How do I process pay on a net to gross basis?

Article ID

10999

Article Name

How do I process pay on a net to gross basis?

Created Date

20th November 2019

Product

IRIS Payroll Business, IRIS Bureau Payroll

Problem

In order to process on a net to gross basis you first need to set up a net to gross pay code at the company level.

Resolution

Set up a NET to GROSS payment type.

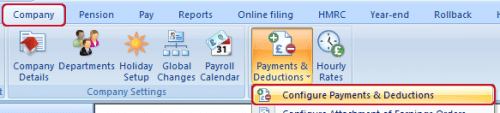

Go to the Company tab | Payments & deductions | Configure Payments and Deductions:

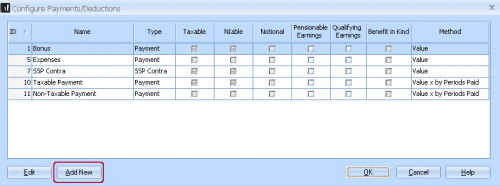

On the payment / deduction list click the “Add New” button along the bottom:

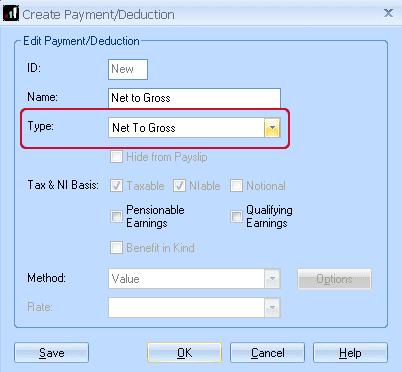

Type in a name for the payment, this is how the item will be displayed on the payslips. Under Type select “Net to Gross”:

Save and close out of the payment / deduction list.

Using the NET to GROSS payement for an employee

Scenario 1: Employee Whole Pay on Net to Gross Basis

Go to the Pay tab | “Enter Variations“

Add the net to gross payment into the Pay/Ded grid at the bottom of the variations screen.

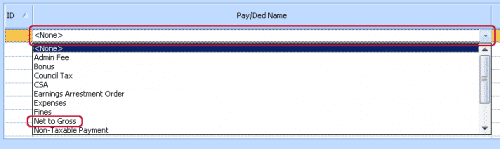

Click on a line with the description <None>, open the drop-down menu and select your net to gross payment.

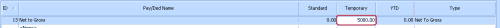

Add your net amount to the temporary amount field:

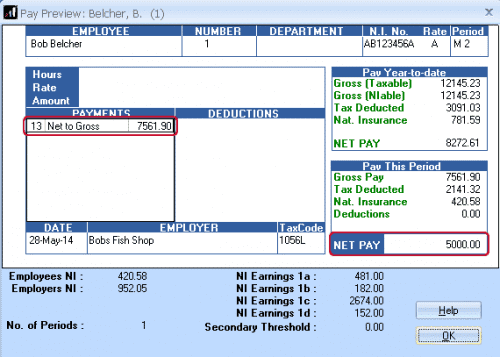

If you want to check the pay, click Preview, you will see the employee is receiving the net pay typed into the box and this has been grossed up to cover the tax/NI contributions:

When you save the variations the system will gross up the net amount leaving the employee with the desired pay.

Scenario 2: Using Net to Gross combined with other gross pay elements:

If you want to pay an employee normal gross pay but include a net bonus for example:

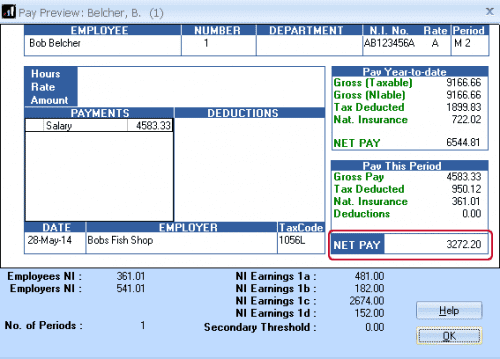

In variations, configure the gross pay elements (excluding any net amounts) and preview the pay. On the preview make a note of the net pay:

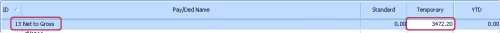

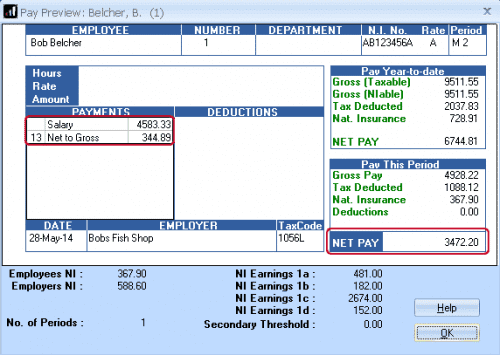

In this example, I want to also add on a net bonus of £200. Take the original preview net amount and add to this the value of the net bonus (3272.20 + 200.00 = 3472.20). You now use this value in the net to gross line:

If you then check the preview you will see pay element break down:

NOTE: Do be careful when using net to gross in combination with other gross pay elements. The system will always process the net to gross LAST. This will mean the employee will receive whatever net amount is typed into this line. If using net to gross with other pay elements make sure you use the FULL NET PAY on the net to gross line.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.