Splitting Apprenticeship Levy across multiple databases with the same PAYE reference.

Article ID

12138

Article Name

Splitting Apprenticeship Levy across multiple databases with the same PAYE reference.

Created Date

19th May 2017

Product

IRIS GP Payroll

Problem

How to split apprenticeship levy across multiple payroll company files, each with the same PAYE reference number.

Resolution

There is no functionality available to accommodate for apprenticeship levy for companies using the same PAYE reference across different company databases.

The current workaround is the following:

In the company which is used to submit the EPS, set the App Levy Allowance to £15,000. In all other companies disable App Levy.

Every month you will need to add up the NIable gross across all payrolls to calculate the apprenticeship levy and manually enter these values.

To calculate the apprenticeship levy due follow the calculation:

(Total Pay Bill Year to Date * 0.005) – ((Annual Levy Allowance ÷ 12) * month number) – (Apprenticeship Levy Paid Year to Data) = Apprenticeship Levy Due this month.

If you are having trouble with this calculation please contact our support team for assistance.

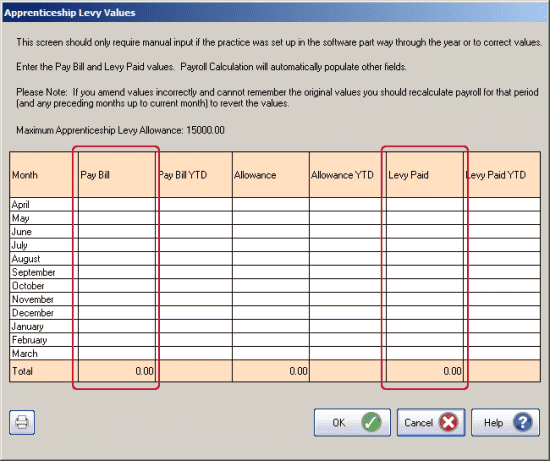

Once you have the values for the total pay bill and the apprenticeship levy due you must type these values into Apprenticeship levy table.

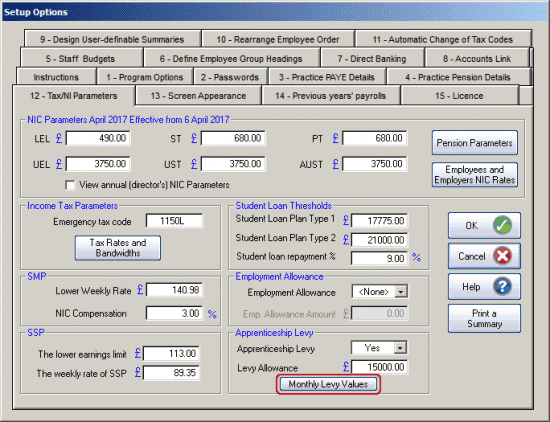

You can enter this by going to “Setup/Options” > “12-Tax/NI Parameters” > “Monthly Levy Values”.

You will need to enter the monthly Pay Bill figure and the Levy paid figure, the other boxes will populate automatically.

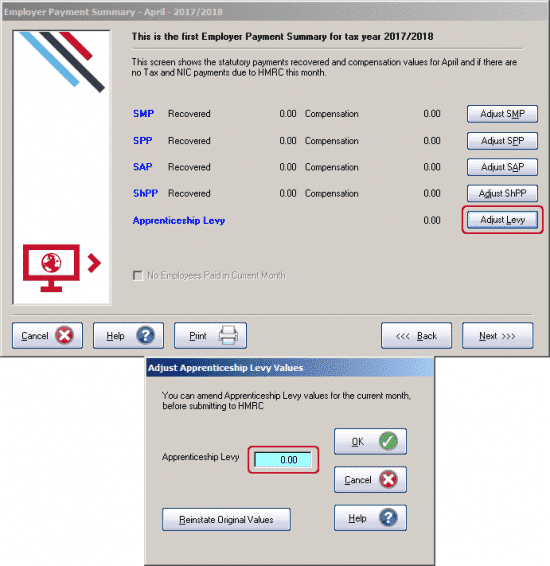

Once you have done this you can then submit the EPS submission. You will need to manually enter the amount of Apprenticeship Levy calculated earlier as part of the EPS submission wizard:

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.