I've processed pay for an employee on the wrong NIC rate.

Article ID

11182

Article Name

I've processed pay for an employee on the wrong NIC rate.

Created Date

6th April 2018

Product

IRIS GP Payroll

Problem

I've processed pay for an employee on the wrong NIC rate. How do I correct the error?

Resolution

We can correct the error in the next normal payroll run:

Enter the correct NI code in the employee’s main details screen.

Print a copy of the employee payslips for the months in question, a P11 and a copy of the existing P32.

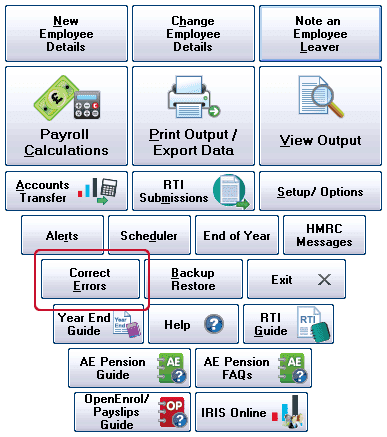

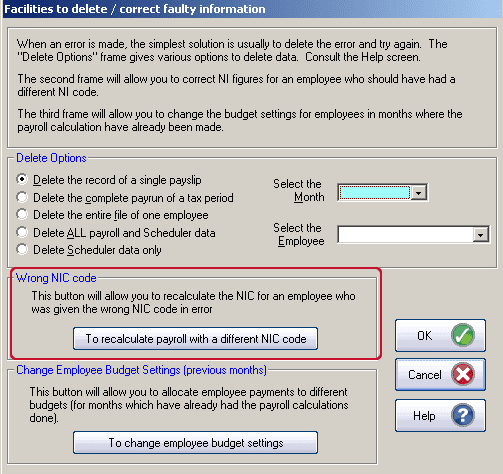

From the main screen click on “Correct Errors” and then on the option “To recalculate payroll with a different NIC code“:

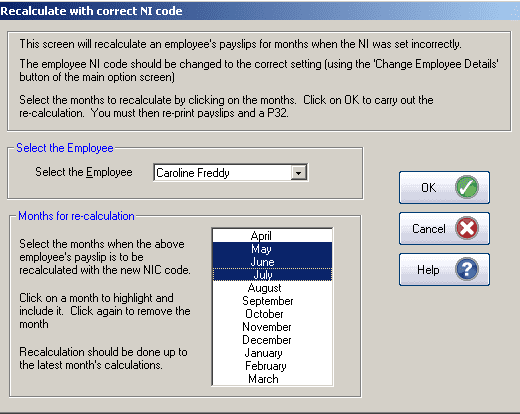

Use this screen to re-calculate the national insurance with the new NI code. Selected the affected employee from the drop down and highlight the months you want to re process with the new rate.

IRIS GP Payroll requires that you do the calculations up to and including the last month of the payroll calculations.

Print the new copy of employee payslips and reimburse the employee for any changes in the NI calculations.

Print a new version of the P32 and compare the payments to PAYE in the old and new P32s. Any change in PAYE payments will be due to the changes in employee and employer NIC. The next payment to PAYE can be adjusted to take account of any changes.

It is worth reprinting the employee P11 to check that the NIC figures are now correct.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.