45 Tax Return questions answered

Updated 22nd August 2024 | 22 min read Published 31st December 2020

As we hit busy season, various questions are bound to arise about completing Tax Returns using IRIS Personal Tax.

Below we give you 45 questions and answers.

- What version of IRIS should I be on to submit 2020 or 2021 Personal Tax returns?

Answer: For Tax Year 2020 – you will only be able to submit Tax Returns if you are running Version 20.1.0 – However, we recommend you be on at least Version 20.3.0.

But for 2021: there will be a new update in April 2021 to allow you to submit those ones for 20/21

2. Property mortgage loan (Type 16 expense), why is my Residential finance cost relief is missing on comp AND then being carried forward?

Answer - it is being carried forward because the client does not meet three HMRC rules:

a) There needs to be enough profit for the property.

b) There needs to be enough taxable non-savings income.

c) The calculation will also be restricted if there is any other type of 'income tax relief'

Reports and run the residential finance relief comp – this will explain the calculation and the relief can also be partially restricted, and the rest carried forward

3. ERROR CODE 3001 6492 - Most common solutions below: -

Answers:

a) You are not allowed to claim entrepreneur’s relief on a residential property, both cannot be claimed at the same time. Check this by going to:

Dividends | Capital Assets | Assets | Double click on the asset in question | Land and property magnifying glass | Check to see if residential property is ticked.

Close this box and then go to ‘Disposals’ |Highlight the disposal in the second window | Check entrepreneurs’ relief box.

b) Trading income allowance claimed on a trade with no turnover. Check this by going to: Trade Profession Vocation – Sole Trade Partnership - Edit accounting period - Remove figure in ‘Other income’ and enter it in the ‘Turnover box’.

c) The difference on the 6492-error message is the Class 2 NIC figure. For this, go to: Trade Profession Vocation | Sole Trade Partnership | NIC adjustments | Untick voluntary payments.

d) If the user has overridden the tax deducted at source figure for interest income, delete the entry from the section and enter it in: Interest | Government Security.

e) Have you overridden any Interest entries? So, for instance have you entered an Interest entry in it has calculated the 20% tax figure and you have then overridden this? If this has been done this is a HMRC restriction which is what is causing the error.

f) Have you overridden any Trust entries? This one is much like the Interest entry one above

4. Computation Exception Warning - Pension contributions exceed 100% of net relevant earnings. Please check the contributions. What does this mean?

Answer: Your net relevant earnings can be found under Employment | Earnings/Foreign Earnings.

Check the entry in: Under Reliefs | Pension Contributions | Personal Pension Contributions

The gross figure in the personal pension contributions cannot exceed the net relevant earnings in the ‘Employment’ section. The exception report is appearingbecause that figure exceeds the net relevant earnings. However, if you are happy with the tax computation you can still file your return.

5. The State pension/ Other pension entered is missing from the tax computation/tax return.

Answer: This is because of a rule from HMRC where it will supersede your manual value with their own values.

- Setup

- Retrieve HMRC data options

- Switch on the 5 tick boxes and Ok

- Pension

- Other pensions or State pension

- Bottom right – tick: View pension summary

- Set all to manual values - ok and close.

6. HMRC data retrieval of data for all/some clients is missing – why?

- Ensure you are on the latest iris version (help and about)

- Setup/ auth agents/ highlight the row with pre-population - reset credentials and say yes. Close and click retrieve HMRC data and log back in and answer security questions etc

- Then load a client in PT which needs employment/pension data and click retrieve HMRC data button on top right.

- If you still have a warning or no data, then it is very likely a HMRC issue - they have confirmed every year they normally finish compiling everyone data by the end of each year

- You can keep trying every day, but it is never going to be 100%. If you need the data asap then either chase the client for this, use estimated figures or call HMRC.

7. Student loan deductions – where to enter.

Answer: Employment / Expenses / New/ Type 10 Student loan deductions.

8. Foreign sole trader income will not appear on the tax comp – why?

Answer: You need to enter the income TPV/ Foreign income first AND then make the same entry under Sole trade or Partnership as well. This is because HMRC needs to know out of all your income, how much is from Foreign sources.

9. How do pay NIC 2 national insurance?

Answer: If you want to voluntary pay NIC class 2 – Reliefs/ Miscellaneous/ NIC adjustment / Tick override and enter in the value and tick Voluntary payments.

10. I want to import income/expenses from excel/csv to a Furnished Holiday let (FHL) property

Answer: Go to UK property income / create a FHL property first / then click FHL property options/ Import from File/ Import file and look for the excel/csv file.

11. How to offset losses against other income in personal tax?

Answer: Go to Trade, Profession or vocation/Sole trade partnership-click period/adjustments losses overlap tax/enter in tab that says offset against other income.

12. How to claim EIS relief in personal tax?

Answer: Go to Edit in the top left hand corner -capital assets- create a loss via assets/other capital gains/ then click edit in the top left hand corner of the capital assets window/losses and other information/enter figure in share loss relief used against this year’s income (double entry needed in the same heading).

13. Top slicing calculation looks incorrect for 19/20 in personal tax?

Answer: The calculation is incorrect for 19/20 as HMRC calculations have not been correct, you must file the Personal Tax Return online and wait for HMRC to send a revised calculation.

14. Jointly owned property is not splitting the income 50/50?

Answer:

- Go to UK Land and Property and then UK Property Income. Double click on the first relevant property //Untick the “Property let jointly?” tick box// Click the Joint Income magnifying glass.

- Delete all other sharers and change the owners share back to 100% as well // Click OK twice more until you are back on the Personal Tax screen with no popups.

- Then run a tax computation to refresh the system.

- Double click on the same property. Tick the “Property let jointly?” tick box//Add the sharers info back in.

15. The box to claim marriage allowance is greyed out?

Answer: Go to setup-retrieve HMRC data-ensure boxes are ticked//this will allow the user to select manual or HMRC value.

16. Why is the private pension is not showing up on tax comp?

Answer: Go to setup in the top left hand corner - retrieve HMRC data//tick all boxes//go to pension and state benefits//other pensions/view pension and state benefit summary/select manual value/Run another comp.

17. How do I unmatch a payment on account?

Answer: Go to Administration in the top left hand corner - client account - highlight payment - click match/then click match again.

18. HMRC data is not picking up anything info for some clients?

Answer: Ensure PAYE number has been entered/click between HMRC and manual values. Go to Set up-authorised agents-reset agent credentials. Set up data retrieval again. If it still does not pick up the data, may need to check with HMRC as Iris has no control over the data collected per client.

19. How to make a voluntary class 2 payment?

Answer: Go to Trade, Profession or Vocation - Sole Trade or Partnership/click NIC adjustments/Tick override and voluntary payments made.20. P11D – How do I submit an amended P11d to correct an earlier submission I made to HMRC?

Answer: HMRC Restriction – they will not yet allow an amended P11d to be submitted online – you will need to print it out and post it to HMRC.

21. Where to enter disguised remuneration/Loan Renumeration?

Answer: If this links to an employment, go to: Employment | Earnings/Foreign Earnings | Highlight Employment | Edit | Tick ‘Earnings include disguised remuneration’.

If this does not link to an employment, go to: Reliefs | Miscellaneous | Disguised Remuneration

22. EIS has been deferred in previous year. Now it needs to show as taxable in this year as it has been crystalised.

The clients’ capital gains transactions would need to be entered into IRIS as follows:

there are 3 options to choose from:

- Enter the disposal of the EIS shares and claim relief on the disposal to reduce the taxable gain to the required level.

- If there is a loss (need to create the loss in cap assets - under other cap gains) which can be offset against the other income can be entered via the edit menu within capital assets- click edit- losses and other information and complete both of the share loss relief used against this year’s income boxes.

- If there is a gain - the element of deferred gain which has become taxable within the tax year can be entered within the other capital gains section, (also you can enable the brokers schedule option within this section as this will eliminate the need to enter an acquisition date.

23. Due to Covid-19, the client had not paid their July payment on account. How to deal with this?

Answer: Administration | Client Account | Tick ‘Show full amounts’ and ‘Show fully matched payments’ | Highlight July payment on account | Delete | Yes. If you get an error message stating that it has already been matched, then go to: Match - This should open a new window. If any figures show in the ‘Matched here’ column for any entries, it means it is matched. Go to each of these entries and click on ‘Match’, then ‘Save’. You can then delete this payment on account

24. Where to change HMRC username and password details in IRIS?

Answer: Sign in as the Master user in IRIS | Setup | Practice Options | Tax Options (right-hand side) | Click relevant tab depending on the software they are trying to submit on | Enter details.

25. The business has ceased. However, overlap relief is not showing. Why is this?

Answer:

- It could be a refresh issue. Therefore, go to: Reports | Trade Computation, and close the report. Then, check to see if the overlap relief is being utilised

- Trade, Profession or Vocation | Sole Trade or Partnership | New (bottom half) | Change | Please ensure the most recent account date entered is same as the cessation date

- Trade, Profession or Vocation | Sole Trade or Partnership | Edit (top half) | Please ensure the correct cessation date is entered. Also, go into the ‘Related’ tab and ensure the individual has the correct end date entered.

26. How to deal with an employment that you do not know the PAYE reference for?

Answer: Employment | Earnings/Foreign Earnings | Double click on the employment | View | Tax tab - enter ‘NA’ for the PAYE reference

27. I have multiple pension figures entered in the pension section but only a couple of them are showing on the tax comp. But all of them are showing on the schedules of data? Answer: Go to Pensions and state benefits/ State pension/ View pension and state benefit summary/ Was set to HMRC. Switched to manual value.

28. I have turnover entered in for a sole trade (or partnership) but when I run the tax computation nothing is showing.

Answer: Go to Trade profession or vocation/ Sole trade or partnership/ Highlight the sole trade on the top half/ Then on the bottom half click on New/ Add in a new period a year ahead of their last accounting period/ Click ok/ No need to enter any figures in this period. The system just needs to cover the full year.

29. How do I enter in student loan that came out of someone’s P60?

Answer: Employment/ Expenses/ Highlight Employment on top half/ Click on New on bottom half/ Next to type click on the magnifying glass and select Type 10 for student loan/ Enter in the details.

30. I am carrying back a loss for a sole trade (or partnership) but it is not showing in the previous year?

Answer: Steps to do if carrying back loss from 2020:

1 – Trade profession or vocation |Sole trade or partnership | Go into the current accounting period | Adjustments Losses Overlap Tax tab | Enter loss amount to carry back

2 - Reliefs | Miscellaneous | Tax Calc | Tax code overpaid, underpaid and repaid tax |Tax Underpaid/Overpaid from earlier years. Manually enter in here the tax savings amount from the loss carry back.

3 - Reliefs | Miscellaneous | Additional info | sa101 | Make note of breakdown

3: To show the Losses brought back in 2019 tax year:

4 - Other income | Any other losses | "Future trading or certain capital losses" | Enter the same figure that was entered into loss carry back of the sole trade or partnership.

5 - Reliefs | Miscellaneous | Tax calc | Tax code overpaid, underpaid and repaid tax| Fill in tax reclaiming now field | Enter the tax savings amount that was manually figured out

- Reliefs | Miscellaneous | Additional info | sa101 | Make note of breakdown

31. I have a property that is split between a husband and wife, I have entered it on the husband, and it is fine, but nothing is appearing for the wife on her return.

Answer: 1. Go into person you entered the info into. Then go to UK Land and Property and then UK Property Income. Double click on the first relevant property

2. Untick the “Property let jointly?” tick box

3. Click the Joint Income magnifying glass. Delete all other sharers and change the owners share back to 100% as well.

4. Click OK twice more until you are back on the Personal Tax screen with no popups. Then run a tax comp to refresh the system.

5. Then go back and double click on the same property.

6. Tick the “Property let jointly?” tick box

7. Add the sharers info back in.

32. I am getting the message “Entry in sa108 losses claimed against income of previous return year -please complete sa108 losses in return year” when trying to generate the return. How can I fix this?

Answer: Edit | Capital Assets | Other Capital Gains or Shareholding | Open the EIS loss entry- Please select Unlisted Shares in Asset Type | OK. | Then regenerate the Electronic Tax Return and submit.

33. Missing residential finance relief on the Tax Computation -

If you get a call where you run the residential finance comp (from a type 16 mortgage loan) but the relief and calculation is missing from the very top of that comp – its because of this:

Answer:

The reduction is the basic rate value (currently 20%) of the lower of:

1. Finance costs - costs not deducted from rental income in the tax year (this will be a proportion of finance costs for the transitional years) plus any finance costs brought forward

2. Property business profits - the profits of the property business in the tax year (after using any brought forward losses)

3. Adjusted total income - the income (after losses and reliefs and excluding savings and dividends income) that exceeds clients personal allowance.

Look at this helpsheet https://www.gov.uk/guidance/changes-to-tax-relief-for-residential-landlords-how-its-worked-out-including-case-studies

The clients adjusted total income - the income (after losses and reliefs and excluding savings and dividends income) that exceeds client’s personal allowance is NIL.

34. Can I print an SA302 from IRIS Personal Tax?

Answer: HMRC has recognised that the IRIS tax computations can now be used in replacement of an SA302. The clients name and UTR must be visible on the tax computation. To print a Tax Computation, select Reports | Tax Computation.

PLEASE BE AWARE THAT THIS WILL NOT HAVE SA302 PRINTED ON THE TAX COMPUTATION AS AN SA302 IS ONLY AVAILABLE FROM THE HMRC. HOWEVER, HMRC HAS STOPPED PROVIDING THESE FORMS.

HMRC have not provided any link that we can point our clients to regarding this. Therefore if you have any banks/mortgage lenders that do not accept our computations then you will need to contact the HMRC which they have advised on their website.

Please see the KB https://www.iris.co.uk/support/knowledgebase/kb/ias-11886/

35. How do I deactivate clients from Personal Tax?

Answer: Firstly, ensure you are viewing the client you wish to deactivate.

Delete the tax year data for the client you wish to deactivate, to do this go to edit | delete tax year data. Then click Client and Status – say NO to the question ‘Is this person currently a client’

When you now go to view the client browser screen you will notice this client is no longer appearing within the list, as the view is set to ‘Currently registered in Personal Tax’ by default.

Next to ‘Show clients registered in’, change the drop-down option to ‘Whole Practice’.

You will be able to select the client you previously deactivated and re-register them back into Personal Tax so historical data can be accessed again if ever needed.

36. How to claim multiple reliefs for capital gains (asset/shareholding/other capital gains) disposal?

Answer: Edit | Capital assets | select the disposal | tick relief | select type 0

37. Why am I receiving a fatal error 1000 for all my clients when trying to submit a tax return?

Answer: Fatal error means that HMRC gateway is busy. You will need to keep attempting to file the return possibly at another time until it goes through.

38. Authentication Failure

There are three reasons why an Authentication Failure message can occur.

- The user ID or password details are incorrect

- The clients UTR number is not correct

- The service has not been activated using the PIN provided by HMRC

Checking the user ID and Password

- Log into IRIS Personal Tax as a MASTER user and select the client

- From the Setup menu select Practice Options

- Click the Tax options button

- Check that the User ID and Password boxes have been completed correctly

- If the client has been assigned to an alternative accountant check the User ID and password have been entered correctly for the alternative accountant, this can be done by clicking the Client menu, select View, click the Accountant button, click the magnifying glass to the right of the alternative accountants details then view the accountant and click Tax Options

It is possible to highlight and copy this information from IRIS and paste into the relevant login boxes on the Government Gateway website. This is a good way to ensure the details have been entered correctly.

Checking the client's UTR number

Log onto the Government Gateway Website and check the client list for the practice, ensure that the UTR number shown for the client is the same as the UTR number entered into IRIS Personal Tax.

Checking the service has been activated

To check this log onto the Government Gateway website using your User ID and Password and check for any options to activate the service.

Note, If the User ID and Password are correct and the UTR number is correct, refresh the clients file by reprinting the electronic Tax Return (to the screen) then transmit again.

If the client is still receiving the authentication message, then it is advised to contact HMRC as the message is coming directly from them.

39. When select final tax return, I am getting a warning to say that some sections are incomplete?

Answer: You will need to right click on sections on the left hand side i.e. employment, pensions and click on view/change status/highlight entries individually and click on complete all.

40. Can I file a tax return without a UTR?

Answer: HMRC Restriction. No this cannot be done.

41. How do I enter a consolidation?

Answer: Go to: Edit | Capital Assets | Click on shareholding | Events | Consolidation | Enter a date | Go to each event and reduce the amount to show what the shares have been changed to

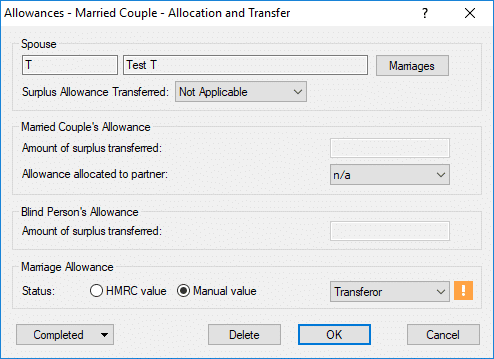

Married couple, allocation, and transfer

42. Marriage allowance of 10% of £12500(for 2020) is not showing on the computation for the recipient

Check the following:

The recipient needs to be a basic rate taxpayer – total income should generally be between £12,501 - £50,000

The transferor income needs to be less than the personal allowance (£12,500)

Ensure the Married Couple – Allocation and Transfer screen look as follows (Reliefs | Allowances | Married couple – Allocation and Transfer)

-- - -

Spouse field should be completed

Amount of surplus transferred should be blank and allowance allocated to partner should be set to n/a

Recipient should be selected in the marriage allowance section

If not retrieving from HMRC then manual should be selected.

If non-resident is ticked in reliefs | miscellaneous | residence question, in the same screen select Personal allowances and Double taxation relief tab | tick ‘Claiming personal allowances as a non-resident on some other basis’

43. Marriage allowance transfer of £12500(for 2020) is not showing on the computation for the transferor

Check the following:

- The transferor income needs to be less than the personal allowance (£12500)

- The recipient needs to be a basic rate taxpayer – total income should generally be between £12,501 - £50,000

- Ensure the Married Couple – Allocation and Transfer screen look as above: (Reliefs | Allowances | Married couple – Allocation and Transfer)

- Spouse field should be completed

- Amount of surplus transferred should be blank and allowance allocated to partner should be set to n/a

- Recipient should be selected in the marriage allowance section

- If not retrieving from HMRC then manual should be selected.

- If non-resident is ticked in reliefs | miscellaneous | residence question, in the same screen select Personal allowances and Double taxation relief tab | tick ‘Claiming personal allowances as a non-resident on some other basis’

44. In the marriage allowance section, the HMRC and manual value options are greyed out

- Answer: Go to setup | retrieve HMRC data practice options – tick marriage allowance

- Marriage allowance personal allowance transfer of £1190(for 2019) is not showing on the return for the recipient

Answer: This is not meant to show on the return of the recipient. The box on the return is only for the transferor to fill out.

A claim must be made first online so HMRC are aware of the claim. https://www.gov.uk/marriage-allowance

45. Where do I enter in CIS deductions for a sole trade?

Answer: Sole Trade and partnership | double click the relevant period at bottom of screen | Adjustments, losses overlap & tax | Enter figure in Deductions made by contractors on account of tax (CIS25s)