Trust tax- Invalid Data Entry: Address Incomplete content, 3001 4066

Article ID

ias-11675

Article Name

Trust tax- Invalid Data Entry: Address Incomplete content, 3001 4066

Created Date

19th June 2014

Product

IRIS Trust Tax

Problem

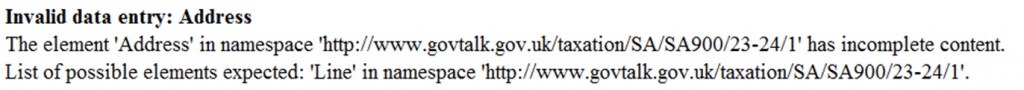

Trust tax- 3001 4066 Invalid Data Entry: Incomplete content Address

Resolution

This error message is presented when the address information for related parties for the Trust is not fully complete; full address information needs to be entered regardless of whether the related parties are clients or non-clients (every Beneficiary, Trustee, Settlor etc etc). To complete the address information and remove the above error message, please follow these steps:

1. In Trust Tax, load the client and select correct year, click Client and then View

2. Click the Related tab

3. Highlight a related party to the Trust and click View Client

4. Click the Address tab and enter in the full address information. Also make sure the address in each row is not too long or has hidden blank spaces which can count towards the maximum number of characters for address fields. Do not use special characters etc

5. Repeat the above for each related party to the Trust.

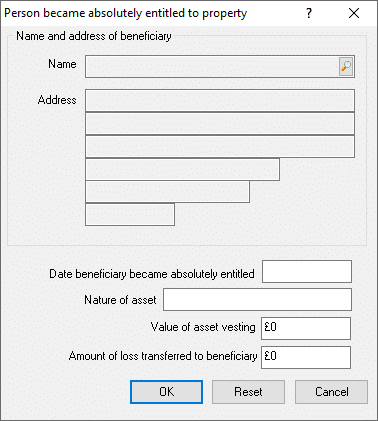

6. If you have checked EVERY client and non client and confirmed they have an valid address, then now check other areas in Trust tax- where there is an asset which requires a ADDRESS entry. For Example 1: Under Capital Gains | Person become absolutely entitled to. This requires an address

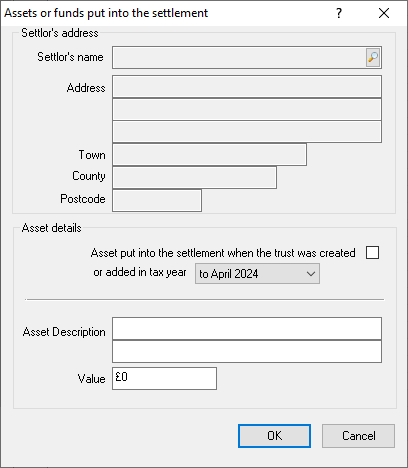

Example 2: Trust | Assets or funds put into the settlement. This require an address

For the full list of Invalid warnings – Read this KB

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.