How do I process a new starter?

Article ID

11130

Article Name

How do I process a new starter?

Created Date

4th May 2016

Product

IRIS GP Payroll

Problem

How do I process a new starter?

Resolution

New starters are reported to HMRC via the Full Payment Submission (FPS). There are several mandatory fields in the employee details, others that are desirable for HMRC and some that are only required in certain circumstances.

Mandatory information for new starters

• Surname

• Forename

• Date of Birth

• Date Started

• Starter Details (P46)

• Address – first two lines and Postcode *

* if the address is a foreign address we recommend that you enter your Practice postcode here

Desirable information for new starters

• NI Number is desirable; however not knowing the NI Number for some of your employees will not stop submission to HMRC

• Normal hours worked per week

Information required for new starters in certain circumstances

• Irregular Payment (if applicable to an employee, requires completion prior to your first Full Payment Submission)

• Passport Number

How to process a new starter WITH a P45

• Create a new employee via New Employee Details

• Enter mandatory employee information

• Using the “Starter Details” button, enter the to-date values from the P45 in the “Previous Employment” section.

• Tick the valid response on the Starting Declaration or complete the Expat Details, click “Finish“

• Enter the tax code from the P45 in the Employment Details section, Tax Code field

• If required, select “Yes” for Student Loan Deduction in the Employment Details section. For details on which plan type to use see below.

• Click “OK“

How to process a new starter WITHOUT a P45

• Create a new employee via New Employee Details

• Enter mandatory employee information

• Leave the Tax Code field in the Employee Details section blank – this field will be automatically completed based on the response given to the Starter Declaration

• If required, select ‘Yes’ for Student Loan Deduction in the Employment Details section

• Click ‘Starter Details’

• Tick the valid response on the Starting Declaration or complete the Expat Details

• Click ‘OK’

If you haven’t received the employee information in time for their first pay day you must still notify HMRC by completing the information on “Starter Details” to the best of your knowledge on their behalf.

The option selected sets the tax code as follows (17/18 tax year):

Option A – 1250L Cumulative

Option B – 1250L Week1 / Month 1

Option C – BR Cumulative

P46 Not complete – 0T Week 1 / Month 1

Use the tax code selected until informed otherwise by the HMRC.

If a new starter gives you a P45 after their first payday but you have already submitted the FPS for that pay period and you have already received the employee’s tax code from your Tax Office you should:

• Disregard the tax code on the P45

• Continue to use the tax code received from HMRC

• Enter the Gross Pay and Tax Paid figures from the P45 in “Starter Details” > “Change the values of pay and tax in a previous employment“

However, if you haven’t received a tax code for the employee from HMRC

• Check the P45 figures are correct and enter the relevant tax code in “Employee Details” > “Tax Code“

• Enter the Gross Pay and Tax Paid figures from the P45 in “Employee Details” > “Starter Details” > “Change the values of pay and tax in a previous employment“

Automatic Enrolment (Workplace Pension Reform) of new starters.

If you are using the IRIS AE Suite as part of payroll to assess and enrol employees, any new starters would be assessed for eligibility when you process their first payroll. You shouldn’t normally need to enter any details in either “Pension Details” > “Auto Enrolment Details” as these are completed automatically during assessment/enrolment.

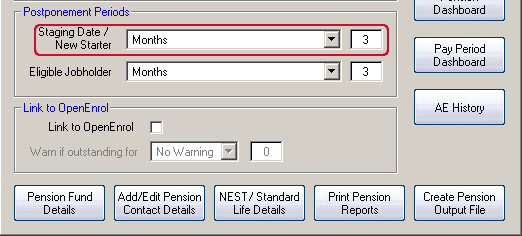

If they are deemed to be eligible job holders when the assessment occurs they will be enrolled or postponed as per your settings in “Setup/Options” > “4-Practice Pension Details” > “Auto Enrolment Details“

In the example pictured above, if a new starter is assessed as eligible in their first pay they would then be postponed 3 months from their recorded start date. An exception to this rule occurs when the new starter isn’t included in payroll for more than one pay period from their start date, eg start date falls in month 1, employee isn’t paid and assessed until month 3. In this scenario any postponement selected would apply from the start of the pay reference period where assessment occurred, in this example, the start of the pay reference period for month 3.

Student Loan Plan Type

As of the 2016/17 tax there is now an option of which student loan plan type the employee should be set to. The difference in the plan types is the threshold at which deduction will begin. The threshold for plan type 1 (19/20 tax year) is £18,935. The threshold for plan type 2 (19/20 tax year) is £25,725. BOTH plan types calculate deduction at 9% of the NIC liable pay. When you receive the SL1 from HMRC it will specify which plan type to use.

Please Note: There is no provision on the p45 form to indicate which plan type an employee should be on. When you add a new starter to the system, the employee needs to confirm the following;

• Did they live in Scotland or Northern Ireland when they started the course? OR

• Did they live in England or Wales and started the course before 1 September 2012?

If so, set them to plan type 1.

• Did they live in England or Wales and started the course on or after 1 September 2012.

If so, set them to plan type 2.

If your employee cannot confirm these details, ask them to contact the Student Loan Company (SLC). If they’re still unable to confirm their plan type, start making deductions using plan type 1 until you receive further instructions from HMRC.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.