a client in PT is part of company LTD- Load the company in P11D, Top left, See client ID click the mag glass, ‘View’ the company, Related and involvements, Find the client and put in a TO date in the past OR archive the client in PT.

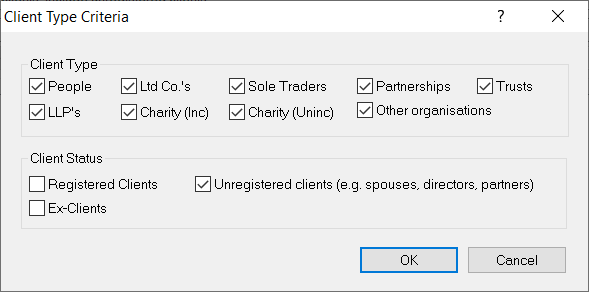

Using Datamining to create a report: If you need to report on unregistered (archived) clients, it is a option under Forms as a tick box ‘Unregistered clients’ (remember to untick Registered client as it searches for both). The option ‘Ex-Clients’ is a client with a ‘terminated date’ on their client maintenance screen.

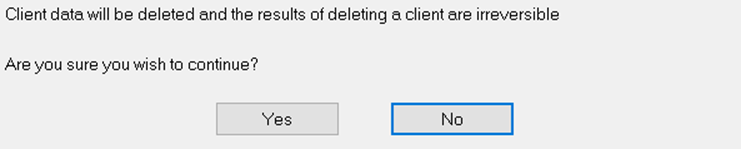

How to delete a client from IRIS? To delete a client from your IRIS Database (Note: you cannot reverse this deletion unless you keep a backup of your IRIS Database or a Extract of client before the deletion), load the tax program, Client, Select, highlight the client, click DELETE and say yes to the pop up, then another pop up will appear, click DELETE again and it will ask you a 3rd time (image below) if you want to proceed.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.