Employment Allowance in PAYE-Master

Article ID

11560

Article Name

Employment Allowance in PAYE-Master

Created Date

6th January 2020

Product

IRIS PAYE-Master

Problem

How do I activate employment allowance in PAYE-Master?

Resolution

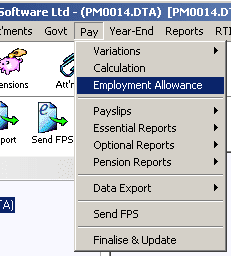

To activate employment allowance go to “Pay” > “Employment Allowance“:

Set the option for employment allowance here to “Yes“. The values for amount remaining for current and previous years should be left unchanged unless you are taking over payroll part way through the tax year.

- Activate the Employment Allowance in the Pay menu (not the Pay icon) option by saying “Yes” and choosing “Save”

- Calculate the payroll (even if already calculated, it must be calculated again for the Employment Allowance to work)

- Finalise the payroll

- Check the PAYE Remittance report

PLEASE NOTE: Employment allowance status is reported to HMRC via the EPS. The EPS does not include any values for employment allowance. When you activate employment allowance the next EPS you send will show the status as “Yes”. HMRC do not need to hear anything else about employment allowance until the status changes, as such further EPS submissions (EVEN IF RESENT FOR THE SAME PERIOD) will show the status as “None”. If you then deactivate employment allowance the next EPS will show the status as “No”.

For further Employment allowance FAQs click here

Employment Allowance is changing in the 2020/21 tax year?

From April 2020, employers with a Class 1 secondary National Insurance liability of £100,000 or more in the preceding tax year are no longer eligible for Employment Allowance. Class 1 secondary National Insurance means Employer’s NI.

Additionally, from 2020/21 Employment allowance will be given as de minimis State Aid. Therefore, the Employment Allowance application will need take account of the rules on de minimis State Aid, if said rules apply to your business.

Therefore, from 6 April 2020 onwards, employers must make extra checks to work out whether they are eligible, and submit a new claim for the Employment Allowance each tax year, as claims will not automatically renew each tax year.

We will make further information available as legislation and software processes are finalised.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.