AML: the cost of doing nothing

While AML compliance seems daunting, doing nothing isn’t an option. Failing to comply can result in a hefty fine; in 2022, HMRC issued £3.2 million in money laundering fines.

How can you make sure you’re getting it right every time?

In the fast-paced realm of accounting where resource and time are incredibly limited, knowledge and technology play a significant role in supporting AML compliance.

5 AML tips for accountants

The first step to tackling your Anti-Money Laundering (AML) responsibilities is knowing where to start. Consider the following areas for your firm:

-

Regular Risk Assessments

Ensure that ongoing risk assessments are a fundamental aspect of your firm’s procedures. A diligent accountant conducts Anti-Money Laundering (AML) ID checks, credit screens and risk assessments for new clients as well as remaining vigilant for client warning signs throughout the year.

-

Monitor Tax Returns with ‘No Net Liability’

Pay close attention to tax returns indicating ‘no net liability.’ If a client’s tax return shows no tax liability, it raises concerns for both you and HMRC. While legitimate reasons may exist, it’s crucial to inquire and record answers in your files.

-

Consider HMRC’s Information on Your Clients

Acknowledge the depth of HMRC’s intelligence on your client. Recognise the sophistication of HMRC’s profiling systems in understanding your client’s connections to third parties.

-

Assess Client IT Skills

Assess the client’s comfort with technology and their willingness to engage with it. It’s crucial for firms to develop the skills to assist clients who may be hesitant to use technology. Provide a support mechanism to guide them through the process and build confidence.

-

Scrutinise Motives Behind Hiring Your Services

Always question the motive behind hiring your services. Beyond the initial reasons for engaging an accountant, consider the client’s broader needs. Thorough due diligence at the start of the relationship is crucial for a comprehensive understanding of the client’s background and motivations.

Regular Risk Assessments

Ensure that ongoing risk assessments are a fundamental aspect of your firm’s procedures. A diligent accountant conducts Anti-Money Laundering (AML) ID checks, credit screens and risk assessments for new clients as well as remaining vigilant for client warning signs throughout the year.

Featured Guide

Anti-Money Laundering (AML) for accountants: protecting your firm against dirty money

Want to better understand Anti-Money Laundering? Looking to uncover client warning signs? Keen to improve your AML processes? Look no further.

Our handy guide breaks down everything you need to know about AML, offering a one-stop-shop resource which answers:

- What are money laundering and AML?

- What does AML mean for accountants?

- Who does AML apply to?

- What are the client warning signs?

- What software can help with AML?

- And more!

The role of AML software

At IRIS, we know that you want to focus on the work that matters. To do that, you need time.

The problem is that Anti-Money Laundering (AML), while vital, requires a huge investment of resources and time – not something to be taken lightly as regulators have been asked to “step up their efforts”. We believe with the right tools, not only can AML compliance be easily achieved but wider tasks such as client onboarding can also be significantly streamlined.

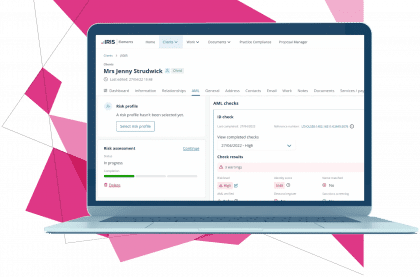

Software such as IRIS Elements AML alleviates your burden, diminishing the reliance on paper audit trails and helping identify risks within your client base.

Further reading on AML software

Blog Article

Anti-money laundering (AML) compliance: the cost of doing nothing

Blog Article

Protecting your practice against dirty money as AML checks tighten

Product

IRIS Elements AML

AML compliance software to keep you and your practice compliant across all of your AML obligations, from UK and international ID checks to HR screening.